Top TSX Dividend Payers

First National Financial is one of our top dividend-paying companies that can help boost the investment income in your portfolio. These stocks are a safe way to create wealth as their stable and constant yields generally hedge against economic uncertainty and deliver downside protection. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

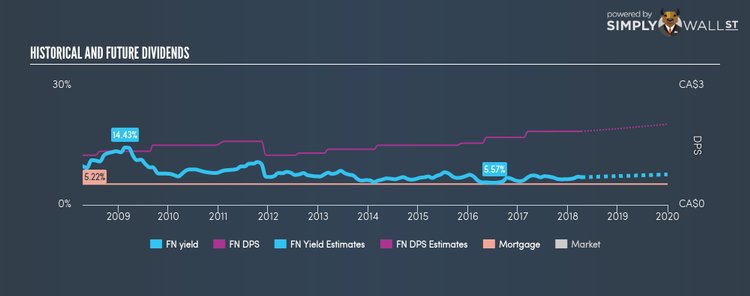

First National Financial Corporation (TSX:FN)

First National Financial Corporation, through its subsidiaries, originates, underwrites, and services residential and commercial mortgages in Canada. The company now has 940 employees and with the market cap of CAD CA$1.60B, it falls under the small-cap stocks category.

FN has a juicy dividend yield of 6.98% and pays 53.30% of it’s earnings as dividends , with analysts expecting the payout ratio in three years to be 66.56%. FN’s last dividend payment was CA$1.85, up from it’s payment 10 years ago of CA$1.25. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. The company outperformed the ca mortgage industry’s earnings growth of 1.29%, reporting an EPS growth of 4.48% over the past 12 months. More detail on First National Financial here.

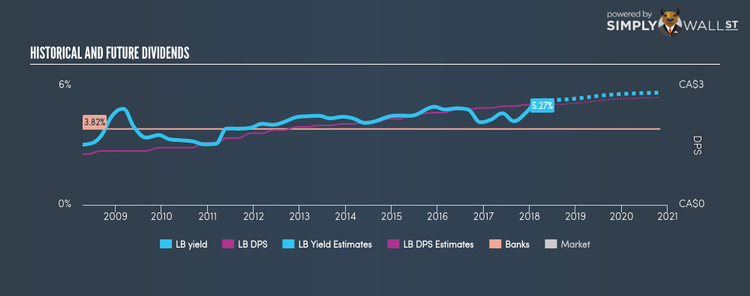

Laurentian Bank of Canada (TSX:LB)

Laurentian Bank of Canada, together with its subsidiaries, provides banking services to individuals, small and medium-sized enterprises, and independent advisors in Canada and the United States. Formed in 1846, and currently headed by CEO François Desjardins, the company size now stands at 3,771 people and has a market cap of CAD CA$2.00B, putting it in the mid-cap category.

LB has a substantial dividend yield of 5.27% and pays out 45.06% of its profit as dividends . LB’s dividends have seen an increase over the past 10 years, with payments increasing from CA$1.28 to CA$2.52 in that time. The company has been a dependable payer too, not missing a payment in this 10 year period. More detail on Laurentian Bank of Canada here.

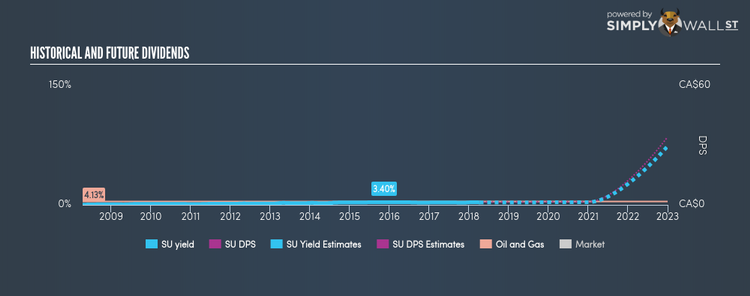

Suncor Energy Inc. (TSX:SU)

Suncor Energy Inc. operates as an integrated energy company. Established in 1953, and headed by CEO Steven Williams, the company provides employment to 12,381 people and with the stock’s market cap sitting at CAD CA$75.46B, it comes under the large-cap group.

SU has a good dividend yield of 3.11% and distributes 47.69% of its earnings to shareholders as dividends , and analysts are expecting the payout ratio in three years to hit 59.78%. In the last 10 years, shareholders would have been happy to see the company increase its dividend from CA$0.20 to CA$1.44. It should comfort existing and potential future shareholders to know that SU hasn’t missed a payment during this time. Interested in Suncor Energy? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.