Top Undervalued TSX Stocks This Month

Loblaw Companies and Aberdeen International are two of the stocks I have identified as undervalued. This means their current share prices are trading at levels less than what the companies are actually worth. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

Loblaw Companies Limited (TSX:L)

Loblaw Companies Limited, a food and pharmacy company, provides grocery, pharmacy, health and beauty, apparel, general merchandise, retail banking, credit card, insurance, and wireless mobile products and services in Canada. Founded in 1956, and currently run by Galen Weston, the company size now stands at 195,000 people and with the company’s market capitalisation at CAD CA$26.15B, we can put it in the large-cap category.

L’s stock is currently floating at around -36% lower than its actual worth of $106.15, at a price of $67.87, based on its expected future cash flows. This discrepancy gives us a chance to invest in L at a discount. Also, L’s PE ratio is around 16.1x relative to its consumer retailing peer level of 22x, implying that relative to its competitors, L’s shares can be purchased for a lower price. L is also in great financial shape, as current assets can cover liabilities in the near term and over the long run. The stock’s debt-to equity ratio of 89% has been reducing for the last couple of years revealing its ability to reduce its debt obligations year on year. Continue research on Loblaw Companies here.

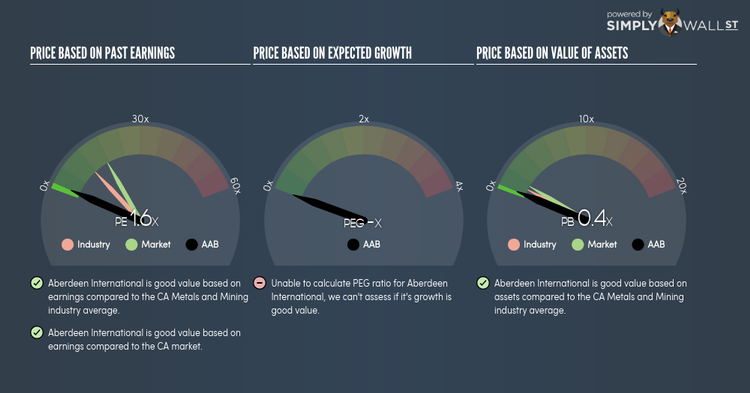

Aberdeen International Inc. (TSX:AAB)

Aberdeen International Inc. operates as a resource investment company and merchant bank focusing on small capitalization companies in the metals and mining sector. Aberdeen International was established in 1987 and with the stock’s market cap sitting at CAD CA$17.29M, it comes under the small-cap stocks category.

AAB’s shares are now hovering at around -27% beneath its actual level of $0.25, at the market price of $0.19, based on its expected future cash flows. The difference between value and price signals a potential opportunity to buy AAB shares at a discount. Moreover, AAB’s PE ratio is around 1.6x while its metals and mining peer level trades at 11.6x, meaning that relative to its competitors, AAB can be bought at a cheaper price right now. AAB is also in great financial shape, with current assets covering liabilities in the near term and over the long run. AAB also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Interested in Aberdeen International? Find out more here.

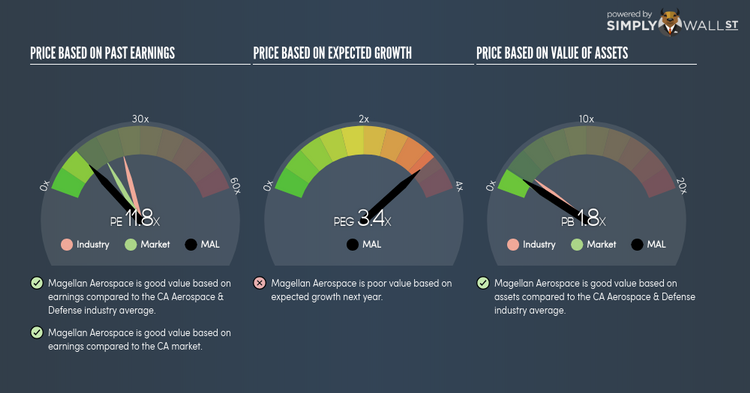

Magellan Aerospace Corporation (TSX:MAL)

Magellan Aerospace Corporation, through its subsidiaries, designs, engineers, and manufactures aero engine and aero structure components for aerospace markets in Canada, the United Sates, and Europe. Formed in 1994, and currently headed by CEO Phillip Underwood, the company provides employment to 3,900 people and with the stock’s market cap sitting at CAD CA$1.23B, it comes under the small-cap group.

MAL’s shares are now floating at around -44% less than its true level of $37.45, at the market price of $20.82, according to my discounted cash flow model. The divergence signals an opportunity to buy MAL shares at a low price. In addition to this, MAL’s PE ratio stands at around 11.8x relative to its aerospace & defense peer level of 23.8x, implying that relative to its comparable company group, we can purchase MAL’s shares for cheaper. MAL is also in great financial shape, with current assets covering liabilities in the near term and over the long run. The stock’s debt-to equity ratio of 17% has been declining over the past couple of years revealing MAL’s ability to pay down its debt. More detail on Magellan Aerospace here.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.