Wednesday morning was disappointing for the U.S. economy

It’s been a disappointing morning for the U.S. economy.

Before the market opened on Wednesday, both ADP’s report on private payroll growth for May as well as the second estimate for first quarter GDP were released. Both reports missed expectations.

In the first quarter, the U.S. economy is now estimated to have expanded at an annualized rate of 2.2%, down from the 2.3% rate of growth reported back in April and below expectations for this estimate to be the same as the first.

This miss relative to expectations, however, does not indicate the economy slowed in the first quarter or is turning more disappointing overall. Paul Ashworth, chief U.S. economist at Capital Economics, said in a note Wednesday that this revision actually paints a more positive picture of the economy than the initial reading reported last month.

“Despite the downward revision to first-quarter GDP growth, the composition is actually more encouraging now,” Ashworth noted.

“The contribution from inventories was reduced from 0.4% points to 0.1%, while growth in intellectual property investment was revised up to 10.9% annualized, from 3.6%. The growth rate of final sales to domestic buyers, a better gauge than GDP of underlying strength, was revised up to 1.9%, from 1.6%.”

These revisions, then, essentially show that consumer spending in the first quarter was better than previously reported while the value of U.S. business innovation also increased.

Additionally, second quarter growth is currently tracking to growth north of 3%.

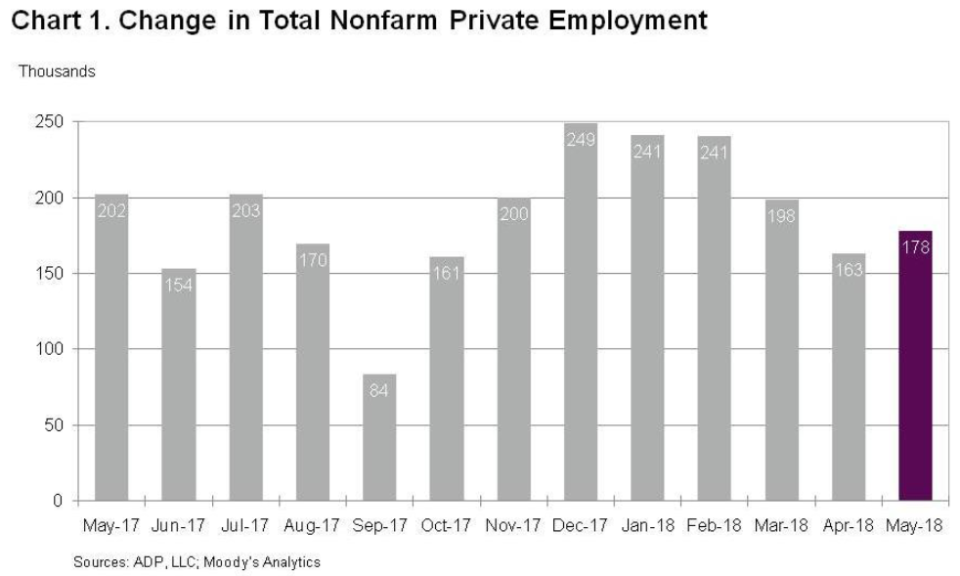

On the labor market side, ADP’s report showed that 178,000 jobs were created in the private sector in May, fewer than the 190,000 that was expected by economists. April’s report — which initially showed that 204,000 jobs were created during the month — was also revised down to show that 163,000 jobs were created in April.

Ashworth notes that this revision to ADP’s data brings it almost exactly in-line with private job growth of 168,000 reported by the government earlier this month. The signal for Friday’s jobs report coming from this report, then, isn’t likely all that strong.

According to estimates from Bloomberg, Wall Street expects that 190,000 jobs were created in May while the unemployment rate is expected to stay put at 3.9%. Economists have suggested that job growth of around 100,000 is all that’s needed to maintain the current level of unemployment, indicating that slower overall job gains are likely to come to pass in the months and years ahead even without an economic slowdown.

“Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions,” said Mark Zandi, chief economist at Moody’s Analytics, following ADP’s report.

“Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses’ number one problem.”

And after Tuesday’s ugly day in markets, stock prices were higher, bond yields were rising, and markets were bouncing back early Wednesday despite a disappointing morning for the U.S. economy.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland