Top Real Estate Dividend Yielding Stocks To Profit From

Performance in the real estate sector generally tracks the economic cycle. During periods of high growth and inflation, real estate investments usually post strong returns. However, during an economic bust, these investments tend to underperform. During these times, companies such as Becker Milk and Fronsac Real Estate Investment Trust generate high dividend income to shareholders. As a long term investor, I favour these real estate stocks with great dividend payments that continues to add value to my portfolio.

The Becker Milk Company Limited (TSX:BEK.B)

BEK.B has a large dividend yield of 5.08% and is currently distributing 82.53% of profits to shareholders . Becker Milk’s performance over the last 12 months beat the ca real estate industry, with the company reporting 3.15% EPS growth compared to its industry’s figure of -14.54%. More on Becker Milk here.

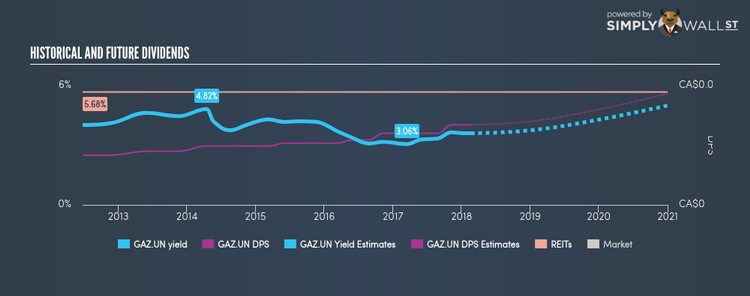

Fronsac Real Estate Investment Trust (TSXV:GAZ.UN)

GAZ.UN has a good dividend yield of 3.60% and distributes 32.85% of its earnings to shareholders as dividends , with an expected payout of 56.85% in three years. Besides capital gain prospects, just the yield is higher than the low risk savings rate – enticing for investors with goals of beating their bank accounts. Plus, a 3.60% yield places it amidst the market’s top dividend payers. Fronsac Real Estate Investment Trust’s earnings per share growth of 31.91% outpaced the ca reits industry’s 8.41% average growth rate over the last year. More on Fronsac Real Estate Investment Trust here.

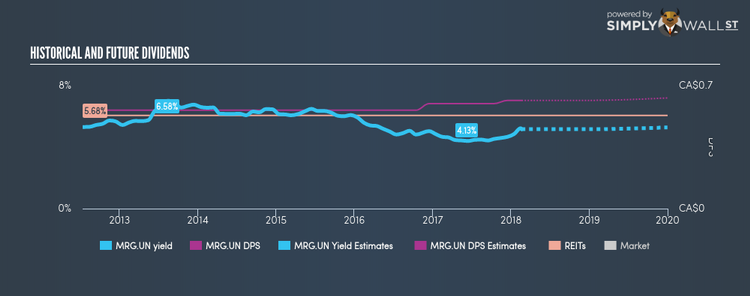

Morguard North American Residential Real Estate Investment Trust (TSX:MRG.UN)

MRG.UN has a substantial dividend yield of 4.84% and pays 23.28% of it’s earnings as dividends , and analysts are expecting a 48.91% payout ratio in the next three years. The company’s 4.84% dividend is both above the low risk savings rate and among the markets top payers. Morguard North American Residential Real Estate Investment Trust’s earnings per share growth of 448.26% over the past 12 months outpaced the ca reits industry’s average growth rate of 8.41%. More on Morguard North American Residential Real Estate Investment Trust here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.