Where is the research and data that dissolving UK Senate is best for school? | Opinion

Britt Brockman, the chair of the University of Kentucky’s Board of Trustees has attempted to assuage concerns about efforts to redefine the University’s governance by scaling back the role of the faculty in the process. He suggests relevant constituents be comforted since “board members are successful business people and public policy representatives.” A review of mission statements at public and private universities will identify the fundamental purpose as “creating, preserving, and disseminating knowledge through research, teaching, and public service.” UK’s mission statement is no exception. Given Mr. Brockman’s claim, it’s reasonable to ask whether a university’s mission statement is consistent with that of businesses.

Milton Friedman, the renowned Nobel-prize winning University of Chicago economics professor famously stated that the singular purpose of business managers and boards was “to maximize profits for the shareholders.” Never lost for words, Friedman went on to say in a groundbreaking NY Times essay ”a business that takes seriously its responsibilities for providing employment, eliminating discrimination, or avoiding pollution is preaching pure and unadulterated socialism.”

It’s not hard to envision what Professor Friedman would have had to say about programs to enhance diversity, equity, and inclusion were he still with us. One of Friedman’s most influential disciples, Harvard Professor Michael Jensen, is the godfather of rewarding CEO’s with lavish incentive compensation. He commented before his recent death that stock options had become “managerial heroin” and what the business world lacked was integrity. He described the world of finance around the time of the financial crisis as “staggeringly bad.” Professor Jensen’s prolific research has been cited over 340,000 times in the academic literature according to Google Scholar.

If the most famous doyens of economics call for an extremely narrow focus for businesses that have occasionally yielded egregiously bad outcomes, it seems hard to believe a claim that business people are best qualified to govern a university. That the university’s senior administration would find this claim credible is disturbing, if not alarming. While a university obviously must assure it has a sustainable financial future, the fundamental aims of universities and businesses seem much more distinct than consistent. There are university’s focused on profit maximization as their mission, however, and they go by names such as the “University of Phoenix.”

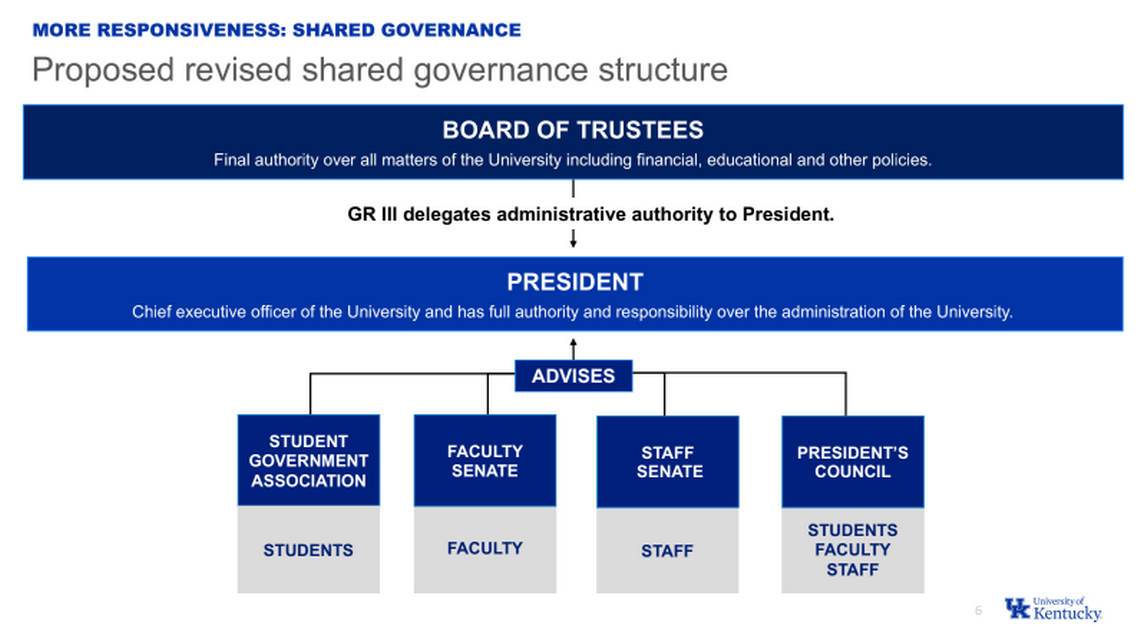

Mr. Brockman contends that the proposed changes in the University’s governance represent “best practices.” Says who? He cites the “Association of Governing Boards,” whose leadership positions are held by representatives of the University of Central Florida, The College of New Jersey, and Old Dominion University. These do not strike me as institutions that UK is aspiring to emulate. What are the peer institutions that are instituting similar changes? And what is the research that supports the claim that these proposed changes will yield positive outcomes? How did the extant faculty role in governance impede the achievement of the mission, as the proposed changes seem to imply? A university builds the rationale for its existence on quality research and teaching, as UK’s mission statement attests. Why will placing more weight on the judgments of those who have never been engaged in either and less on those who have such experience be a better road to governance? As far as I can tell, there has been no adequate response to this question. Instead, the university leadership has said little more than “trust us.” Business members on the board may recall a famous line from Ronald Reagan: “Trust, but verify.”

Dr. Donald J. Mullineaux served as the DuPont Endowed Chair in Banking and Financial Services in UK’s Gatton College of Business from 1984-2015. He also served on the Board of Directors of the Federal Home Loan Bank of Cincinnati from 2011 to 2013, including six years as Board Chair.