Trending on ETFdb.com: Global Markets on Rollercoaster as Britons Head to Polls

ETFdb.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

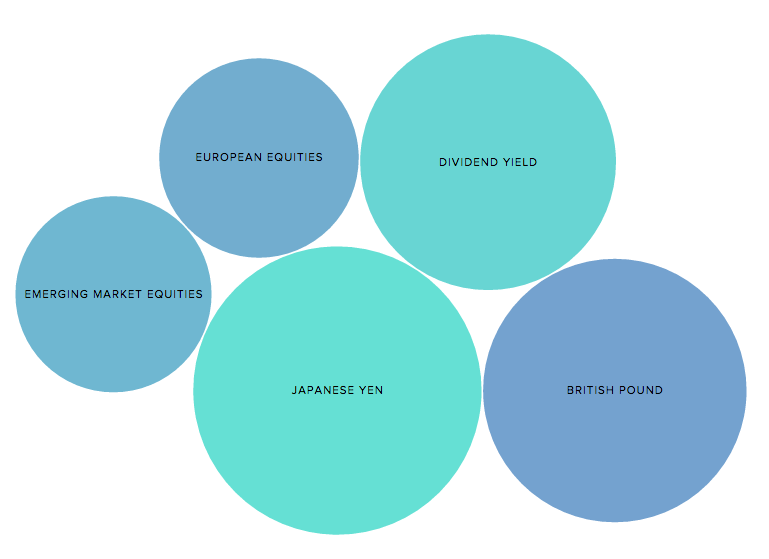

Global financial markets have been on a rollercoaster over the past few weeks as investors are eagerly awaiting the climax of a referendum on Britain leaving the European Union. This past week, European equities, emerging markets and the British pound have all rallied after tumbling in the previous week, largely thanks to polls showing a sentiment reversal on Brexit. These three assets are in our list of trends, along with the Japanese yen and dividend-yield ETFs.

Japanese Yen: Mulling Intervention

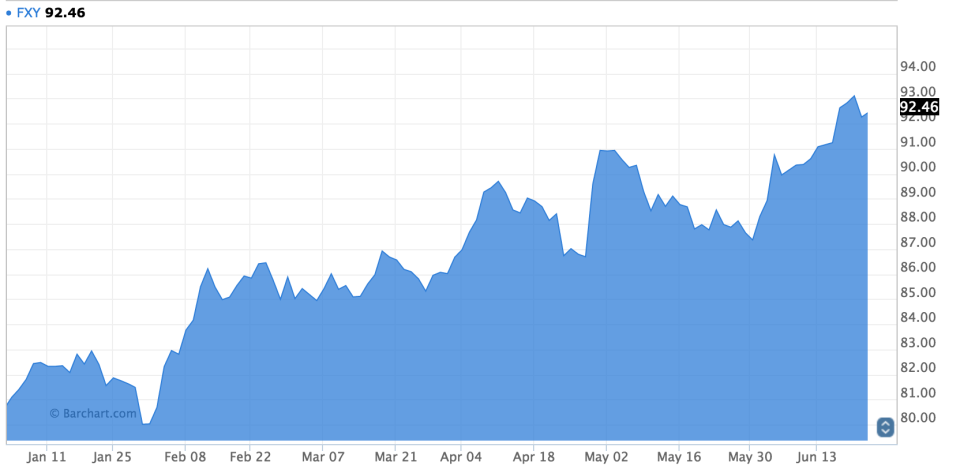

Traffic to our page tracking ETFs with exposure to the Japanese yen has risen nearly 95% in the past week compared to last, as the currency continued its upward movement that started at the beginning of this year. Three events have boosted the currency’s appeal. The Federal Reserve did not increase interest rates on its June 15 meeting, prompting a sudden decline in the dollar relative to the yen. The next day, the yen continued its ascent after the Bank of Japan left the monetary policy unchanged, disappointing many watchers who expected new stimulus measures. The uncertainty surrounding Brexit and investors’ search for safe haven assets further boosted demand for the currency.

The yen has been one of the best-performing currencies this year. Guggenheim Currency Shares Japanese Yen Trust (FXY C+) has jumped nearly 15% year-to-date, and is up 1.5% since the Federal Reserve’s meeting.

The yen’s steep appreciation is posing risks to already tepid economic activity in Japan. Inflation swung further into negative territory in April, to -0.3% year-over-year, while GDP figures are a little more comforting – up 1.7% on an annualized basis in the first quarter. Despite all the headwinds, Japan seems to have little monetary ammunition to jumpstart the economy. It is already running a large QE program and has driven interest rates below the zero bound. The International Monetary Fund (IMF) recently urged the country’s officials to “reload” the so-called Abenomics with an incomes policy to increase wages, in addition to continuing monetary and fiscal measures. However, previous attempts to raise wages hit the opposition of large companies, which provided smaller increases than asked.

In the more immediate period, Japan has not ruled out foreign exchange interventions to halt the yen’s rise. Finance Minister Taro Aso said a few days ago that Japan will respond to the yen’s fluctuations in line with its agreement at the G7 and G20. However, the US Secretary of Treasury, Jack Lew, was not concerned about the strength of the yen, deeming the fluctuations as “orderly.”

British Pound: Rally of Hope

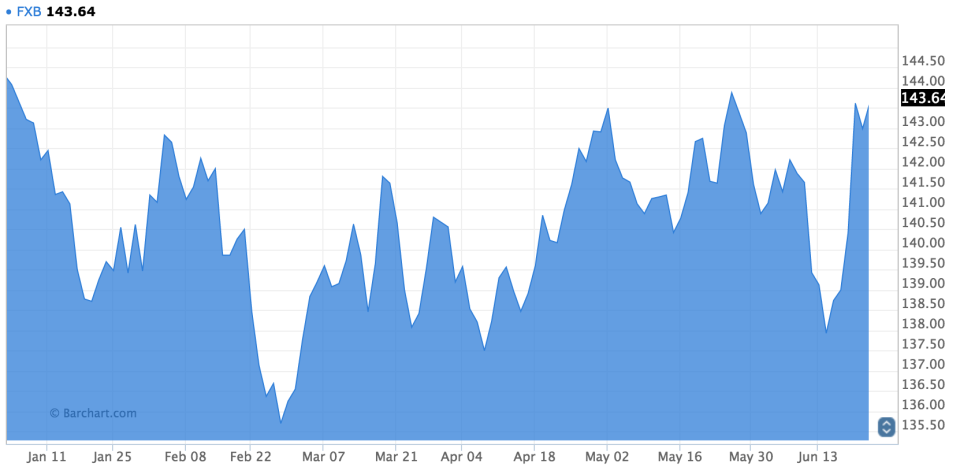

The British pound has increased consistently in the past week on the back of changing sentiment towards the Brexit. Our page containing two ETFs tracking the pound saw its viewership rise 74% week-over-week thanks to the high volatility in the currency. One of the ETFs, Guggenheim Currency Shares British Pound Sterling Trust (FXB A-) has jumped more than 4% this week largely because polls showed the “Remain” camp had garnered strength. Year-to-date, the ETF remains slightly down.

It should be noted that the British pound was present in our trends list last week as well. At the time, polls were showing that Britons were largely favoring an exit from the European Union, an outcome that prompted investors to bid the currency down. Since then, however, the balance has tilted slightly in the opposite direction, with most of the latest polls predicting a narrow victory for “Remain.” But markets seem to have largely discounted the possibility for Britain choosing to leave the EU, considering the pound’s spike and equities’ advance in the past week.

High Dividend Yield ETFs: Risk on

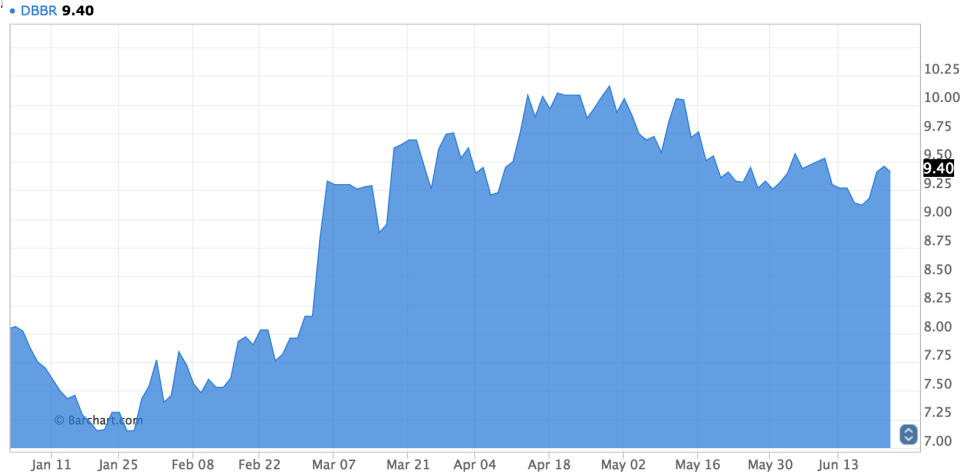

Our page containing high dividend yield ETFs has seen 60% more viewers this week compared to the week-ago period. Most of these ETFs are risky investments tracking volatile assets. For instance, the top five high-dividend-yield ETFs offer exposure to Brazil, leveraged REITs and energy MLPs. The interest in these assets came on the back of a risk-on sentiment, with investors optimistic that Britain will not leave the EU and that Federal Reserve will further delay a rate hike.

For example, Deutsche X-trackers MSCI Brazil Hedged Equity (DBBR A-) – the second highest yielding ETF in our database tracking Brazil’s stock market – has edged up 3.3% in the past five days, extending year-to-date gains to nearly 17%. The dividend yield of this ETF currently stands at more than 24%. But that’s mainly due to a special dividend that was paid out in June of last year.

European Equities: Hinging on Britain

European equities seem to be tracking closely the performance of the British pound thanks to the Brexit referendum. Our page consisting of 84 ETFs offering exposure to the continent’s stocks saw its traffic jump 42% this past week compared to the previous one. The Vanguard FTSE Europe ETF (VGK A) has risen 7% over the last five days, in line with the pound’s performance. Year-to-date, however, Vanguard FTSE Europe is still down more than 2%.

The continent’s stocks have also been boosted by the Federal Reserve’s decision to delay increasing the federal funds rate on its June 15 meeting. But there is no doubt that investors’ optimism that Britain will elect to remain in the EU has had a greater positive impact on the European equity markets.

Emerging Markets: Fed Lends a Hand

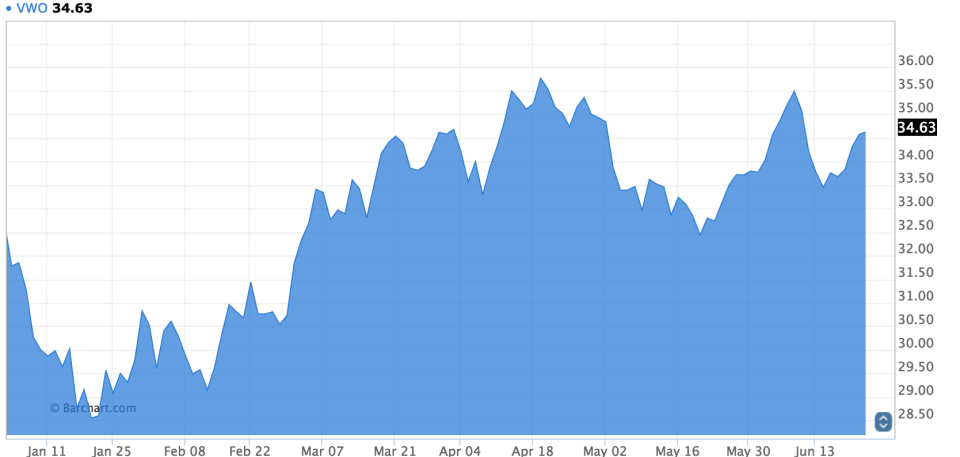

Our page covering Emerging Market ETFs has taken the last position in our list with 15% growth in traffic week-over-week. In line with the global optimistic sentiment, many of the emerging market ETFs have rallied over the past week, with investors clearly betting that Britain will stay in the union following the vote on Thursday. Vanguard FTSE Emerging Markets (VWO A) has edged up more than 2.58% in the past five days, increasing year-to-date gains to 5.87%.

Emerging markets have little direct exposure to Britain, but they are expected to suffer if Europe falls down following a potential “Leave” victory. However, many expect Europe to emerge largely unscathed from such an outcome, leaving emerging markets somewhat shielded from the consequences of the referendum. The Federal Reserve’s decision last week to keep interest rates unchanged has likely boosted these equities more than Britain’s polls.

The Bottom Line

The Japanese yen has taken first position in our list of trends, largely because of a rally triggered by inaction from Bank of Japan and Federal Reserve. But a referendum on Britain’s future has been the central theme this week, with the British pound, European equities and emerging markets all rallying on hopes that Britons will choose to stay in the European Union this Thursday. Meanwhile, high-dividend-yield ETFs made it on our list as risk-on sentiment prevailed lately.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.