Farmer: Trump’s Twitter 'causes a lot of stress in our world'

President Trump's volatile tweets about trade keep sending reverberations around the markets, and farmers are feeling some of the pain.

“It seems like the president has a whim every once in a while and tweets something, and it messes up our markets,” Hope Pjesky, a cattle and wheat farmer from Oklahoma, said on Yahoo Finance’s On the Move. “There’s so much inconsistency and volatility in the markets anyway.”

She said one tweet can change everything for a cattle farmer’s haul.

“We generally haul our cattle to a sale barn on a Sunday, and then the actual auction isn’t until Wednesday,” Pjesky said. “In the two days between there, if the president decides to tweet something negative about markets or tweet about putting more tariffs on other countries, … then the market can nosedive like crazy in those two days. And so, it causes a lot of stress in our world.”

...Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

— Donald J. Trump (@realDonaldTrump) August 23, 2019

A recent example: A potential resolution in the U.S.-China trade war became more fleeting after Trump announced on Twitter on Aug. 23 that he would be imposing more tariffs on Chinese imports.

Although the Chinese government responded by stating that they would not be placing retaliatory tariffs on American goods, Trump’s move still created more market uncertainty for U.S. farmers across the country who are hoping for the trade war to end.

Beijing has targeted past retaliatory actions against American agricultural products like soybeans, pork, corn, sorghum and wheat.

Trump’s trade war carries a price

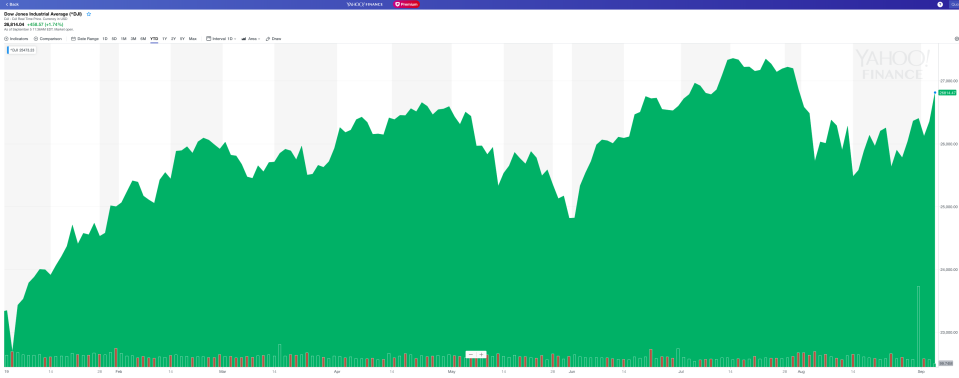

The U.S. stock market has seen a whirlwind kind of year, and much of it is arguably tied to U.S.-China trade tensions. After Trump tweeted that he would be ordering U.S. companies to start looking for alternatives to China for their business operations, the Dow Jones Industrial Average fell more than 700 points on an intraday basis.

“Farmers are small business owners, but unlike many other small businesses, we have so many things that we can’t control like the weather and the normal commodity market situation,” Pjesky said. “But with his impetuousness, it makes it much more volatile than normal.”

As trade relations between the U.S. and China remain cool, American farmers have had to rely on aid through the USDA’s market facilitation program. Many farmers have stressed that they want low trade barriers, not the aid.

In the meantime, U.S. agricultural exports have seen a major hit. Since trade tensions ramped up over the last year, total U.S. dairy exports have been down, with exports to China dropping over 7% year over year. And in 2018, U.S. soybean exports were down 98%.

“I would say more people are noticing the impact that the trade war is having,” Pjesky said. “[Trump’s] support is waning in some ways, but we don’t have a lot of other options, so it’s just something we’re having to deal with.”

In early August, after the U.S. Treasury declared China a currency manipulator, Chinese companies responded by stopping the purchasing of U.S. agricultural products. One farmer described it to Yahoo Finance at the time as “just another nail in the coffin.”

“There will be some longterm damage for certain commodities definitely,” Pjesky said. “Our industries, our commodity groups over many, many years have been working to establish markets in many other countries around the world — and have, in many cases, established wonderful markets.”

“But now this trade war and them having to go and find other places to get the products that they need during it is showing them that we aren’t their only option,” she said. “In certain cases, I hope that the commodities that I’m involved with will regain our markets, but nobody really knows until it happens.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

'We’re pretty helpless': American farmers react to China's latest trade war play

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.