Watching these people day-trade stocks together would make any investor nervous

These days, big cap tech companies are powering both the conversation around markets and the market’s performance itself.

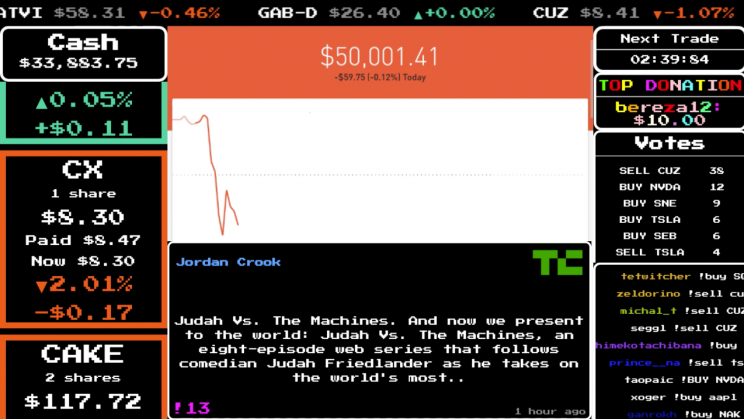

And in a development that won’t allay any concerns about record-high stock prices, enter StockStream, which calls itself the worlds first “cooperative multiplayer stock market game using real money.”

In English, this means people are watching a stock market account fluctuate all day on video-streaming site Twitch. And they can vote on what the portfolio does next using money that isn’t theirs.

Every five minutes, something happens — the account buys a share of Google (GOOGL), or sells a share of AMD (AMD), or buys a share of Tesla (TSLA), and so on. As Business Insider’s Matt Weinberger reported Tuesday, this account is seeded by a $50,000 investment from Amazon engineer Mike Roberts and trades are executed via Robinhood.

Right now, the account is mostly a collection of hot tech stocks that are often among the most heavily-debated companies in the market — 32 shares of AMD, 23 shares of Tesla, 6 shares of Google, and 4 shares of Nvidia (NVDA).

Sprinkled in there are one share of Xerox (XRX), two shares of Cheesecake Factory (CAKE), one share of Pepsi (PEP), one share of Domino’s Pizza (DPZ), a share of Square (SQ), and three shares of Apple (AAPL). (This is not a comprehensive list of the portfolio’s holdings.)

Roberts told Weinberger on Tuesday that after the first day he was “a lot more bullish than [he] already was.” Stock market logic would say this bullishness reflects a belief that stocks would continue to go up. However, Roberts’ concerns seemed to be largely about the game getting coopted by trolls who tried to intentionally pick stocks that would lose the portfolio money and end the game. So, bullish on humanity is perhaps a more apt descriptor.

All about ‘FANG’ stocks

Those who right now view the stock market as overheated and, in turn, set for lower returns going forward aren’t likely to find comfort in watching this game play out in real-time (which, I can attest, is an addicting activity). Additionally, watching an investment portfolio move on a tick-by-tick basis isn’t likely to create the conditions for thoughtful decision making, but will instead induce anxiety when prices go down and euphoria when prices go up.

Year-to-date, the FANG stocks — Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google — are up 30% as a group, according to Bank of America Merrill Lynch data. Add in Apple, up 31% this year, and chipmaker Nvidia, up 34% this year, and you start to hear full-blown concerns about another tech bubble breaking out.

Meanwhile, a recent research report from Bank of America Merrill Lynch’s Savita Subramanian noted that in the final years of bull markets, stock returns have typically been strong. Ahead of the financial crisis-induced crash, for example, the S&P 500 rose 36% during the 24 months ending in October 2007; this rally accounted for nearly 40% of all the gains investors enjoyed during that period. It was, in other words, painful to sell early.

And what BAML’s data also shows is that investors — whether they be professional investors or the retail investors who are participating in things like StockStream — pile into the market after they’ve gotten something like an “all clear” from markets that were already going up.

This final rush of money, then, provides the tinder for the “blow off top” that some strategists have been looking for for some time.

On the one hand, the bulls will see the flow of money into the FANG names and then simply look around and believe that yes, this is completely rational. After all, aren’t we all buying everything from Amazon, watching everything on Netflix, communicating with everyone on Facebook, and getting every answer on Google?

Additionally, research has shown that the stock market’s gains being concentrated in just a few stocks is normal. Since 1926, more than half of the stock market’s gains, for example, have come from just 86 of more than 26,000 stocks. What, then is the big deal about the FANG outperformance?

But in the investing world, there is always something to worry about, and the adage that tops are a “process” — rather than happening all at once — is certainly going to provide the backing for concerns that come out of the clearly-growing public enthusiasm for stocks we see with experiments like StockStream.

The oldest piece of investing wisdom is that you should buy low and sell high. Easy in theory, hard in practice. And while it’s easy now to look back at market’s low in March 2009 and say that you would’ve had the courage to go all-in on stocks then, the reason stocks were so cheap is precisely because most people didn’t.

And it seems that it’s only after a more than tripling in the S&P 500 since that bottom that we feel ready to have fun watching people vote on what stock to buy next. Which is all in good fun, until it’s not.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: