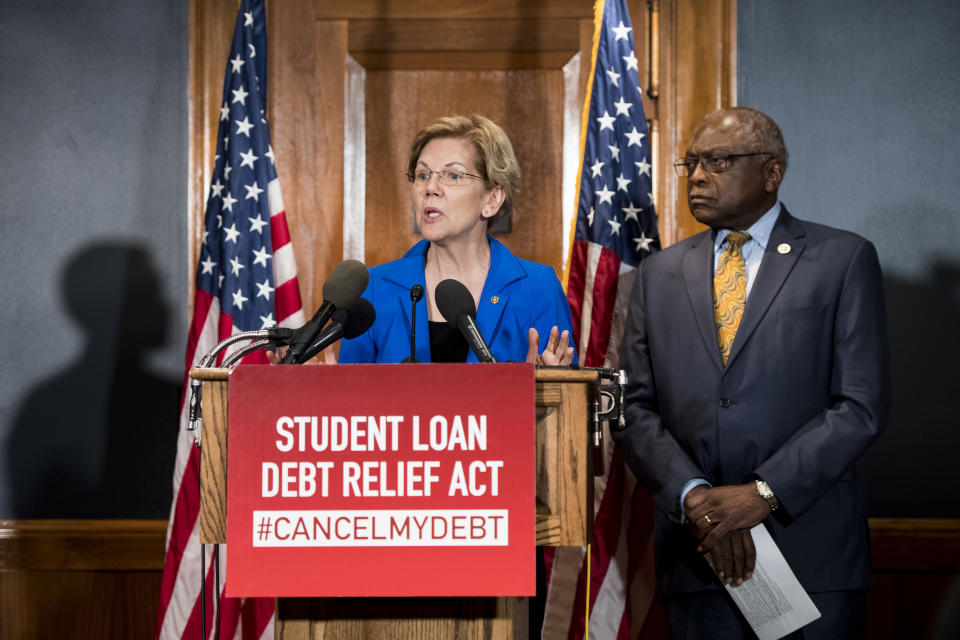

Elizabeth Warren calls student loan appointment ‘an outrageous slap in the face’

The Consumer Financial Protection Bureau (CFPB) appointed a student loan ombudsman nearly a year the previous official resigned, and Sen. Elizabeth Warren (D-MA) is not happy with the agency’s replacement.

The presidential hopeful sent letters to the CFPB Director Kathy Kraninger, Treasury Secretary Steven Mnuchin, and new CFPB Student Loan Ombudsman Appointee Robert Cameron calling “the appointment of Mr. Cameron, a former executive responsible for compliance at a student loan servicer that has been accused of cheating thousands of students and taxpayers... an outrageous slap in the face to student loan borrowers across the country."

Warren noted that under Cameron’s record, the industry had failed to “comply with federal rules and state consumer protection laws” and asserted that Cameron was “not qualified to serve as the Student Loan Ombudsman.”

Warren, who had spearheaded the creation of the CFPB, asked Kraninger and Mnuchin to reconsider — and reject — Cameron's appointment.

‘Straight through the revolving door’

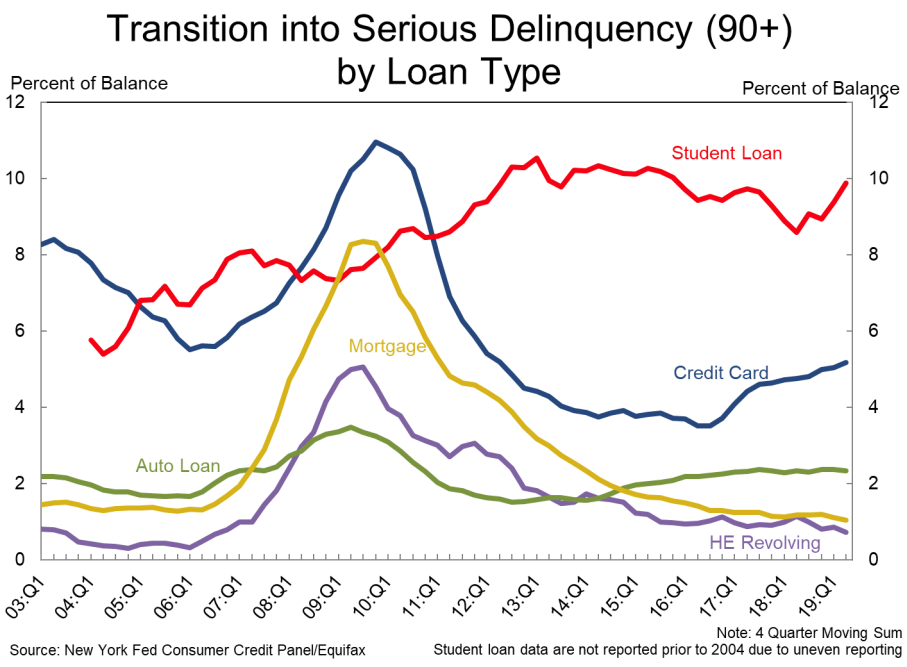

The number of outstanding student loans stand at $1.48 trillion as of the seccond quarter of 2019, according to the New York Fed. Student debt formed 35% of the loans that were in the “severely derogatory” category.

Warren does not appear to think that the new appointment will benefit borrowers.

“Mr. Cameron comes to this role straight through the revolving door, directly from his position overseeing compliance activities’ at the Pennsylvania Higher Education Assistance Authority [PHEAA]… one of the U.S. Department of Education's largest student loan servicers, and one of its most troubled,” Warren wrote to Kraninger.

The former ombudsman, Seth Frotman, who resigned last August in protest of the new leadership’s direction under then-director Mick Mulvaney, echoed Warren’s sentiments.

“Under current leadership, the CFPB has made it its mission to do the bidding of the largest financial services companies in America,” Frotman told Yahoo Finance in a statement. “It is outrageous that an executive from the student loan company that has cheated students and taxpayers, and is at the center of every major industry scandal over the past decade, is now in charge of protecting borrowers rights. This is an insult to the nation's 45 million borrowers who deserve an advocate in their corner.”

‘I therefore urge you to reconsider your decision’

“As you are surely aware, PHEAA's compliance track record has been utterly abysmal under Mr. Cameron's watch… PHEAA has a record of failing borrowers,” Warren told Kraninger. “It is mind boggling that the CFPB's top official responsible for overseeing this servicer's compliance activities is now tasked with protecting borrowers from mistreatment by PHEAA and other student loan companies and servicers.”

Warren also noted that the PHEAA is “one of the Education Department's largest student loan servicers, overseeing more than $350 billion in loans held by eight million borrowers and administering the federal Public Service Loan Forgiveness program (PSLF).”

In her letter to Cameron, Warren asked him to reject the job.

“Your employment history presents an irresolvable conflict of interest that will prevent you from being able to serve as an effective Student Loan Ombudsman,” she said to Cameron. “I therefore urge you to reconsider your decision to accept this position. And if you do not do so, I minimally ask that you recuse yourself from all matters that directly or indirectly affect PHEAA for the duration of your tenure at CFPB.”

Not all groups were opposed to giving Cameron a chance.

Consumer Bankers Association President and CEO Richard Hunt said in a statement on their part, they were “glad Director Kraninger has filled this role” and were looking forward to working with the new appointee “to help improve the student lending marketplace to benefit all borrowers.”

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

'Severely derogatory': U.S. student debt defaults have 'grown stunningly'

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren: 'Betsy DeVos is the worst Secretary of Education' ever

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.