Warren Buffett: 3 Reasons Behind Housing Bubbles & What Investors Should Take Note Of

“A pin lies in wait for every bubble,” said Warren Buffett. “And this was the biggest one.”

In an interview with Brad Bondi of the Financial Crisis Inquiry Commission that was recently made public, Buffett explained why and how housing bubbles are formed. We have summarized his explanation into three key points (see below).

1. Speculations are based on a once sound premise, but it gets distorted over time

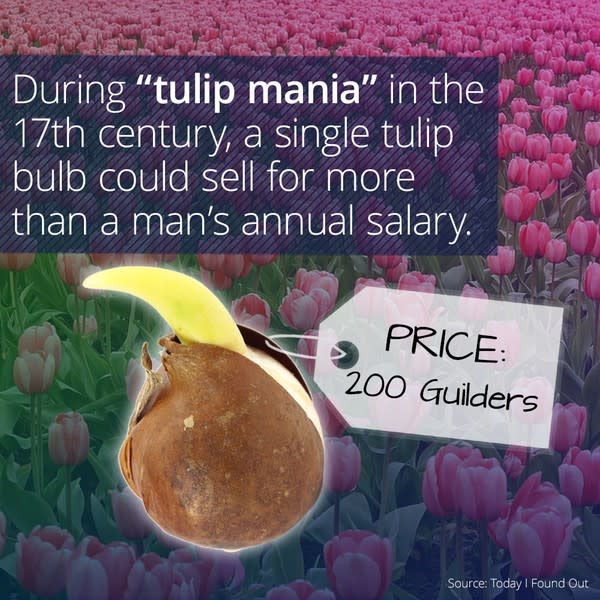

Before we discuss the housing bubble, let’s take a brief look at some of the other most famous bubbles in history, such as the South Sea bubble and the tulip-bulb bubble—how much can you relate to them?

Not very much right? The South Sea Bubble seems out-dated and archaic, and the tulip-bulb bubble…what’s the craze with flowers? But housing is a different matter; it is closer to the heart.

The public might not understand stocks or tulip bulbs, but they understood houses, explained Buffett. What’s more, the craze behind housing is actually quite legitimate.

“It’s a totally sound premise that houses will become worth more over time because the dollar becomes worth less…it’s because the dollar becomes worth less, such that a house that was bought 40 years ago is worth more today than it was then,” said Buffett.

But he also quoted a line from Ben Graham: “You can get in a whole lot more trouble in investing with a sound premise than with a false premise.”

That is because a once sound premise becomes distorted over time and from then on, price action takes over.

2. Mass Delusion and Bull Market Psychology

People don’t need to be trained to contribute to a bubble; they simply need to be encouraged when they see some successes around, which drive them to follow suit.

As Buffett puts it, “When your neighbor has made a lot of money by buying Internet stocks, and your wife says, ‘You’re smarter than he is and he’s richer than you are, so why aren’t you doing it?’ ”

So everyone, from the media investors, the mortgage bankers, the rating agencies, down to the general public bought the trend and came to believe that house prices could not fall significantly.

And no one is going to wake them up from this “mass delusion”.

“If I’m a realtor and I’ve seen a house go from 250, 000 to 500, 000, do I say to the person now, just buying the house at 500, 000, ‘I really think this is kind of dumb because it’s only 250, 000’? It just doesn’t happen,” said Buffett.

Instead, the realtor is more likely to say, “You’d better do it today because there’s going to be more tomorrow,” he said.

3. Easy Leverage Makes the Situation Worse

Another reason why housing become the “biggest bubble in history”, according to Buffett, is that it was the “easiest class to borrow against”.

“I think contributing to that—or causing the bubble to pop even louder, and maybe even to blow it up, was improper incentives—systems and leverage…they will contribute to almost any bubble that you have, whether it’s the Internet or anything else,” he said.

He also noticed that people tend to be more careful with their own money than with other people’s money.

Overall, Buffett acknowledges that home is a good investment, and its value lies beyond its possible appreciation over time.

“So it is not an unintelligent thing to do (to invest in housing). It’s only when it gets into this bubble aspect that it becomes unintelligent,” Buffett added.

It’s ok to buy houses if you find prices reasonable and affordable, and when mortgage rates are attractive, said Buffett.

But he also warned, “I wouldn’t say, ‘Buy three more on speculation,’, and I wouldn’t say, ‘Buy it if it’s going to take 50 percent of your income to service the mortgage.’”

He also advised caution when it comes to leverage.

“It gets down to leverage overall. I mean, if you don’t have leverage, you don’t get in trouble. That’s the only way a smart person can go broke, basically. And I’ve always said, ‘If you’re smart, you don’t need it; and if you’re dumb, you shouldn’t be using it.’ ”