Wall Street can't stop talking about Bitcoin

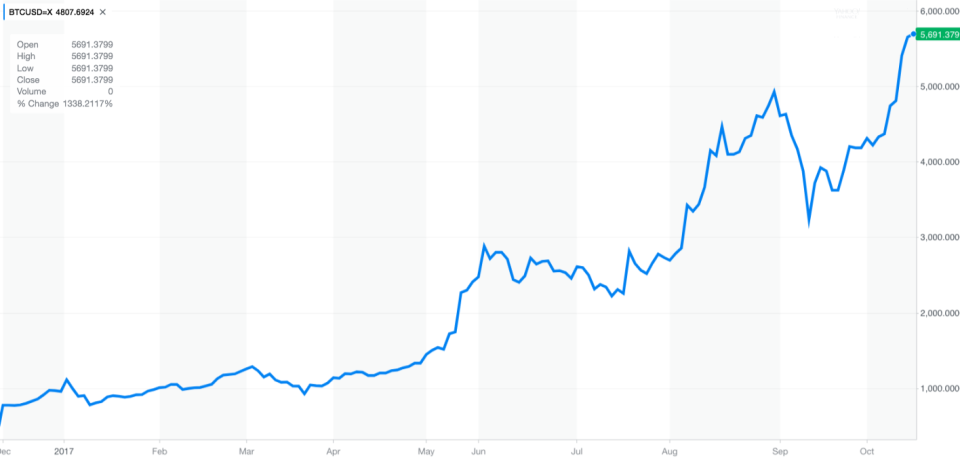

The price of Bitcoin is at a record high.

After breaking through $5,000 for the first time on Thursday, Bitcoin was up another 5% on Friday afternoon to trade near $5,700. Earlier in the day Bitcoin topped $5,800 to hit a fresh record.

And with the controversial cryptocurrency in the headlines, Wall Street just can’t stop talking about Bitcoin.

After saying on Thursday that he was done talking about Bitcoin, JP Morgan (JPM) CEO Jamie Dimon on Friday broke his brief silence, saying at the annual Institute of International Finance membership meeting in Washington, D.C. that he could care less about Bitcoin. Dimon had sworn off discussing the cryptocurrency after making waves last month by saying Bitcoin was in a bubble that would eclipse the size of the tulip bubble seen back in the 1600s.

And yet that Dimon can really lay off ripping Bitcoin seems, at this point, to be in doubt.

According to Bloomberg, Dimon said the cryptocurrency is a “great product” if you’re a criminal, resurfacing the narrative around Bitcoin that dogged the digital currency in its early years given its close association with Silk Road.

Dimon also said that one day governments will crush Bitcoin and that people who buy Bitcoin are stupid. Bloomberg also said Dimon asked rhetorically, “Who cares about Bitcoin?”

Except that a lot of people do. Including many people on Wall Street.

‘Still thinking’

On Thursday, after Dimon said he was done discussing Bitcoin further, JP Morgan’s CFO Marianne Lake said the bank is, “very open minded to the potential use cases in the future for digital currencies that are properly controlled and regulated.”

And the commentary out of JP Morgan came on the heels of Goldman Sachs (GS) reportedly looking at setting up a trading venue for Bitcoin and other cryptocurrencies. Meanwhile, Goldman Sachs CEO Lloyd Blankfein said on Twitter earlier this month that he was “still thinking” about Bitcoin but wasn’t endorsing or rejecting the concept.

Blankfein added that, “folks also were skeptical when paper money displaced gold.” So, there’s that.

Additionally, Wall Street strategist Tom Lee — mostly known for his calls on the stock market — has spent considerable time in the last few months writing research reports on cryptocurrency and said back in August that he had a $6,000 price target for Bitcoin by mid-2018.

Lee also sees Bitcoin rising to $25,000 by 2022 and his bullish view on the currency is “premised on expanded acceptance of digital currencies (as payment platforms), and ultimately broader adoption as a “store of value” (digital currencies have a lot of characteristics that make gold attractive).”

‘Cryptocurrency prices are almost certainly a bubble’

Now, Dimon is certainly not alone in being skeptical of Bitcoin, especially given the price run-up we’ve seen this year. Dimon’s colleague at JP Morgan, strategist Marko Kolanovic, said in a note last month that the cryptocurrency market “exhibits some parallels to fraudulent pyramid schemes.”

And in a big report published on Thursday, analysts at UBS said that, “a twenty-fold increase in bitcoin prices in just two years, and an absence of any fundamental economic backing, cryptocurrency prices are almost certainly a bubble.”

Comments on the extraordinary increase in the price of certain cryptocurrencies need not doom widespread adoption of the blockchain technology that Bitcoin sits on top of. And it is this technology — a decentralized, distributed ledger that encrypts all transactions executed on the blockchain — that really excites the true believers.

Now, some cryptocurrency early adopters would argue that Wall Street and banking types are merely covering their butts by caring about the technology now because eventually fiat money will be replaced by digital money. This is certainly a grand vision, and in this vision the rise of Bitcoin poses a systemic risk to the Western banking industrial complex that has predominated since World War II.

But Wall Street’s interest in Bitcoin is also likely driven by the fact that it’s new, it’s interesting, trading this stuff is exciting, and the potential upside is big. There is, at this point, clearly no putting the cryptocurrency genie back in the bottle and a development in how money moves around is something the financial sector cannot miss if it wants to continue being known as the financial sector.

When Bitcoin first entered the public consciousness in 2013, the meme was that all you could do with it was buy drugs online. But in 2017, there is real money to be made and real money being invested in the space. And finding new ways to make money is more or less the whole point of modern finance.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: