Two Minute Money: Bank fees

Did you know that keeping your money in a bank can actually cost you money?

It’s true, but there are some simple ways to avoid annoying fees.

Most banks charge account maintenance fees. Dodging this cost is actually pretty easy. Check with your bank for specifics, but it typically involves maintaining a certain balance or setting up a direct deposit.

Often the most costly fees are overdraft charges, which hit you when you spend more than you have available in your account. Many banks offer overdraft protection, in which the bank will cover the amount owed using funds from another one of your accounts or credit card. However, you will still be charged a fee—typically $30 per overdrawn transaction.

The thing about overdraft protection is you have to sign up for it, but a 2014 Pew study found more than half of all people who overdrew don’t remember opting into the program.

The easiest way to avoid these fees is not to spend more than you have in the bank! One way to avoid extra fees if you do get overdrawn, is to check your account settings to ensure you’re not enrolled in overdraft protection. Just know that this means your card will get declined if you spend more than you have. And any checks won’t be paid to the payee, who may or may not charge you a fee.

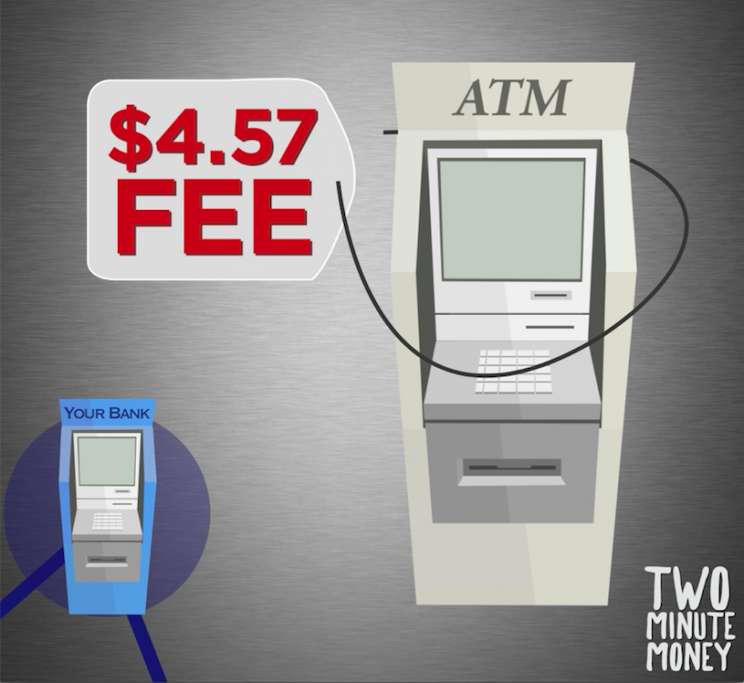

Easy on the ATMs

You can also get charged for withdrawing money from an ATM that’s not owned by your bank. The average out-of-network ATM fee has risen to $4.57 per transaction, including the charges from your bank and the charges from the ATM owner. There’s an easy way to avoid this fee too. Just make fewer ATM visits, and always use in-network machines.

Travel tip

Going on vacation, and you’ve got everything planned and booked ahead of time? Great. Just make sure you watch out for foreign transaction fees when using your debit or credit card abroad.

This is a pretty easy fee to avoid. Depending on where you’re going, many large banks have partnerships with foreign banks. Using one of these partner banks can cut down on your costs, though some banks will still make you pay a currency conversion fee.

If your bank is international, that’s even better. You can use any of your bank’s ATMs without getting charged. Or, if you really want to play it safe, sign up for and use a credit card that has no foreign transaction fee.

America’s three biggest banks scored $6.4 billion in ATM and overdraft charges in 2016. So if you feel like you’re constantly forking over fees, it might be time to switch things up. Several smaller and online banks offer checking accounts with no fees. In the meantime, keep a close eye on your bank statement. Read the fine print, know what you’re signing up for and keep your money where it belongs — in your pocket.