US Bank sees success with Zelle (USB)

This story was delivered to BI Intelligence "Payments Briefing" subscribers. To learn more and subscribe, please click here.

US Bank saw a major increase in transactions made through Zelle, the bank-based peer-to-peer (P2P) offering operated by Early Warning, in Q3 2017, according to Bank Innovation.

US Bank integrated Zelle — which has over 30 other banking partners like Bank of America (BofA), JPMorgan Chase, and Citi — last year. The bank saw a 104% increase in Zelle transactions in the past four months, and a 50% increase in customer enrollment in the P2P offering during that time.

Zelle has leveraged its access to millions of consumers through its banking partnerships to grow its offerings.

Zelle immediately attracted a massive user base upon launching. Zelle's banking partnerships with large banks have allowed it to reach 85 million users rapidly. That's likely due to its accessible platform — Zelle is integrated into existing mobile banking apps, enabling its users to make P2P payments without downloading a separate app or setting up a new account. And it's an indicator that Zelle’s approach of leveraging banks’ network is working — its partner banks saw $33.6 billion in volume in the first half of 2017, compared with rival P2P payment service Venmo’s $14.8 billion.

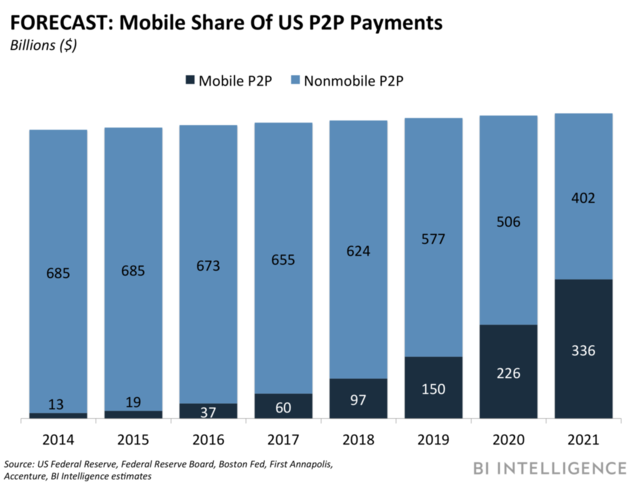

US Bank’s success with Zelle is another indicator that Zelle is actively challenging its competitors. Zelle recently launched a stand-alone app, giving consumers another option for P2P payments, and setting itself up to directly compete with rivals like Venmo and Square Cash. Having two P2P payment offerings could likely continue Zelle's growth as the P2P payments space booms — BI Intelligence forecasts mobile P2P payments will hit $336 billion in 2021, up from $19 billion in 2015. The move would also allow Zelle to remain competitive as the space becomes more crowded with new services, like Apple Pay Cash. The growth of volume among partner banks demonstrates not just rising P2P payments, but also the value that a Zelle partnership brings — BofA saw its P2P payments increase to $4 billion from $2.4 billion in the first year of its partnership with Zelle — and could push the service to the forefront.

Peer-to-peer payments, defined as informal payments made from one person to another, have long been a prominent feature of the payments industry. That’s because individuals transfer funds to each other on a regular basis, whether it's to make a recurring payment, reimburse a friend, or split a dinner bill.

Over the next few years, though overall P2P spend will remain constant, a shift to mobile payments across the board and increased spending power from the digital-savvy younger generation will cause the mobile P2P industry to skyrocket.

That poses a problem for firms providing these services, though. Historically, most of these players have taken on mobile P2P at a loss because it’s a low-friction way to onboard users and won’t catch on unless it’s free, or largely free, to consumers. But as it becomes more popular and starts to eat into these firms’ traditional streams of revenue, finding ways to monetize is increasingly important.

Jaime Toplin, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on mobile P2P payments that:

Forecasts the growth of the P2P market, and what portion of that will come from mobile channels, through 2021.

Explains the factors driving that growth and details why it will come from increased usage, not increased spend per user.

Evaluates why mobile P2P isn’t profitable for companies, and details several cases of attempts to monetize.

Assesses which of these strategies could be most successful, and what companies need to leverage to succeed in the space.

Provides context from other markets to explain shifting trends.

To get the full report, subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and more than 250 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

You can also purchase and download the full report from our research store.

See Also: