UK results — What you need to know in markets on Friday

Markets on Friday will again be focused on politics, but this time it will be action from the U.K., not the U.S., in focus for markets.

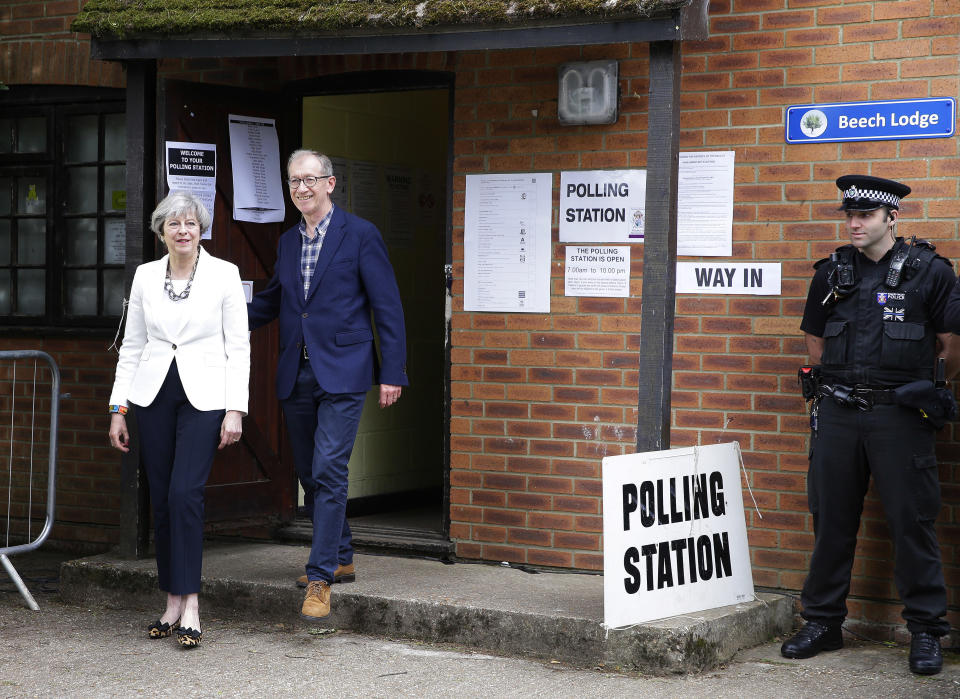

Late Thursday, results from the U.K.’s general election began rolling in, showing that Prime Minster Theresa May’s Conservative Party looked set to lose seats relative to Labour, indicating the U.K. will likely be facing a “hung parliament” where no party can form a government.

The major impact for markets here will be how a change in power in parliament could impact the U.K.’s Brexit negotiations with the EU.

Shortly after the first exit polls were released Thursday, the British pound was down as much as 1.6% to around 1.2748 against the dollar.

Markets will know more about the situation on Friday morning.

In the U.S., Thursday was all about politics as former FBI director James Comey testified before the Senate Intelligence Committee about the bureau’s investigation into Russia involvement in the election, former National Security Advisor Michael Flynn’s contact with Russian officials, and Comey’s conversations with President Trump.

And while Comey’s testimony was politically consequential — among other things, Comey said he began to make a written record of his conversations with the President because he was concerned Trump would lie about them — markets were little-changed following the testimony. Overall, markets seem to have begun to broadly look past the goings-on in Washington, D.C., as it was some time ago that markets bailed on their Trump-specific trades.

On the economic and corporate calendar on Friday, there is little in the way of macro catalysts for investors to react to.

Echoes of the tech boom

On Thursday, shares of Nvidia (NVDA) gained 6% after the stock got an upgrade from analysts at Citi, which raised their price target to $180 per share.

This gain brought Nvidia’s one-year advance to 244% and its gain since the start of 2016 to 385%. The simple bull case for the company is that its chips will power operating systems for autonomous vehicles and other artificial intelligence advances.

And while Nvidia’s performance has far exceeded that of the well-known FAANG stocks powering the markets — Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google (GOOGL) — the company fits into the narrative that right now the market is all about mega-cap, paradigm-shifting tech companies.

After the tech bubble of the late ’90s, so much of the post-bust hindsight focuses on companies like Pets.com and others who had no real business but a sky-high valuation before flaming out.

But the real pain for investors was felt in the so-called “four horsemen” of the Nasdaq — Intel (INTC), Cisco (CSCO), Dell, and Microsoft (MSFT). Since the crash which began in 2000, only Microsoft has recovered to new highs.

Intel shares are down over 40% from where they traded in June of 2000, Cisco shares are off about 50% over this period, and Dell was taken private in 2013 about 65% below where it traded 17 years ago today.

Each of these companies ran — and run — good, profitable businesses that got caught up in the hype of the tech bubble. Today’s tech giants also run businesses that are either extremely profitable, generate huge amounts of cash flow, or are seen as upending entire industries.

But that Nvidia shares reacted sharply to an analyst reaction is, as investor Tsachy Mishal noted on Thursday, “so 1999.” In 1998, for example, Amazon shares gained 19% in a single day after then-star analyst Henry Blodget put a $400 price target on the stock that was trading at $243.

Wall Street analysts serve a number of valuable purposes for investors, but one thing they can also do is add fuel to a fire investors have already created. Clearly, there is mass enthusiasm for the tech companies we can see all around changing the way we shop, interact with family and friends, advertise our businesses, and power our computers.

That these companies are the future — and that this future is worth investing in at high multiples — is an easy story to tell yourself or clients because it is so obviously true. But so too were Cisco and Intel and Microsoft and Dell the future. That this story was and remains broadly correct still didn’t save those stocks.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: