Turkey’s Mystery Outflows Hit Near $10 Billion in Election Month

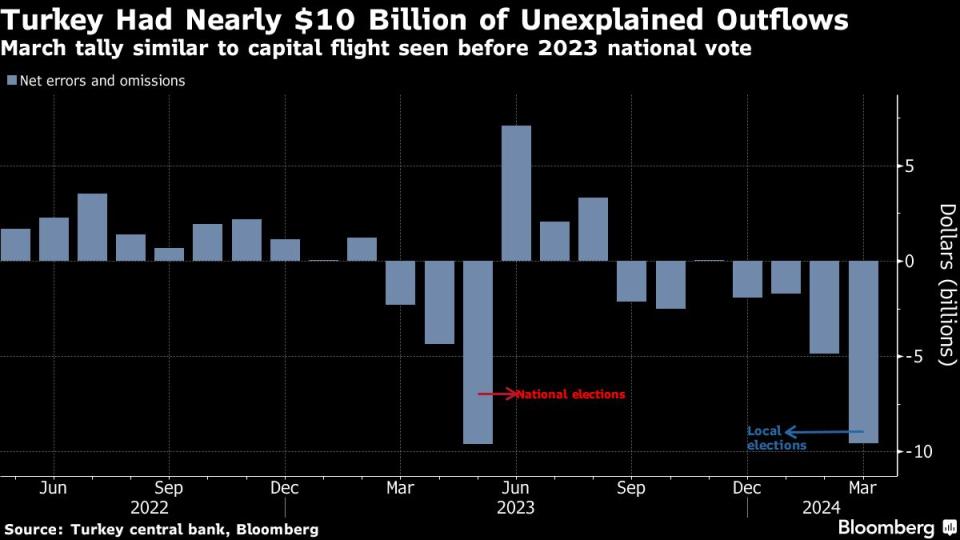

(Bloomberg) -- Unexplained outflows of capital from Turkey surged again during a month when voters went to the polls, a repeat of the money drain it suffered in the run-up to national elections a year ago.

Most Read from Bloomberg

Trump Vows ‘Day One’ Executive Order Targeting Offshore Wind

Macron Puts French Banks in Play With Plan to Transform Europe

Tesla Rehires Some Supercharger Workers Weeks After Musk’s Cuts

Five Under-the-Radar Billionaires Making Vast Fortunes in Modi's India

China to Start $138 Billion Bond Sale on Friday to Boost Economy

Net errors and omissions — or money of unknown origin — had a drop of nearly $10 billion in March, nearly matching the tally in May 2023, according to balance-of-payments-data published on Monday. The outflows set back the central bank’s reserves by about the same amount, as the deficit in the current account ballooned to $4.5 billion, far exceeding the median forecast in a Bloomberg survey of economists.

Elections have been triggers for money flooding out of Turkey, in a reflection of worry about the risk of a sharp currency devaluation after votes are tallied. The lira lost as much as 7% in a single day after last year’s presidential ballot.

Still, the scale of Turkey’s capital flight in March is a surprise given a shift toward more conventional economic policies since last June and the central bank’s focus on ensuring a real appreciation of the lira.

The Turkish currency has stayed on a relatively stable course since the local election, gaining 0.5% against the dollar, even as President Recep Tayyip Erdogan’s party suffered a historic defeat in some of Turkey’s biggest cities.

Read more: Erdogan’s Public Spending Craze to Pause Over Inflation Fight

Hard currency and gold frequently become a refuge of choice for Turks anxious about economic and political volatility. In March, gold imports represented about a quarter of the total current-account deficit.

Additional fiscal adjustments should help put Turkey’s external finances on a more sustainable track by slowing domestic demand, said Istanbul-based economist Haluk Burumcekci.

Though gold imports rebounded in March and April, Burumcekci expects the current-account deficit to narrow in 2024 by a third from last year to $30 billion.

Most Read from Bloomberg Businessweek

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

‘The Caitlin Clark Effect Is Real,’ and It’s Already Changing the WNBA

©2024 Bloomberg L.P.