UK Lawmakers Question Whether ‘Britcoin’ Digital Pound is Needed

(Bloomberg) -- An influential panel in the UK Parliament said the Bank of England should consider whether a state-backed digital pound is really needed because the risks to the banking system and privacy may outweigh the benefits.

Most Read from Bloomberg

The Treasury Committee urged the central bank to “proceed with caution” and think about measures to curtail the risks posed by “Britcoin,” including lowering the limit on the amount of digital pounds consumers can hold.

A panel including members of Parliament from the main political parties concluded that it’s “not clear to us at this stage whether the benefits are likely to outweigh these risks.” Their report — titled “still a solution in search of a problem?” — added to skepticism about the BOE’s work on developing a central bank digital currency, also known as CBDC.

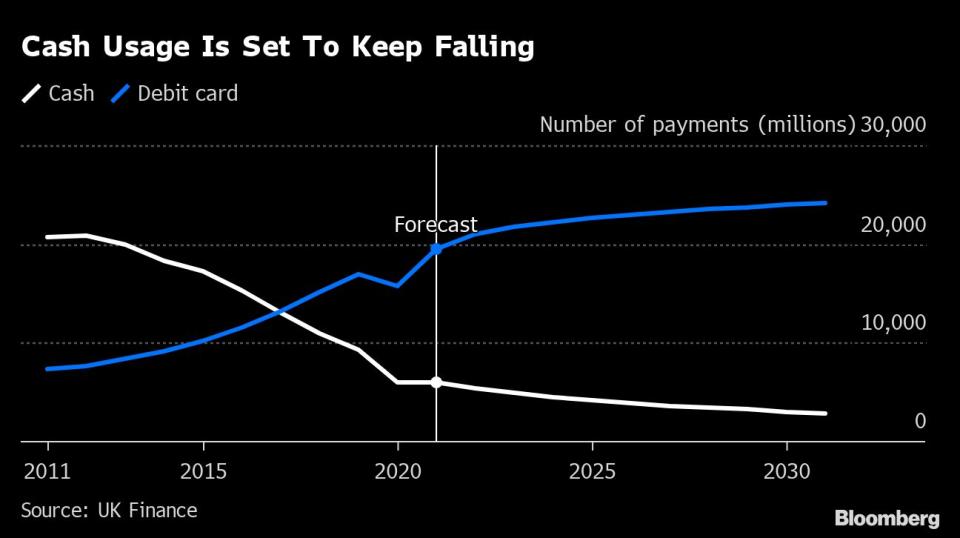

The BOE has said it is likely that a digital version of the pound will be needed as more transactions move online. Cash, which is issued by the central bank, isn’t useful in web-based transactions that are increasingly popular with consumers.

The UK Treasury and BOE are studying how to develop a CBDC and have yet to make a final decision on whether to go ahead. A decision is not expected in the UK for at least two to three years, and the BOE said any new currency wouldn’t be in curculation before the second half of the 2020s.

There are fears that a move to CBDCs could trigger bank runs if consumers used a digital pound as a safe haven instead of regular deposits. Privacy concerns have caught the attention of lawmakers and conspiracy theory groups.

“While we support the Bank of England’s plan to continue working on the design of a potential retail digital pound, I would urge them to proceed with caution and maintain a genuinely open mind as to whether one is actually needed,” said Harriett Baldwin, chair of the Treasury Committee. “It must be clearly evidenced that a retail digital pound will provide benefits to the UK economy without increasing risks or leading to unmanageable costs before any decision is taken.”

The report said there significant risks and challenges from a digital currency, particularly in relation to privacy and financial stability.

The committee recommended a “more cautious approach” to the limit set on individuals’ digital pound holdings. The BOE and Treasury proposed a £10,000 to £20,000 ceiling to head off the threat that people shed bank deposits in favor of CBDCs in times of crisis.

The panel also said officials should consider paying interest on the CBDC and draw up legislation to ensure there are “strong privacy safeguards” for the digital pound.

The BOE’s work on a potential digital pound has sparked a backlash from conspiracy theory groups who warn that CBDCs will be used for state surveillance and controlling how people spend money. The central bank has strongly pushed back against claims that it would be able to be used in this way.

“Although the Bank of England and government state that it is not their intention to be able to access users’ data, it is conceivable that they may in future be tempted to try to make use of such a powerful source of information,” the report from lawmakers said.

The Treasury Committee’s conclusions follows a scathing report by the House of Lords Economic Affairs Committee on CBDCs last year.

“We have yet to hear a convincing case for why the UK needs a retail CBDC,” the Lords report said.

Most Read from Bloomberg Businessweek

B-School Admissions Deans Are Feeling The Pressure From Falling Applications

Anduril Builds a Tiny, Reusable Fighter Jet That Blows Up Drones

No Laws Protect People From Deepfake Porn. These Victims Fought Back

Microsoft Is Happy Being the Co-Pilot on the OpenAI Rocket Ship

Soaring Canadian Housing Costs Power a Population Boom in Alberta

©2023 Bloomberg L.P.