UBER Stock Moves Higher on Mixed Analyst Attention

Uber Technologies Inc (NYSE:UBER) is on several analysts' radars this morning, and is inching higher in response, last seen slightly higher, up 1.02% at $29.79. Specifically, Stifel lifted its rating to "buy" from "hold, " citing "signs of sustainable improvement" and calling the equity's current valuation a "reasonable entry point." Meanwhile, Zephirin Group also chimed in, slashing its price objective to $40 from $48.

This analyst chatter has options players coming in hot right out of the gate. Within the first hour of trading, 15,000 call contracts have exchanged hands -- double what's typically seen at this point -- compared to 2,720 put contracts. Some selling activity could be taking place at the weekly 11/22 and 11/29 30-strike calls.

This preference for calls among options traders is nothing new, though buying calls has traditionally been more popular. In the past 10 days, over four calls have been bought for every put on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).

Taking a look at sentiment surround the ride share concern prior to today, things have been quite bullish. Twenty-four of the 30 in coverage already considered UBER a "buy" or better, with not a single "sell" to be seen. What's more, the consensus 12-month price target of $44.52 is at a healthy 50% premium to current levels.

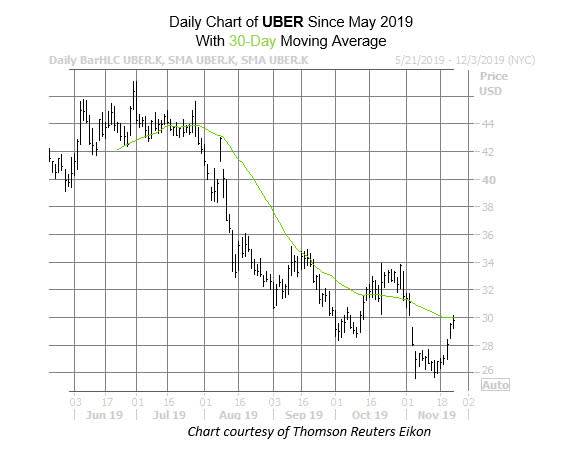

Should some of these gains hold, Uber could notch its fourth consecutive win, and its highest close since its early November post-earnings bear gap, which sent the stock spiraling towards its lowest close on record late last week. Since then, the security has tacked on roughly 15%. Now, the shares are squaring back up with their 30-day moving average -- a trendline that's provided pressure on the charts in recent months.