Trump announces Jerome Powell as next Fed chair, replacing Janet Yellen

President Donald Trump on Thursday announced he will nominate Jerome Powell to replace Janet Yellen as Chair of the Federal Reserve.

Powell, currently a member of the Fed’s board of governors, had emerged as the odds-on favorite to get the nomination in recent weeks. Pending his confirmation by the Senate, he will take over from Yellen on February 4, 2018.

“He’s strong, he’s committed, he’s smart,” Trump said of Powell in an announcement in the Rose Garden Thursday afternoon.

“[Powell] has proven to be a consensus-builder for the sound monetary, and financial, policy that he so strongly believes in,” Trump said. “Based on his record, I am confident that Jay has the wisdom and leadership to address the challenges that our economy may face.”

“I hope the Senate will swiftly confirm him,” Trump said.

Unlike Yellen, Powell is not a PhD-trained economist, having earned a law degree from Georgetown in the 1979 before serving as Undersecretary of the Treasury during the George H.W. Bush administration. Powell was named to the Fed’s board of governors by Barack Obama in 2012 and later re-appointed to a 14-year term set to end in January 2028.

“I am both honored and humbled by this opportunity to serve our great country,” Powell said.

“If I am confirmed by the Senate, I will do everything within my power to achieve the goals assigned to the Federal Reserve by the Congress: stable prices and maximum employment.”

“I congratulate my colleague Jay Powell on his nomination to be Chairman of the Federal Reserve Board,” Yellen said in a statement on Thursday.

“Jay’s long and distinguished career has been marked by dedicated public service and seriousness of purpose. I am confident in his deep commitment to carrying out the vital public mission of the Federal Reserve. I am committed to working with him to ensure a smooth transition.”

The ‘continuity candidate’

Powell is seen by many observers as presenting markets with a seamless transition from the Yellen-led Fed in terms of how he will likely seek to conduct monetary policy.

“Markets should take a Powell announcement largely in stride, keeping financial conditions easy and

providing little disruption to an economy that is experiencing solid growth,” said Peter Hooper, an economist at Deutsche Bank.

“In addition, Powell has now had five years experience working inside the Fed, by all reports very effectively on both macroeconomics/monetary policy and on regulatory policy. He seems well versed in both important spheres of Fed responsibility.”

Tom Porcelli, chief U.S. economist at RBC Capital Markets, said last week that Powell, “would be a natural extension of Yellen at a point where policy is not screaming for a wildly different policy approach.”

Ian Shepherdson, an economist at Pantheon Macroeconomics, called Powell the “continuity candidate.”

A regulatory divergence

The most likely area where Powell will differ from Yellen as Fed Chair is on financial regulation.

Powell has been seen my some economists as more sympathetic to the de-regulatory push made by some members of the Trump administration, notably Treasury Secretary Steven Mnuchin. Recall that back in August, Yellen made a speech at the prestigious Jackson Hole Symposium which effectively argued that the Fed’s post-crisis regulatory approach had been correct.

It’s also worth noting that on Wednesday, newly-confirmed Fed governor Randal Quarles, vice chair for supervision, attended his first FOMC meeting since being confirmed. Quarles is seen as an ally of a financial industry seeking less regulatory pressure from the Fed.

Paul Ashworth, an economist at Capital Economics, wrote in a note last week that Powell would be a “good compromise candidate since he is a Republican, appears to be fairly closely aligned with Yellen on the interest rate outlook, but is more open to loosening financial regulation.”

During a speech in October about the Treasury market, Powell said, “There is certainly a role for regulation, but regulation should always take into account the impact that it has on markets—a balance that must be constantly weighed. More regulation is not the best answer to every problem.”

In terms of monetary policy, however, Powell is not expected to stray from Yellen’s view, with Shepherdson noting that Powell did not once dissent — that is, vote against — any Fed action taken during his time on the board of governors and the FOMC.

The market outlook

In the wake of reports over the past few weeks pointing to Powell as a favorite to land the job, market reaction has been muted.

Porcelli writes that Powell, “will practice a patient approach to policy which is identical to what is in place now.” Which is to say — the Fed will likely raise rates in December and three times next year given recent inflation readings, which have been below the Fed’s 2% target.

On Wednesday, the Fed said in its latest policy statement that it is, “monitoring inflation developments closely.”

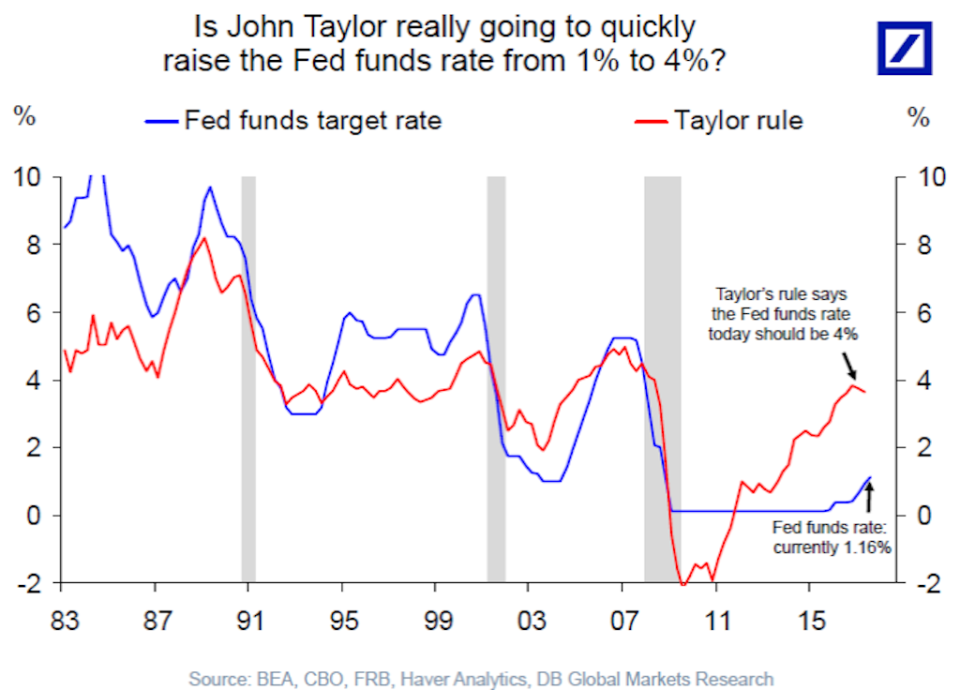

As we noted late last month, John Taylor, the Stanford economist who had also been reported as one of Trump’s top choices for the job, posed larger potential risks to markets according to most economists and strategists.

Taylor is best known for the “Taylor rule,” a framework for conducting monetary policy that would have seen benchmark interest rates set notably higher in recent years. This outline for policy would’ve been in tension with Trump’s self-proclaimed preference for low interest rates.

But the installation of Powell — or Taylor, for that matter — at the top of the Fed is not a sign that a policy overhaul is necessarily coming to the central bank.

Rick Rieder, global chief investment officer of fixed income at BlackRock, told Yahoo Finance in early October that at the Fed, unlike an elected office, the staff that remains in place between Chairs drive a lot of the thinking. In this view, then, no matter who replaced Yellen at the helm of the central bank, there was unlikely to be a complete shift in the Fed’s overall approach to conducting policy.

And right now that dominant theme at the Fed is to raise interest rates steadily, but cautiously, and wind down its balance sheet in an orderly, but deliberate, manner.

Whatever comfort financial markets have come to have with the current Fed regime, it seems unlikely that this dynamic will change with Powell at the helm.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: