Walmart Has Struck a Chord With Online Grocery Sales in China

Don't look now, but Walmart (NYSE: WMT) is crushing the online grocery market in China. Walmart's net sales in the People's Republic of China for the third quarter of 2017 increased 4%, and comparable sales increased 2.5%.

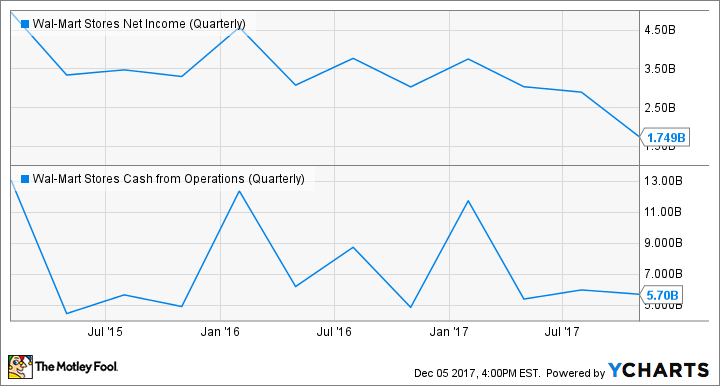

Foreign expansion is critical to Walmart's growth, almost as important as its ability to adapt to a world increasingly driven by e-commerce. As the United States' biggest retailer, the company's ability to grow is always a concern for investors. Its overall results have left much to be desired in recent years:

WMT Net Income (Quarterly) data by YCharts

Enter Walmart's Chinese operations. Not only is it making inroads as a big-box retailer, but it's beginning to make strides as a market leader in the country's burgeoning online-order grocery market.

Image Source: Walmart.

Interestingly, China was not always a poster child for growth at Walmart HQ. As recently as last year's annual report, Walmart noted that its international operations were hampered by negative comparable store sales in both China and the U.K.

That has changed -- and it's thanks in large part to the company's online-ordering initiatives fueled by its 12.1% ownership stake in, and partnership with, Chinese e-commerce powerhouse JD.com. During its Q3 conference call, Chinese operations were a highlight, and management went out of its way to note that operating income is now growing faster than sales in China and that 140 Walmart Stores (of the total 424) now offer one-hour order delivery.

Walmart gets a win in China

Optimists on Walmart's future believe that Walmart has what it takes to adapt to an increasingly e-commerce-driven world. They note that Walmart's vast geographic reach, coupled with the ability to make individual deliveries, is a recipe for success in a world dominated by companies like Amazon.

Walmart's geographic reach makes it a force to be reckoned with for "last-mile" sales.

Not only can Walmart use its stores as "warehouses" (something Amazon didn't have in the beginning), but it has embraced technology. Shoppers can go to a Walmart, consider an item, order online, and have it delivered to their home or arrange in-store pickup.

A customer-retailer dynamic like this is why Amazon bought Whole Foods. Amazon knew it needed to meet customers where they live. And that's why they are already outfitting Whole Foods stores with Amazon pickup lockers and enhancing grocery delivery options.

Walmart already has what Amazon wanted in Whole Foods.

A 20th-century company a 21st-century world?

Naturally, there are concerns. Walmart has had to change its thinking, and those nervous about Walmart's international growth note that customer perceptions matter. Consumers are used to ordering online on Alibaba and Amazon -- and know what they're getting.

Also, Amazon has a head start in fulfilling individual orders. That is, Walmart's distribution is designed to get inventory to its thousands of stores, while Amazon is perfectly calibrated to get individual orders packaged, boxed, and delivered.

To combat these cracks in its armor, Walmart is making major investments in technology and partnerships that are already driving results in places like China. It has invested billions in JD.com. It has even waded further into the JD.com pond by investing in JD's New Dada application. Today, New Dada is China's largest courier and local grocery logistics platform.

Dada arranges couriers and deliverymen for products on JD.com. Now, New Dada is being used to deliver Walmart's one-hour guaranteed grocery deliveries in the PROC. The move is a win-win for both companies, as not even JD's competitor Alibaba guarantees one-hour delivery.

Walmart also isn't ignoring its home market. On Sept. 6, 2017, Walmart announced that online ordering of groceries for pickup became available at 1,000 locations. In January of this year, it was even announced that free two-day shipping on over 2 million items was available. Also, thanks to a deal struck with Alphabet, consumers can shop Walmart through their Google Home device.

Needless to say, this isn't your grandfather's Walmart.

What you need to know

Walmart's online grocery success in China is a positive development.

Gaining a foothold in the emerging industry of online grocery ordering in the world's most populous nation not only shows Walmart can thrive in the 21st century, but that management has its fingers on the pulse of modern omnichannel retail.

The megaretailer founded all those years ago by Sam Walton is making every effort to adapt to what the market is demanding in all of its operating regions.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Sean O'Reilly has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), and Amazon. The Motley Fool has a disclosure policy.