How Trump is helping to widen the trade deficit he hates

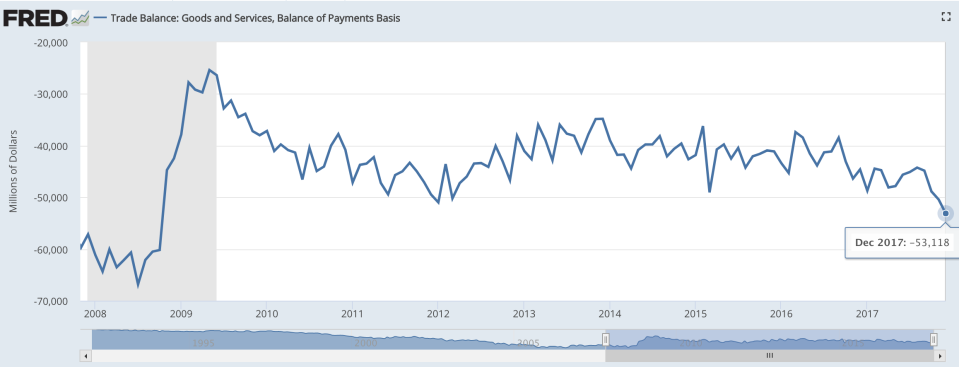

The U.S. trade deficit jumped to the highest level in nine years, according to a Department of Commerce report on Tuesday. Despite President Donald Trump’s repeated promise to shrink trade deficits, it rose 12.1% to $566 billion during his first year in office and leaped 5.1% in December alone.

And this may be just the beginning of an upward trend following Trump’s tax cuts, according to economists. Derek Scissors, resident scholar at American Enterprise Institute calculates the tax cuts may boost the trade deficit by $200 billion. A BofA Merrill Lynch Global Research report also expects the share of the trade deficit in GDP to grow 0.2 percentage points by 2020.

It’s not uncommon to see the trade deficit jump following tax cuts, just look at the 2001 and 2003 tax cuts under President George W. Bush, and President Ronald Reagan’s cuts in the early 1980s. But Trump has been especially vocal about lowering the deficit gap, citing it as a failure of previous trade policy. He called the trade deficit “unacceptable.” “We are going to start whittling that down, and as fast as possible,” Trump said after his trip to Asia last November.

Here is how the tax cuts may actually do the complete opposite and widen the trade deficit.

More spending: As corporate America cheers for the tax cuts and offers perks including bigger paychecks to employees, increased income is likely to bring more consumption, which fuels the need for foreign goods (a fundamental of the trade deficit). Thus, boosting imports and worsening the trade balance. With the economy at full employment right now and output relatively constrained, Harvard Professor Jeffrey Frankel believes the impact could be more problematic, because “the increase in spending afforded by tax cuts goes entirely, rather than only partly, into the current-account deficit,” he wrote in January.

Inflation and stronger dollar: Increasing consumer demand may also lead to inflation, push prices for U.S. products higher and make foreign goods more attractive to domestic buyers. To achieve the tax cut, the government is likely to borrow more, which will push the increasing budget deficit even higher. With the Federal Reserve expected to raise interest rates in response to demand increase, the dollar is also likely to be stronger, which makes U.S export less competitive in terms of price in the international market.

More foreign direct investment: This is exactly what Trump hopes to achieve with the corporate tax cuts, you may think. In Davos, he sent the message “America is open for business” to invite foreign investors. Some manufacturers have already been moving from Asia to the U.S. for lower production costs and government incentives, a trend that’s likely to continue with tax cuts. But more investments in the U.S. count as capital imports from abroad. More money flooding in may also contribute to a larger trade deficit.

There is no simple way to reduce the trade deficit

While Trump often blames poor trade agreements for the trade deficit, that may not be the whole story. The trade deficit isn’t necessarily a bad thing, and it’s an oversimplification to look at the deficit without putting it into the context of the economy. Part of the gap is caused by countries that use unfair trade policies to dump goods in the U.S, but it has a lot to do with the strong consumer culture and low savings rates since the 1970s, which create a robust demand for foreign goods.

Trump has taken measures to fight trade deficits, including urging companies to manufacture in the U.S., and imposing harsh sanctions on major foreign trade partners like China. Economists see the fundamental issue, in the long run, is what happens internally: getting spending in line with saving as a nation.

“It’s very hard to fix the trade deficit if you don’t fix your borrowing problem,” Ethan Harris, head of global economics BofA Merrill Lynch Global Research told Yahoo Finance. “It’s about having discipline budget in the government, keeping the deficit small, and encouraging family savings so we can fund ourselves internally.”

Krystal Hu is a reporter for Yahoo Finance. Follow her on Twitter.

Read more:

The real reason why traders are shorting Alibaba

Why it will be hard for Trump to stop China’s alleged intellectual property theft