Top Undervalued NasdaqCM Stocks This Month

Companies that are recently trading at a market price lower than their real values include Gravity and NACCO Industries. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

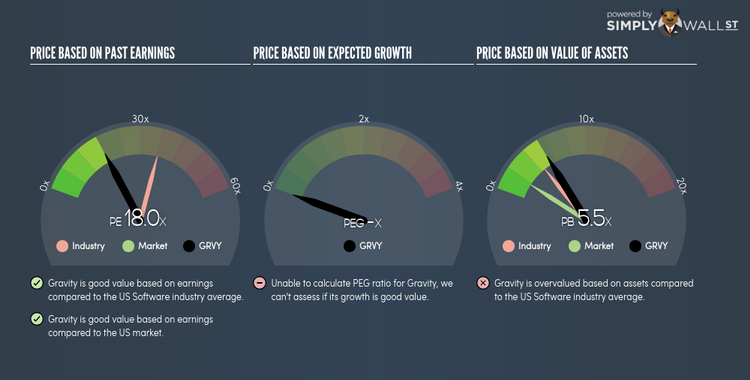

Gravity Co., Ltd (NASDAQ:GRVY)

Gravity Co., Ltd. develops and publishes online games in South Korea, Japan, the United States, Canada, Taiwan, Hong Kong, Macau, China, and internationally. Formed in 2000, and run by CEO Hyun Park, the company now has 353 employees and with the stock’s market cap sitting at USD $257.40M, it comes under the small-cap stocks category.

GRVY’s stock is currently hovering at around -50% under its actual level of KRW142.95, at the market price of US$70.90, based on my discounted cash flow model. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. In addition to this, GRVY’s PE ratio is trading at 18.05x compared to its Software peer level of, 36.31x suggesting that relative to its comparable set of companies, GRVY’s shares can be purchased for a lower price. GRVY is also in great financial shape, with short-term assets covering liabilities in the near future as well as in the long run. GRVY has zero debt on its books as well, meaning it has no long term debt obligations to worry about. Interested in Gravity? Find out more here.

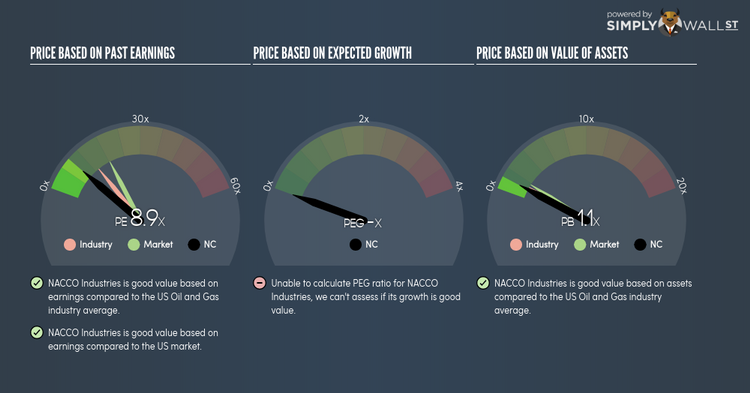

NACCO Industries, Inc. (NYSE:NC)

NACCO Industries, Inc. operates primarily in the mining industry. Founded in 1913, and currently run by John Butler, the company provides employment to 400 people and with the stock’s market cap sitting at USD $251.48M, it comes under the small-cap stocks category.

NC’s shares are currently floating at around -30% less than its intrinsic level of $52.06, at a price of US$36.50, based on my discounted cash flow model. This mismatch signals an opportunity to buy NC shares at a discount. Furthermore, NC’s PE ratio is currently around 8.91x against its its Oil and Gas peer level of, 13.36x indicating that relative to its competitors, you can buy NC’s shares at a cheaper price. NC is also a financially robust company, with short-term assets covering liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 22.58% has been falling for the past few years indicating its capability to reduce its debt obligations year on year. More detail on NACCO Industries here.

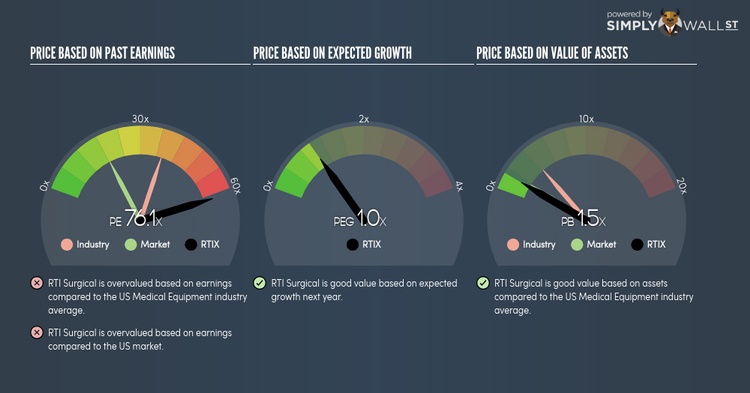

RTI Surgical, Inc. (NASDAQ:RTIX)

RTI Surgical, Inc., together with its subsidiaries, designs, develops, manufactures, and distributes biologic, metal, and synthetic implants worldwide. Formed in 1997, and currently lead by Camille Farhat, the company employs 942 people and has a market cap of USD $262.36M, putting it in the small-cap stocks category.

RTIX’s shares are now trading at -41% under its actual value of $7.22, at the market price of US$4.25, based on my discounted cash flow model. This mismatch indicates a chance to invest in RTIX at a discounted price.

RTIX is also in good financial health, with short-term assets covering liabilities in the near future as well as in the long run.

More detail on RTI Surgical here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.