How Warren Buffett could make Berkshire Hathaway America's biggest company

How big could Berkshire Hathaway (BRK-A) get? With $210 billion in revenue, which ranks it number four on the Fortune 500, it would seem that Berkshire might have already grown to the sky, right?

Not exactly.

In fact, there’s reason to think that Berkshire could become the biggest company in the America, passing Apple (AAPL), Exxon (XOM) and even Walmart (WMT), the three companies ahead of Berkshire on the list.

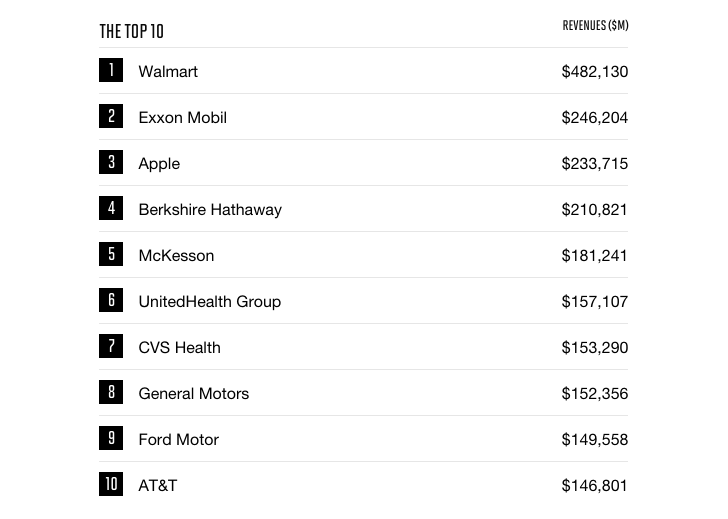

Let’s take a look at the numbers—specifically the 2016 Fortune 500—to help me illustrate:

First, it’s interesting that Apple and Berkshire are number three and four. Both have been growing fast but by different means. Apple’s jaw-dropping growth—remember this company was at death’s door 20 years ago—has been done almost 100% through organic sales growth. Again, a stunning, almost unprecedented rise in revenue. Berkshire, while it has garnered a great deal of internal sales growth has benefited mightily from massive acquisitions like Precision Castparts in 2015 (its biggest deal ever), Burlington Northern Sante Fe (2009), and Kraft Heinz (2013).

Exxon, in the number two spot, owes its position mostly to its massive core business that it has built over the years, plus being a consolidator in the oil and gas business, i.e. buying Mobil in 1998 and more recently XTO in 2009.

Berkshire’s march up the rankings has been impressive. In 1995—the first year Fortune merged its list of biggest service companies with biggest industrial companies to form what you might call the modern Fortune 500 list—Berkshire ranked #295. In 2000 it was #64. It 2005, #12. And of course it’s the only company this big that was built and still run by one guy: Buffett!

Both Apple and Exxon seem to be well within reach of Berkshire’s grasp, with “only” $23 billion and $35 billion more in sales respectively than Berkshire. Of course, you have to remember that these companies—especially perhaps Apple—may do a large acquisition at some point. You hear for instance that Apple with its $200 billion cash trove “should” or “will” buy Disney, #53 on the Fortune 500. That would immediately add $52 billion in revenues to Apple moving that company in the #2 spot.

And so what about Walmart? With $482 billion in sales—or $272 billion more than Berkshire—it would seem to be out of reach for Berkshire. Berkshire would have to more than double to pass the retailing giant.

Could Berkshire ever eclipse Walmart? Maybe, maybe not. One thing in Berkshire’s favor is that it’s growing much faster than Walmart organically. But of course if Berkshire were ever to pass Walmart it would need to do a number of major deals.

And of course that’s exactly what Buffett has been doing recently. So exactly how could Buffett get say $300 billion in revenue? Even buying Exxon $246 billion (not likely), Apple $233 billion (maybe) wouldn’t do the trick. But how about buying some combination of CVS $153 billion, GE $140 billion, Costco $116 billion, or Microsoft $93 billion?

It’s fun to speculate, right?

What Buffett said

And what does Buffett himself actually think about these rankings? He couldn’t possibly care, right? Don’t be so sure.

I recently asked Buffett: “Do you ever have your eye on making Berkshire the number one company in the Fortune 500?”

And he said: “I think over time, if we can find ways to reinvest all the earnings it should become that because we’re reinvesting all the capital. Now, whether we can do that intelligently at scale, for how long is an open question. I mean, the money belongs to the shareholders, and we should only keep it if we think we’re turning a dollar into more than a dollar when we keep it. And that gets harder, a lot harder as we get bigger. And our success will be less in the future in doing it than it has been in the past, for sure. But if we can keep finding things, then we’ll keep generating cash to buy ’em. (LAUGH)”

To me, that sounds like he’s keeping his eye on it.

What do you think?

—

More on Warren Buffett and Berkshire Hathaway: