Warren Buffett Bought Apple Inc. Stock. Why Haven’t You?

Investing guru Warren Buffett has always been cautious about the tech sector. A rapidly changing landscape and fierce competition make it difficult to choose a winner for the long term. However, Buffett has been a bit more open to tech investments over the past few years and a recent regulatory filing showed that the Oracle of Omaha has been buying up shares of Apple Inc. (NASDAQ:AAPL).

Earlier this week, regulatory filings showed that Buffett increased his holdings of AAPL stock by 3% during the third quarter to a total 134 million shares. His purchase makes him the fifth-largest Apple stock holder.

To be sure, data on these purchases is somewhat outdated and it’s never a good idea to blindly follow anyone, even Warren Buffet, I think he is on to something. The AAPL stock price has been on a bit of a roller coaster ride so far this year as worries about iPhone sales weighed on investor confidence in Apple’s future.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

However, even with the ups and downs, AAPL stock has still increased more than 45% so far this year, that, combined with the tech-maker’s strong financial position, compelling moat and strong brand position, make it a good long-term pick. As AAPL stock has declined 4% over the last five day, we are at a good entry point.

AAPL’s Big Pile of Cash

Apple’s fourth quarter results beat expectations and gave investors a reason to believe that The Fruit was on its way back to the top. Revenue came in at $52.6 billion, above analysts expectations of $50.7 billion. More importantly, AAPL topped forecasts of 46 million for iPhone unit sales, with the actual figure coming in slightly higher at 46.7 million.

Although the iPhone unit sales were only marginally higher than what analysts were expecting, Apple brought in a ton of cash as the iPhone 8 and iPhone 8 Plus became the firm’s best-selling products as soon as they were launched.

Guidance for the future was equally as impressive with revenue seen rising to somewhere between $84 billion and $87 billion in the first quarter.

That will add to Apple’s already strong financial position. The company is sitting on a big pile of cash, which bodes well for investors in several ways.

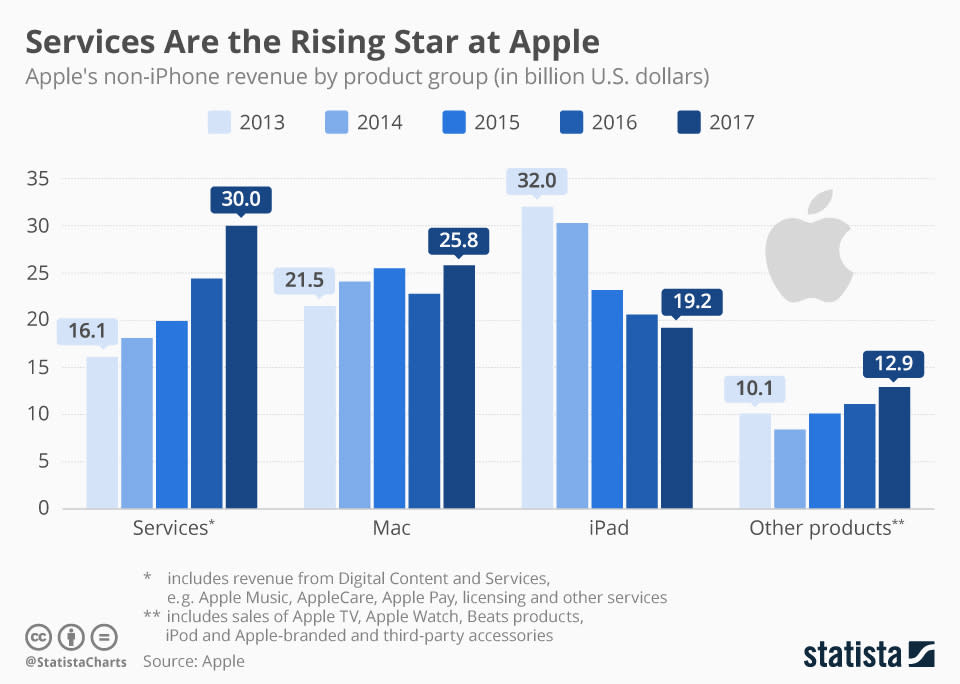

Source: Statista

First, it gives the company purchasing power. Not only does Apple have the ability to spend on R&D to ensure that its products are cutting-edge, but the firm has the ability to acquire peers in the industry that are struggling. A huge cash reserve also makes for a strong safety net in the event of a macroeconomic meltdown. Geopolitical tension across the globe coupled with worries about economic certainty means that companies like Apple, which relies on consumers’ disposable income, could become vulnerable. Apple’s safety net of cash means the firm will be able to weather even the worst-case scenario.

Kind to Investors

The other reason having so much cash on-hand is a good thing is that it makes AAPL stock very investor-friendly. Apple’s respectable 1.5% dividend yield is an added bonus for investors, and the firm’s payout ratio of just 26 means it’s also very reliable.

A lot of Apple’s cash is actually held overseas though, and bringing it back to the U.S. would create a huge tax burden for the company. However, many are expecting to see Congress approve a tax reform bill that would allow AAPL to bring a lot of that money back.

From there, there’s a lot of speculation as to what Apple will do with the cash. It’s likely that the firm will use $100 billion of the near $220 billion it would have if the tax bill is passed to pay down its debt. The rest of the money could be set aside for strategic acquisitions, but many believe that at least part of that cash will make its way to shareholders either through buybacks or a one-time special dividend payment.

Bottom Line on AAPL Stock

AAPL stock has a lot of potential now that the firm’s iPhone sales have been reignited. The company has a history of being generous with shareholders and the new tax code could prove to be a major windfall for investors. Buffet significantly increased his stake in Apple over the past few months, and you’d be wise to follow suit.

As of this writing, Laura Hoy was long AAPL.

More From InvestorPlace

The post Warren Buffett Bought Apple Inc. Stock. Why Haven’t You? appeared first on InvestorPlace.