Trump puts Fed independence at risk with Cain and Moore picks, but it will survive

The Federal Reserve — our nation’s central bank, or the bank for banks — has enormous power. That’s why, at its founding in 1913, it was deliberately created to be a step removed from day-to-day politics.

With his verbal attacks on the Fed and plans to nominate two yes-men to be members, however, it’s clear that President Donald Trump does not respect that distance. The question is whether we should be alarmed, given the Fed’s immense authority to control the U.S. economy.

The Fed can literally create money out of thin air, by buying Treasury securities. It simply creates deposits on its own account to pay for them, thus expanding the money supply. When it wishes to shrink the money supply, it sells securities from its portfolio and private bank deposits are extinguished.

The Fed regulates banks and controls the interest rate that banks charge each other on overnight loans, called the federal funds rate. It also controls the interest rate on loans it makes to private banks, known as the discount rate. And the Fed controls the percentage of deposits that banks must keep in reserve to make sure they always have the resources to pay depositors who need their money.

Read more commentary:

Trump adviser Stephen Moore doesn't belong on the Federal Reserve

Call Donald Trump what he is: the meddler in chief in everyone’s business

President Trump, your Fed envy is showing

To insulate it from politics, its founders established 12 regional Federal Reserve banks with presidents elected by boards of local bankers and businessmen. Presidents appoint the members and chairman of the Federal Reserve Board in Washington, and they must be confirmed by the Senate.

The experience of central banks throughout history is unambiguous: The greater their independence from politics, the better they are able to do their job of maintaining price stability, low interest rates and moderate business cycles to the greatest extent possible. However, since President Woodrow Wilson signed the law creating the Fed, virtually every president has complained that it often takes actions that irritate voters — and that presidents receive the blame.

Conservatives were wrong in Great Recession

Of course, merely being independent doesn’t guarantee that the Fed won’t make mistakes. Almost all economists blame the Fed, to a greater or lesser extent, for the Great Depression of the 1930s and the great inflation of the 1970s.

By contrast, during the Great Recession in 2008 and 2009, the Fed took many extraordinary actions, such as vastly increasing the money supply, to prevent the financial system from melting down. Conservative economists were uniformly critical and predicted that higher inflation would result.

These economists were wrong. Inflation did not result, and there is no question that the economy would be in much worse shape had their advice been followed.

Now, the conservative economic community seems to have flip-flopped 180 degrees. Instead of tight money, it wants easy money — the exact same policy it criticized back when its preferred monetary policy would likely have caused an economic depression. If there were a Democrat in the White House now, there is absolutely no question that Republican economists would still be calling for tight money and higher interest rates to forestall inflation, which conservatives always see just around the corner.

Flip-flopping to do Trump's bidding

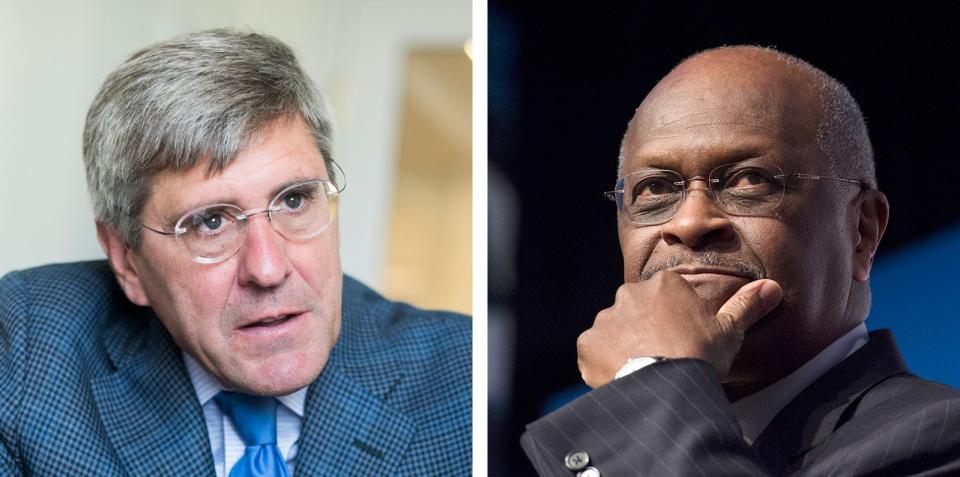

The only reason for this flip-flop is that Trump has decided that easy money will aid his reelection next year. He has found two vocal supporters, conservative think tank economist Stephen Moore and businessman Herman Cain, willing to jettison everything they said about the Fed during the Obama administration and do their best to give Trump what he wants.

Fortunately, the structure created to protect the Fed’s independence is strong. Even if they are confirmed by a rubber-stamp Republican Senate, Moore and Cain will be only two votes on the seven-member board and only two out of 12 on the policymaking Federal Open Market Committee, which additionally includes five regional bank presidents.

Politicization of the Fed is a bad idea; it has caused major problems in other countries as well as our own. Most economists credit the inflation of the 1970s to political pressure on the Fed by Presidents Lyndon Johnson and Richard Nixon. But the Fed is a stronger institution today and is led by a responsible chairman, Jerome Powell. (Disclosure: I worked with Powell for several years at the Treasury Department.) I feel confident that the Fed can overcome two board members who take their orders straight from the White House.

Bruce Bartlett worked on Capitol Hill, at the Treasury Department and the White House for many years. His latest book is "The Truth Matters: A Citizen's Guide to Separating Facts from Lies and Stopping Fake News in Its Tracks." Follow him on Twitter: @BruceBartlett

You can read diverse opinions from our Board of Contributors and other writers on the Opinion front page, on Twitter @usatodayopinion and in our daily Opinion newsletter. To respond to a column, submit a comment to letters@usatoday.com.

This article originally appeared on USA TODAY: Trump puts Fed independence at risk with Cain and Moore picks, but it will survive