Value Partners Acquires High-Impact Holdings

- By David Goodloe

Value Partners (Trades, Portfolio) invested in more than two dozen new holdings in the second quarter, and about one-third of those acquisitions had impacts of greater than 2% each on the portfolio.

Warning! GuruFocus has detected 4 Warning Signs with LSE:LIVN. Click here to check it out.

The intrinsic value of WB

The largest acquisition in the quarter was the purchase of 2,417,519 shares of Weibo Corp. (WB), a Beijing-based social network company, for an average price of $24.21 per share. The transaction had a 5.52% impact on the portfolio.

The stake is 1.14% of Weibo's outstanding shares and 5.52% of Value Partners (Trades, Portfolio)' total assets. Value Partners (Trades, Portfolio) is Weibo's leading shareholder among the gurus.

Weibo has a price-earnings (P/E) ratio of 166.28, a forward P/E of 68.97, a price-book (P/B) ratio of 17.19 and a price-sales (P/S) ratio of 20.52. GuruFocus gives Weibo a Financial Strength rating of 9/10 with no debt and a Profitability and Growth rating of 3/10 with return on equity (ROE) of 13.19% that is higher than 66% of the companies in the Global Internet Content & Information industry and return on assets (ROA) of 9.85% that is higher than 75% of the companies in that industry.

Weibo sold for $51.63 per share at market close Tuesday. The DCF Calculator gives Weibo a fair value of $3.32.

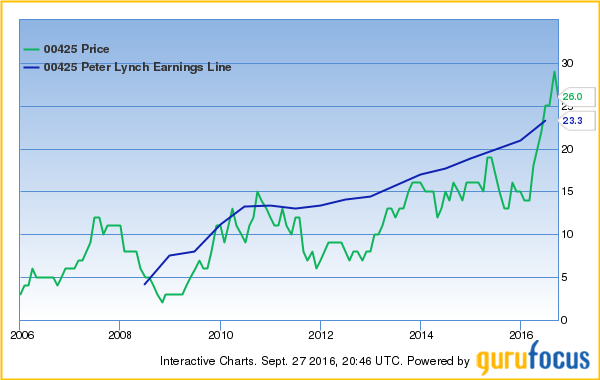

Value Partners (Trades, Portfolio) bought a 17,278,000-share stake in Minth Group (HKSE:00425), a Chinese supplier of auto parts to international automakers, for an average price of 17.9 Hong Kong dollars ($2.31 in U.S. currency) per share. The acquisition had a 4.49% impact on the portfolio.

The stake is 1.54% of Minth's outstanding shares and 4.49% of Value Partners (Trades, Portfolio)' total assets. Value Partners (Trades, Portfolio) is Minth's only shareholder among the gurus.

Minth has a P/E of 17.23, a P/B of 2.65 and a P/S of 3.23. GuruFocus gives Minth a Financial Strength rating of 7/10 and a Profitability and Growth rating of 8/10 with ROE of 15.77% that is higher than 70% of the companies in the Global Auto Parts industry and ROA of 10.89% that is higher than 82% of the companies in that industry.

Minth sold for 26.85 Hong Kong dollars per share Tuesday. The DCF Calculator gives Minth a fair value of 36.8 Hong Kong dollars with a 27% margin of safety.

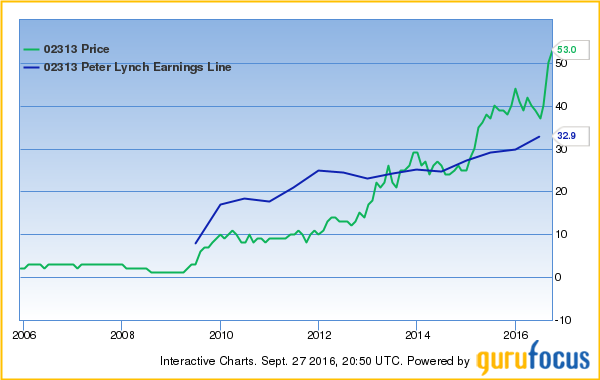

Value Partners (Trades, Portfolio) purchased 11,249,000 shares in Shenzhou International Group Holdings Ltd. (HKSE:02313), a Chinese clothing manufacturer, for an average price of 39.65 Hong Kong dollars. The deal had a 4.37% impact on Value Partners (Trades, Portfolio)' portfolio.

The stake is 0.8% of Shenzhou's outstanding shares and 4.37% of Value Partners (Trades, Portfolio)' total assets. Value Partners (Trades, Portfolio) is Shenzhou's leading shareholder among the gurus.

Shenzhou has a P/E of 24.25, a P/B of 4.72 and a P/S of 5.25. GuruFocus gives Shenzhou a Financial Strength rating of 7/10 and a Profitability and Growth rating of 7/10 with ROE of 20.74% that is higher than 81% of the companies in the Global Textile Manufacturing industry and ROA of 14.42% that is higher than 90% of the companies in that industry.

Shenzhou sold for 53.65 Hong Kong dollars per share Tuesday. The DCF Calculator gives Shenzhou a fair value of 62.28 Hong Kong dollars with a 14% margin of safety.

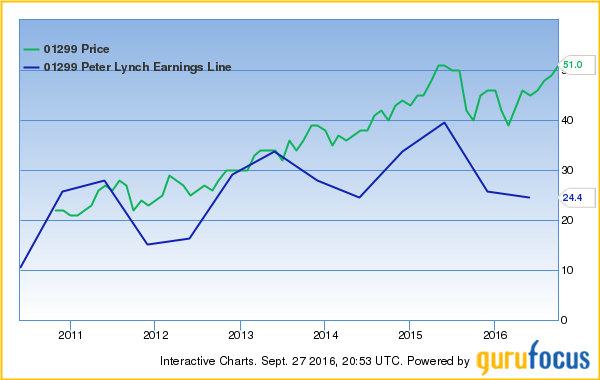

Value Partners (Trades, Portfolio) invested in 8,887,400 shares in AIA Group Ltd. (HKSE:01299), a Chinese insurance and financial services company, for an average price of 43.24 Hong Kong dollars per share. The transaction had a 4.27% impact on the portfolio.

The stake is 0.07% of AIA's outstanding shares and 4.27% of Value Partners (Trades, Portfolio)' total assets. Matthews Pacific Tiger Fund (Trades, Portfolio) is AIA's leading shareholder among the gurus with a stake of 20,140,800 shares. The stake is 0.17% of AIA's outstanding shares and 1.84% of the fund's total assets.

AIA has a P/E of 31.66, a forward P/E of 17.86, a P/B of 2.25 and a P/S of 3.44. GuruFocus gives AIA a Financial Strength rating of 6/10 and a Profitability and Growth rating of 6/10 with ROE of 7.92% that is lower than 54% of the companies in the Global Insurance - Life industry and ROA of 1.47% that is higher than 73% of the companies in that industry.

AIA sold for 51.9 Hong Kong dollars per share Tuesday. The DCF Calculator gives AIA a fair value of 17.44 Hong Kong dollars.

Value Partners (Trades, Portfolio) purchased 457,200 shares in Alibaba Group Holding Ltd. (BABA), a Chinese ecommerce company, for an average price of $74.47 per share. The deal had a 2.92% impact on the portfolio.

The holding is 0.02% of Alibaba's outstanding shares and 2.92% of Value Partners (Trades, Portfolio)' total assets. Frank Sands (Trades, Portfolio) is Alibaba's leading shareholder among the gurus with a stake of 19,915,897 shares. The stake is 0.8% of Alibaba's outstanding shares and 4.9% of Sands' total assets.

Alibaba has a P/E of 36.94, a forward P/E of 31.25, a P/B of 7.88 and a P/S of 15.84. GuruFocus gives Alibaba a Financial Strength rating of 7/10 and a Profitability and Growth rating of 8/10 with ROE of 23.33% that is higher than 87% of the companies in the Global Specialty Retail industry and ROA of 13.77% that is higher than 90% of the companies in that industry.

Alibaba sold for $108.26 per share Tuesday. The DCF Calculator gives Alibaba a fair value of $31.34.

Value Partners (Trades, Portfolio) acquired a 14,324,798-share stake in Inner Mongolia Yili Industrial Group Co. Ltd. (600887.SS), a Chinese dairy company, for an average price of 15.27 Chinese yuan renminbi ($2.29 in U.S. currency) per share. The transaction had a 2.89% impact on the portfolio.

The stake is 0.24% of the company's outstanding shares and 2.89% of Value Partners (Trades, Portfolio)' total assets. Matthews Pacific Tiger Fund (Trades, Portfolio) is the company's leading shareholder among the gurus with a stake of 32,078,874 shares. The stake is 0.53% of the company's outstanding shares and 1.22% of the guru's total assets.

The company has a P/E of 18.73, a P/B of 4.79 and a P/S of 1.62. GuruFocus gives the company a Financial Strength rating of 8/10 and a Profitability and Growth rating of 7/10 with ROE of 25.89% and ROA of 13.43% that are higher than 89% of the companies in the Global Packaged Foods industry.

The company sold for 16.11 renminbi per share Tuesday. The DCF Calculator gives the company a fair value of 9.2 renminbi.

Value Partners (Trades, Portfolio) bought a 2,388,000-share stake in China Mobile Ltd. (HKSE:00941), a telecommunications company based in Beijing, for an average price of 85.59 Hong Kong dollars per share. The acquisition had a 2.19% impact on the portfolio.

The stake is 0.01% of China Mobile's outstanding shares and 2.19% of Value Partners (Trades, Portfolio)' total assets. China Mobile's leading shareholder among the gurus is Causeway International Value (Trades, Portfolio) with a stake of 13,352,839 shares. The stake is 0.07% of China Mobile's outstanding shares and 2.8% of Causeway's total assets.

China Mobile has a P/E of 14.56, a forward P/E of 15.17, a P/B of 1.72 and a P/S of 2.40. GuruFocus gives China Mobile a Financial Strength rating of 8/10 and a Profitability and Growth rating of 7/10 with ROE of 11.93% that is higher than 66% of the companies in the Global Telecom Services industry and ROA of 7.75% that is higher than 78% of the companies in that industry.

China Mobile sold for 95.1 Hong Kong dollars per share Tuesday. The DCF Calculator gives China Mobile a fair value of 121.4 Hong Kong dollars with a 21% margin of safety.

Value Partners (Trades, Portfolio) invested in a 6,186,500-share stake in Techtronic Industries Co. Ltd. (HKSE:00669), a Hong Kong-based manufacturer of power tools and electronic equipment, for an average price of 30.11 Hong Kong dollars per share. The deal had a 2.07% impact on Value Partners (Trades, Portfolio)' portfolio.

The stake is 0.34% of Techtronic's outstanding shares and 2.07% of Value Partners (Trades, Portfolio)' total assets. Value Partners (Trades, Portfolio) is the company's only shareholder among the gurus.

Techtronic has a P/E of 18.47, a P/B of 3.06 and a P/S of 1.36. GuruFocus gives Techtronic a Financial Strength rating of 6/10 and a Profitability and Growth rating of 7/10 with ROE of 17.37% that is higher than 84% of the companies in the Global Tools & Accessories industry and ROA of 7.70% that is higher than 79% of the companies in that industry.

Techtronic sold for 29.6 Hong Kong dollars per share Tuesday. The DCF Calculator gives Techtronic a fair value of 43.41 Hong Kong dollars with a 32% margin of safety.

Value Partners (Trades, Portfolio) also bought five new stakes that had impacts on the portfolio of between 1% and 2% - Samsung Electronics (005930.KS), Beijing Enterprises Holdings (HKSE:00392), Luye Pharma Group (HKSE:02186), Pegatron (4938.TW) and BOC Aviation (HKSE:02588).

Disclosure: I do not own any stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with LSE:LIVN. Click here to check it out.

The intrinsic value of WB