U.S. Offshore Wind Prospects: Overblown Promises and Blown-Up Costs

In energy policy, it is physics that matters above all else. Executive Orders from the Oval Office, Directives of the European Union, or Acts of Parliament driven through with fanfare by Her Majesty’s Government in London may give the plausible appearance that wishes are horses and beggars may ride, and in comfort too, but it is no more than appearance. As Richard Feynman, the great laughing natural-philosopher of our age, observed with savage economy after the Challenger disaster: “For a successful technology, reality must take precedence over public relations, for nature cannot be fooled.”

Physics matters. It was not a random or arbitrary fluctuation, much less political favor or the power of vested interest, that led coal to dominate British energy supply as early as 1700, eroding the status of a deeply resistant landed aristocracy and gentry. It was not thanks to politicians that in the following centuries coal, oil, and gas established an overwhelming position in global energy supply. On the contrary, it was the intrinsic physical properties of those fuels that led to their preferment, properties which can be summed up in a single term: Fossil fuels are of low entropy. They are, in the technical, thermodynamic sense, highly improbable, being dense stocks of energy, the improbability of which can be rendered in a multitude of changes to the world in accordance with human wishes, improbable changes that we call wealth. And if the low-carbon candidates to replace those fossil fuels do not have similarly favorable or superior physical properties, no amount of policy support will be able to compensate for the deficiency. Nature cannot be fooled. Reality matters.

But what is the reality of renewable energy? In one of his first actions as president, Mr. Biden has expressed the wish to “double” offshore wind in the U.S. by 2030, an ambiguous phrase that probably means he and his advisers wish to see twice the current development portfolio of offshore wind capacity to be operational within a decade, or 18,000 MW rather than the present 9,000 MW in an advanced stage of preparation. The attraction is easily explained. The U.S. already has a great deal of onshore wind power, 112,000 MW, subsidized through Production Tax Credits and mostly located on and around a line running from North Dakota to Texas, a broad belt characterized by strong winds, cheapish land, and low construction costs. Unfortunately, it is also distant from the main corridors of demand on the East and West coasts. Offshore wind along the coasts therefore seems like a tempting option for expansion, but is it wise?

The U.S. has almost no experience with offshore wind, with only two small projects completed, totaling 42 MW, about 0.2 percent of Mr Biden’s apparent aspirational 2030 target for this technology. However, this need not be a leap in the dark. In pursuit of relevant data, the U.S. can look to Europe, and particularly to the United Kingdom, which already has 10,000 MW of wind deployed in the British seas, some dating back to the early 2000s. Nearly everything the U.S. might wish to know is there. Extracting that information, however, will not be straightforward since the British government and the wind industry are colluding in an obfuscation of the truth. Both sides claim that costs are falling, the government because it is reluctant to admit failure after many tens of billions of dollars of subsidy, the industry because its participants hope to survive long enough to be rescued out by a future government so desperate that it provides new (and probably covert) subsidies.

Fortunately, one can obtain the economic facts of the offshore and indeed the onshore wind story, which is also discouraging, from the public filings of audited accounts. Professor Gordon Hughes of the Department of Economics at the University of Edinburgh has undertaken this analysis for over 350 companies that own and operate wind farms, covering a period of over 15 years. The work is published by the charity, Renewable Energy Foundation, which I direct, and is freely available from the REF website: Wind Power Economics: Rhetoric and Reality.

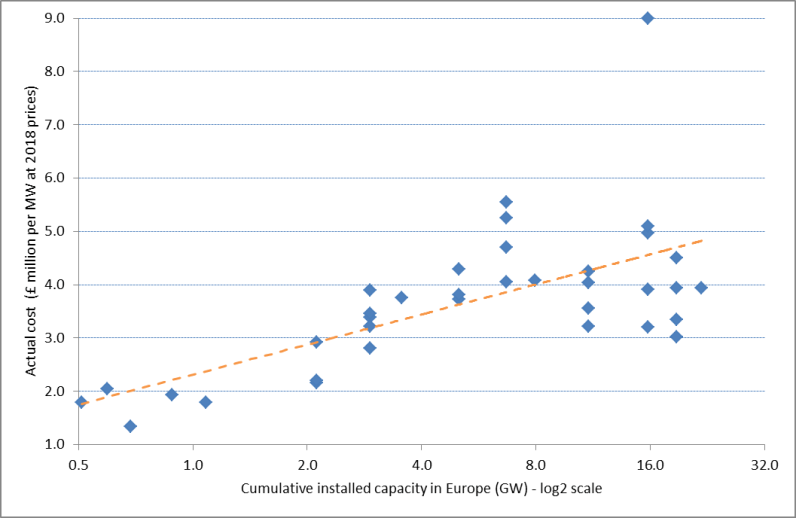

The analysis finds that offshore capital construction costs rose steadily until the early 2010s and show no sign of a sharp decline thereafter. The following figure charts the actual costs (pounds per MW of capacity at 2018 prices) for offshore wind in the U.K. including transmission connections (vertical axis) against cumulative installed capacity in Europe (horizontal axis), thus putting to the test the widely held belief that due to economies of scale and learning average costs will fall as installed capacity increases.

Source: Gordon Hughes for Renewable Energy Foundation: www.ref.org.uk

As a matter of recorded fact, costs have increased by about 15 percent for every doubling in total wind capacity in North Western Europe, mostly because of the necessity of using sites that are more distant from shore and in deeper water, requirements from which the U.S. would not be immune. Professor Hughes finds that these trends greatly outweigh any reductions in cost due to the use of larger turbines.

Of particular interest to the United States is the outlier in the figure, which represents a floating wind-turbine project, Hywind, the costs of which are double the average for fixed turbines in deep water. The majority of the available U.S. offshore wind resource flows over waters more than 60 meters deep, ruling out seabed foundations.

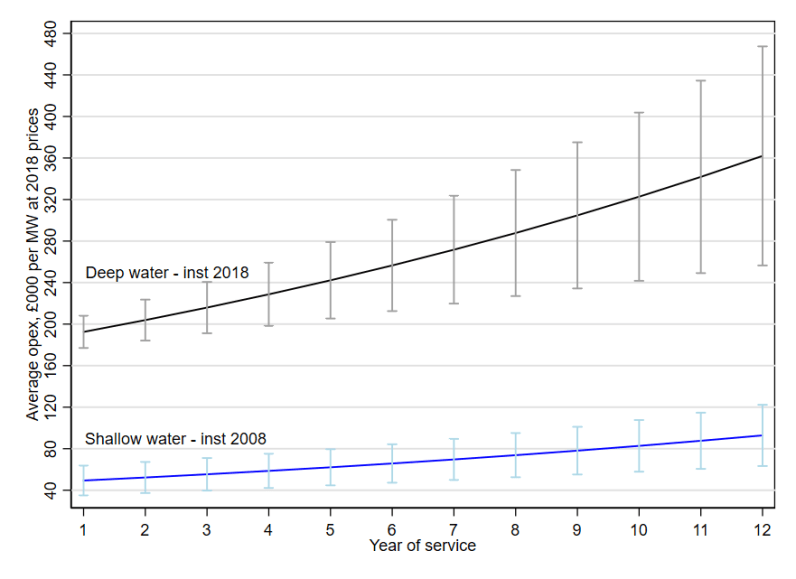

But more important still than capital expenditure are the trends in operational costs. The data collected from the audited accounts of wind farm companies reveals not only that such costs rise for a wind project as it ages, which ought to be unsurprising, but also that they have tended to rise over time for new projects. It is these trends in operational costs that are critical to the lifetime economics of a wind farm, on- or offshore, though with particularly marked consequences for the latter and for obvious reasons: the sea is proverbially “cruel,” viciously so to electrical and mechanical equipment. The following figure charts the evolution of average operating costs (expressed in £ per year per MW at 2018 prices) for typical offshore projects.

Source: Gordon Hughes for Renewable Energy Foundation: www.ref.org.uk.

The analysis allows for turbine size, water depth, and the arrangements for grid connection. The blue line shows the costs for a project in shallow water (less than ten meters depth) installed in 2008, while the gray line describes the operational costs for a deep-water wind farm (greater than 30 meters depth) built in 2018. As can be seen, the operating cost when aged one year for the deep-water project is some 60 percent higher than for a shallow-water project. Indeed, the data suggest that the operating costs have increased by about 6 per cent annually over the period 2008 to 2018.

Operating costs also rise sharply as a wind farm ages, by about 5.5 per cent in real terms for each year of service.

The result is that even if the wind turbine performance does not decline with age, the average operating cost per megawatt-hour of electrical energy generated will exceed the expected revenue from market prices shortly after twelve years, well below the 20 and 30 year Cost Recovery Periods assumed by, for example, the U.S. National Renewable Laboratory (NREL) in their models.

U.K. offshore wind capital expenditures and operating costs of the order actually recorded in 2018–2019 imply a breakeven price of £152/MWh ($206/MWh). These projects receive a subsidized price of £161/MWh. That is four times the current wholesale price, and greatly in excess of the prices nominated and bid by developers of future wind projects as acceptable to them in a Contract for Difference (CfD), a complex scheme which guarantees but also caps the price per MWh that the wind farm can obtain for its output. These CfD bids averaged at £112/MWh ($150/MWh) and £65/MWh ($88/MWh) in CfD Allocation Rounds 1 and 2 respectively. To break even at these lower prices one must either assume unrealistically high levels of availability and productivity (load factor) or an unlikely reversal in the observed cost trends. Demands for a bailout appear all but certain.

Real-world experience in the U.K. and indeed in Denmark, a country also analyzed in great detail in the Hughes study for REF, presents a stark warning to the United States; the costs of wind power have not been falling over the last heavily subsidized decade. Indeed, they remain very high, particularly for offshore wind, with operational expenditure actually rising sharply.

While only now beginning to enter public-policy debate, these points are in fact understood by many market and financial analysts, with fragments of the information circulating in confidential newsletters. The markets know, however obscurely, and Mr. Biden should bear that in mind before putting the U.S. consumer and taxpayer on the hook for a large expansion of offshore wind. This will be very expensive electricity, even before the cost of managing an increasingly stochastic grid network is taken into account.

The real puzzle here is how first-class scientific nations could have gone so far down a road that is intrinsically, physically, without strong promise. Why did any policymaker think that it would be cheap to convert the high entropy, almost random heat of wind flows into the low entropy of the improbable, reliable and timely electricity supply required by a sophisticated economy? Large capital expenditure and operating costs, as well as significant grid costs, are inevitable if governments insist on making the sow’s ear of wind into the silk purse of modern energy.

This planning failure is more than a question of painful domestic economics and inadequate climate policy. The broader hazards of driving the U.S. towards renewable energy are brought into sharp focus by increasingly intense competition from a China whose president has admitted that its emissions from low entropy, but high emitting, fossil fuels will continue to rise until 2030 and remain substantial for some considerable time thereafter, with the country only aspiring to become carbon neutral in 2060.

If China fulfills that aspiration, it will be on its own terms and no other: There is every reason to think that Beijing is making an end run around renewables, dressing the window with what are, for that gargantuan national system, mere traces of wind and solar, while in reality concentrating on the accumulation of great wealth from fossil fuels, now rendered cheap by coerced exclusion from the Western markets. With that wealth in hand, China will deploy advanced nuclear to generate both electricity and hydrogen on the largest possible scale so as to honor its longer-term climate change promises while simultaneously securing its economic, military, and geopolitical preeminence. A nuclear China would be richer, stronger, and cleaner than any of its competitors. The engineer bureaucrats of Beijing know nature far too well to think that she can be fooled. The lawyers and ideologues in the White House take a different view, for now.