Value-Adding Growth Stocks To Buy Now

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

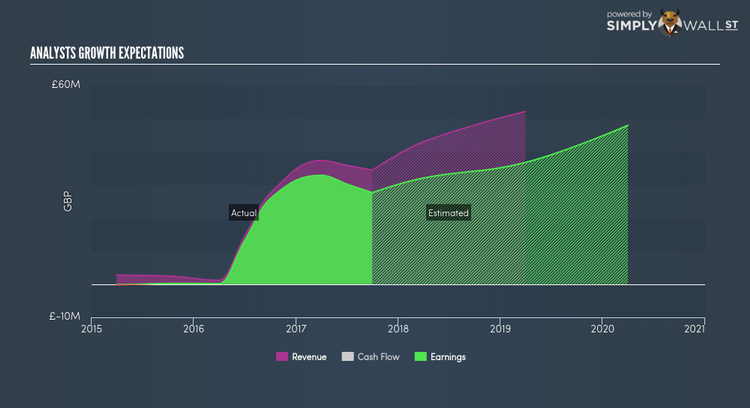

Draper Esprit plc (AIM:GROW)

Draper Esprit plc, formerly known as Ingleby (1994) plc, is a private equity and venture capital firm specializing in any stage in the lifecycle of a business from seed and series A stage, growth capital to pre-IPO investments, late stage, cross-stage investments, buyouts, PIPES, and also makes direct and secondary investments in portfolio companies. Established in 1984, and headed by CEO Simon Cook, the company now has 17 employees and with the stock’s market cap sitting at GBP £318.67M, it comes under the small-cap category.

Could this stock be your next pick? Take a look at its other fundamentals here.

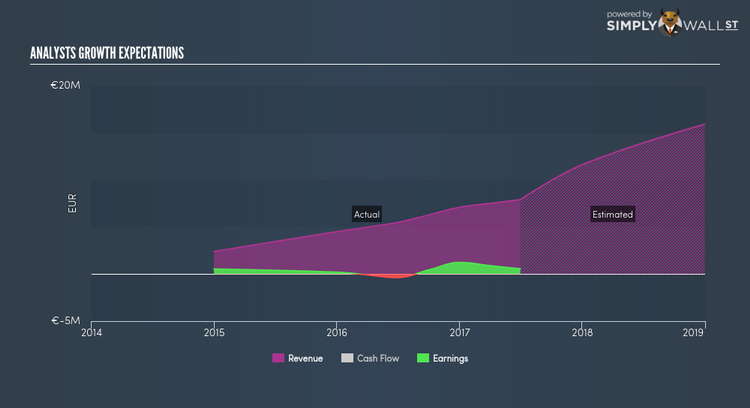

Defenx Plc (AIM:DFX)

Defenx Plc, a security software company, provides a range of products for the mobile, PC, and network security markets worldwide. Formed in 2009, and headed by CEO Alessandro Poerio, the company now has 15 employees and with the company’s market cap sitting at GBP £6.62M, it falls under the small-cap group.

A potential addition to your portfolio? I recommend researching its fundamentals here.

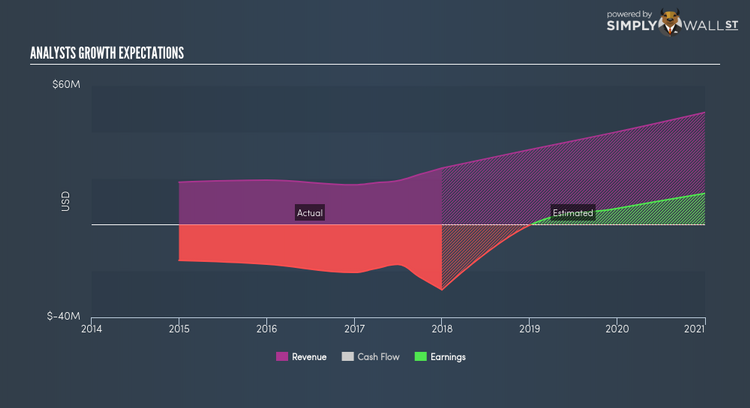

Boku, Inc. (AIM:BOKU)

Boku, Inc. provides mobile billing and payment solutions for merchants and mobile operators. Established in 2008, and currently headed by CEO Jonathan Prideaux, the company employs 150 people and with the stock’s market cap sitting at GBP £213.78M, it comes under the small-cap stocks category.

BOKU’s projected future profit growth is an exceptional triple-digit, with an underlying 64.06% growth from its revenues expected over the upcoming years. It appears that BOKU’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. BOKU ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about BOKU? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.