From the wealthy to Wall Street, here's how the 2020 Democrats would redraw the US tax code with their plans

Joe Raedle/Getty Images; Mark Wilson/Getty Images; Sean Rayford/Getty Images

The Democratic presidential candidates have unveiled a series of tax plans that align with their political goals.

Despite an ideological gulf between them, the moderate and progressive wings of the party agree on hiking taxes on the very wealthy and corporations, and providing relief to the middle class.

Sanders and Warren seek to raise substantial new federal revenue to pay for sweeping government initiatives like Medicare for All and to wipe out student debt.

From the wealthy to Wall Street to Main Street, here's how the 2020 Democrats would change how Americans are taxed.

The 2020 Democratic presidential candidates have rolled out scores of tax proposals signaling their goals and what they would seek to achieve if they defeat President Trump and win the White House.

Despite their wide ideological differences, there is a consensus among progressive and moderate candidates to ramp up taxes on the richest citizens and corporations to fund plans that would realign the nation's economy and provide relief for the middle class.

Sens. Bernie Sanders and Elizabeth Warren are two progressives leading the pack with huge spending plans sporting price tags well into the tens of trillions of dollars, arguing they will accelerate economic growth. Sanders is generating momentum and rising in polls after a near-win in the Iowa caucus and a victory in the New Hampshire primary.

Moderates such as former Vice President Joe Biden and former South Bend Mayor Pete Buttigieg are also proposing significant increases in federal spending, but are pursuing incremental changes on healthcare and education.

Gaining prominence in a volatile primary field, former New York City Mayor Mike Bloomberg rolled out a tax plan projected to raise trillions of dollars in tax revenue.

The tax-and-spend approach of the field represents a departure from past elections.

"It's a bucking of the trends we've seen for the past 20 years, where Democratic administrations have relied on refundable tax credits," said Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center who analyzed the tax plans of the 2020 candidates, noting that credits put money back into the pockets of taxpayers.

Instead, leading Democratic candidates are veering toward an activist model of governance with a stronger emphasis on redistributing wealth. And with the spending plans, she said, "you see it upfront."

The size of their spending mirrors the ambition of each candidate to either adjust or completely remake the role of government — and their efforts to change American society with it.

From the wealthy to Wall Street to Main Street, here's how the 2020 Democrats would change how Americans are taxed.

Sen. Bernie Sanders has proposed substantial new taxes on wealthy Americans and corporations to fund an ambitious progressive agenda.

Brian Snyder/Reuters

Sanders has centered his campaign around the idea of a wholesale progressive revolution. He pushed the Democratic Party significantly to the left on issues like a $15 minimum wage and tuition-free public college during his first presidential run in 2016.

He seeks to implement a Green New Deal, Medicare for All, and a federal jobs guarantee, among other plans.

It's a platform with a hefty price tag — and that comes with several key tax plans:

Enact a "wealth tax" on the ultra-rich that would impose a 1% annual tax on households net worths of $32 million, steadily increasing to 8% on fortunes above $10 billion.

Implement an "income inequality tax" plan to increase the corporate tax rate by 0.5% on companies paying their chief executives at least 50 times more than their average worker. It would gradually scale up to 5% on those with wider disparities.

Raise the corporate tax rate to 35% after it was slashed in the 2017 Trump tax cuts.

Eliminate the $132,000 cap on taxable income for Social Security and instead apply payroll taxes on wages above $250,000 to drastically expand the program.

Hike the estate tax to a maximum rate of 77% on those worth over $1 billion.

Levy a tax on Wall Street stock and bond trades.

The Progressive Policy Institute (PPI), a center-left organization, said in a recent report that Sanders had proposed just over $50 trillion in new spending — the Green New Deal and Medicare for All made up the largest portion.

Sen. Elizabeth Warren also has a sweeping collection of plans that would collect substantially more tax dollars from the richest Americans and expand the size of the federal government.

Sean Rayford/Getty Images

Warren has proposed a raft of progressive plans to remake the American economy and tilt the scales of economic power back toward the middle class.

The cost of her agenda is estimated to be $30 trillion, which would significantly expand the size of the federal government. To help pay for it, Warren is relying on collecting more taxes from the wealthiest Americans and corporations.

These are the key tax plans underpinning her ambitious agenda:

Pass her signature wealth tax, which would levy a 2% rate on households with assets over $50 million and tripled to 6% on those with fortunes above $1 billion.

Raise the corporate tax rate to 35% and reverse the Trump tax cuts.

Create 7% surtax on corporate profits based on their financial statements.

Impose a 14.8% tax on investment income for individuals earning above $250,000 and couples making more than $400,000 to finance Social Security expansion.

Levy capital gains tax at the same rate as ordinary income for the top 1% of US households.

Eliminate income cap on Social Security taxes for employees earning above $250,000 a year and enact a 14.8% tax on earnings over that amount, split between workers and employers.

Shift money paid to health insurance companies for premiums to the federal government to cover the campaign's estimated $20.5 trillion price tag of Medicare for All.

Her campaign estimates the wealth tax would raise $3.75 trillion in revenue over a decade — and Warren says the money would be used to cover the cost of universal childcare, K-12 education, free public college, and cancelling student debt.

Some experts, though, contend the wealth tax would generate fewer tax dollars than initial projections suggest — that's if it becomes reality as others have argued its unconstitutional.

The PPI report noted that compared to her rivals, Warren proposed more spending on research and low-income students.

Former Vice President Joe Biden is pushing for a smaller expansion of government compared to his progressive rivals. But it would also be paid for with taxes on the very rich.

Jordan Gale/Reuters

Biden has anchored his candidacy on the notion he is uniquely capable to restoring normalcy in Washington, touting decades of experience in Congress and the White House.

The former vice president says he would attempt to work with Republicans on his legislative priorities, like strengthening the Affordable Care Act.

His campaign estimates it would raise $3.4 trillion over 10 years from Biden's tax plans:

Roll back the Trump tax cuts and raise the corporate tax rate to 28%.

Widen the child-care tax credit to $8,000.

Restore top individual tax rate to 39.6%.

Expand renewable-energy tax credits and deductions, and scrap fossil fuel subsidies.

Make all income subject to payroll taxes to protect Social Security.

Expand earned-income tax credit to older employees.

Tax capital gains equivalent to ordinary income for employees earning over $1 million.

Create tax credits for smaller businesses adopting savings plans in their workplaces.

Unlike Sanders or Warren, Biden is not attempting to soak the rich in taxes, and his spending platform is modest by comparison.

But it still represents significantly more taxes on owners of capital. The PPI report also noted his spending would be directed toward improving infrastructure, education, and scientific research.

Former South Bend Mayor Pete Buttigieg has carved out moderate positions, but he still wants to ramp up taxes on the rich and corporations.

Associated Press/Charlie Niebergall

Buttigieg has touted a message of generational change and renewed unity to Washington, channeling former President Obama's first 2008 campaign.

Though billing himself as a moderate, Buttigieg's $7 trillion spending plan, per a campaign estimate, is larger than the proposal Biden unveiled. And his economic platform is also further to the left.

Here are his key tax plans:

Increase marginal tax rate for highest earners.

Roll back Trump tax cuts and restore the corporate income tax rate back to 35%.

Enact a financial transaction tax on Wall Street trades.

Tax capital gains at the same rate as ordinary income.

Pass a carbon tax and dividend to curb its emissions and combat global warming.

Allow additional 50% tax deduction for cost of employing interns in rural or underserved areas.

Expand earned-income tax credit for low-income workers and families.

Scrap tax preferences for fossil fuel companies.

Slap a tax penalty on pharmaceutical company when it fails to reach an agreement with the federal government on a drug.

Buttigieg is seeking to create a public health insurance plan, combat climate change, and invest heavily in childcare and K-12 education.

Sen. Amy Klobuchar also wants to increase taxes on the very rich while providing a lot of relief for the middle class with tax breaks or credits.

AP Photo/Patrick Semansky

Klobuchar, another moderate, has relayed her legislative credentials and a common-sense approach to governing on the campaign trail.

The Minnesota senator is also contending that her platform will help win over voters in critical states like Wisconsin and Michigan. Here are her tax plans:

Increase income and payroll taxes for high-income earners.

Raise corporate tax rate to 25%, rolling back Trump tax law.

Levy minimum tax on the biggest corporations.

Scrap tax breaks for fossil fuel companies.

Create new tax preferences for communities impacted by climate change.

Establish tax credits for farmers, businesses investing in research, manufacturers upgrading equipment, and employers helping workers save up for retirement.

Expand earned-income tax credit to benefit families.

Implement new payroll tax for Social Security on employees earning above $250,000.

Tax capital gains at the same rate as ordinary income.

Last year, she rolled out a $100 billion plan to combat drug and alcohol addiction and improve mental health treatment.

Klobuchar is prioritizing shoring up American infrastucture and aiding seniors.

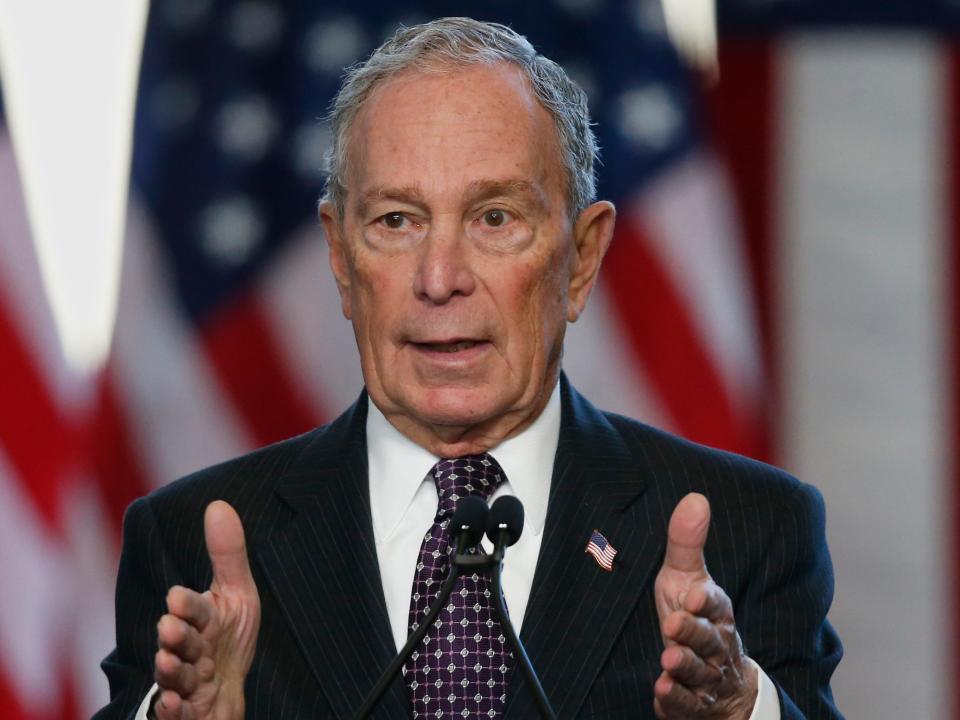

Former New York City Mayor Mike Bloomberg has rolled out a tax plan that would raise more revenue than Biden, but less than Sanders and Warren.

Associated Press

Bloomberg, a wealthy media executive, is running as a business-friendly moderate Democrat with a record of advocating for gun control and climate change action.

The former New York City mayor unveiled a plan proposing $5 trillion in new tax revenue from the richest Americans and corporations — a sizable amount that's almost 50% larger than Biden's tax increases.

His platform is calling for a range of new and changed taxes:

Raise the corporate tax rate to 28%, partially rolling back Trump's tax cut.

Restore the top marginal tax rate on income to 39.6%.

Tax capital gains the same rate as ordinary income.

Create a financial-transactions tax on every stock and bond traded.

Impose a 5% surtax on people earning above $5 million in income yearly.

Eliminate tax breaks for fossil fuel companies.

Extend and create more tax credits for solar and wind companies.

Increase federal tax on cigarettes by $1 per package, indexed to inflation.

Expand the earned-income tax credit.

Bloomberg, though, has a conservative tilt within the field on economic policy.

He staunchly opposes the wealth tax and the idea of universal healthcare, arguing that Medicare for All would "bankrupt us for a very long time."

The billionaire media executive's plan to crack down on Wall Street underscores a shift in his own views toward financial regulation, which he derided in the past. Now it aligns with the Democratic electorate.

In 2014, Bloomberg called the landmark Dodd-Frank law that toughened regulations on banks and financiers "a package of stupid laws" that Wall Street learned to ignore.

Tom Steyer wants to end tax breaks for "big polluters" and cut income taxes by 10% for the middle class.

Chris Carlson/Getty Images

Steyer, a wealthy hedge fund executive from California, invested heavily in Democratic causes such as combating climate change before running for president.

His tax plan's primary goals are to:

Enact a wealth tax on household net worths above $32 million, topping out to 2% on fortunes above $1 billion.

Restore the top tax rate for individuals at 39.6%.

Cut income taxes by 10% for individuals earning less than $200,000 and families making less than $250,000.

Restore the corporate tax rate to 35%, undoing that portion of Trump's tax cuts.

Tax capital gains at the same rate as ordinary income.

Unlike Bloomberg, Steyer is molding himself as a progressive, given he's embraced a tax on wealth.

Rep. Tulsi Gabbard has not introduced many tax proposals.

Associated Press

Gabbard has honed a message of non-intervention overseas, but is light on tax plans.

Her tax plans include:

Steadily increasing payroll tax rates from 6.2% to 7.4% by 2043.

Eliminating tax breaks for fossil fuel companies.

Extending tax credits for wind and solar energy.

Tech entrepreneur Andrew Yang dropped out of the 2020 race. But he had an array of proposals that complemented his drive for "human-centered capitalism," including universal basic income and subsidized marriage counseling.

Justin Sullivan/Getty Images

Yang centered his campaign on confronting the threat of automation, warning it would lead to mass unemployment. Universal basic income was his signature plan.

His "Freedom Dividend" proposal would guarantee payments of $1,000 a month — or $12,000 a year — to every US citizen over 18 years old with no strings attached.

Other tax plans included:

Passing tax incentives to encourage additional investment in film, TV, and theater.

Imposing a charge on profits made from self-driving trucks to fund severance packages for unemployed drivers.

Taxing Wall Street transactions at 0.1%.

Deducting the cost of a college course in personal finance from tax bills.

Subsidizing marriage counseling for interested couples.

Creating tax incentives to encourage people to buy gun safety products or upgrade their firearms to make them safer.

Declaring the April deadline for taxes a federal holiday.

Levying a 1% tax on university endowments above $30 billion.

Read the original article on Business Insider