Trump is to blame for strong dollar, not the Fed: Economist

In President Trump’s habitual complaints about the Federal Reserve, he blames the central bank for a U.S. dollar that’s too strong. On June 11, he tweeted that the euro and other currencies have been devalued against the dollar, putting the U.S. at a big disadvantage and blamed the Fed for interest rates being “way too high.”

This is because the Euro and other currencies are devalued against the dollar, putting the U.S. at a big disadvantage. The Fed Interest rate way too high, added to ridiculous quantitative tightening! They don’t have a clue! https://t.co/0CpnUzJqB9

— Donald J. Trump (@realDonaldTrump) June 11, 2019

But analysts at Capital Economics say that Trump’s own protectionist trade policies are partly responsible for the dollar’s strength.

If it was only the Fed’s actions that mattered, the dollar would be weakening right now, says Michael Pearce, senior U.S. economist at Capital Economics. “Investors are betting on interest rate cuts over the next few years and that should be pushing the dollar down,” he says. (Higher interest rates typically increase the value of the dollar.)

But that hasn’t happened. The dollar is up 2% vs. the euro which is down over 2% year to date as of Friday morning.

Trump sees a strong dollar hurting his economic policy goals. “I want a strong dollar but I want a dollar that does great for our country, not a dollar that’s so strong that it makes it prohibitive for us to do business with other nations and take their business,” Trump said back in March.

If the U.S. dollar is less expensive relative to other currencies, foreigners can purchase more American products, which would further stimulate U.S. manufacturing, limit imports, and help reduce the trade deficit.

Trump has lambasted the Fed numerous times since he’s been in the White House for what he says is overly tight monetary policy. The Fed last raised rates in December to a target range of 2.25% to 2.5%. Trump said in an interview in March with Fox Business News that the economy would have grown over 4% instead of 3.1% if the Federal Reserve had not raised rates during 2018.

Protectionist policies

Trump’s own protectionist trade policies are to blame for the dollar’s recent rise, says Capital Economics.

Tariffs have led to a flight to safety, rising demand for safe assets like U.S. Treasuries – thus boosting the dollar. “President Donald Trump’s trade agenda...has prompted some of that flight to safety. The threat of protectionism, the increased tariffs on China [those are factors that are] playing into this,” says Capital Economics senior US economist Michael Pearce.

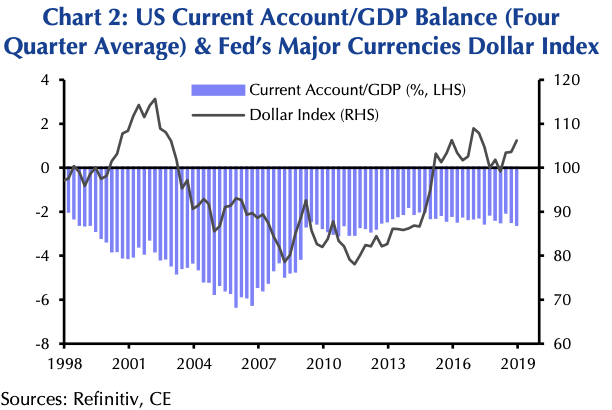

Trump is right that the euro and other currencies are devalued compared with the dollar, but Pearce says the weakness of those currencies isn’t exceptional. The Fed’s major currencies dollar index (which includes the euro, Japanese yen, and Canadian dollar, among others) is only around 14% above its long-run average over the past 46 years.

Pearce says the euro being “devalued” is not a deliberate strategy, but a byproduct of the weakness of the euro-zone economy. The European Central Bank has had to keep interest rates very low for a long time in order to boost the economy.

Trade deficit

Trump often talks about the need to address the trade deficit. “We’re the bank that everybody wants to rob. And that’s what they’ve been doing for a long period of time... $800 billion we have in trade deficits with other countries,” Trump said in a CNBC interview on Monday.

The trade balance is the main component of the current account deficit for the U.S. and it has stayed below what’s considered a sustainable 3% of GDP, according to Capital Economics. “The current account deficit remains small so we’re close to balance. So we don’t have a big current account deficit which might undermine the dollar further ahead,” says Pearce.

He adds that if the U.S. were running a large current account deficit, concern over the dollar would be justified – to boost exports, reduce imports and get closer to a current account balance. “The strength of the dollar really is just a reflection [that the] U.S. economy has done relatively well over the past 10 years compared to economies elsewhere,” Pearce says. “So there’s not some nefarious plot to hold back America. This is just a normal consequence of what you’d expect.”

Capital Economics projects the dollar will strengthen even more in the second half of 2019.

Follow Sibile Marcellus on @SibileTV

More from Sibile:

U.S.-Mexico trade tensions are far from over and could soon escalate again

Trump ‘is playing with fire’ as more tariffs are threatened: JP Morgan

How U.S. importers are avoiding Trump’s tariffs

New Trump tariffs would affect nearly 70% of consumer goods: Citi

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.