Top Growth Stocks This Week

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

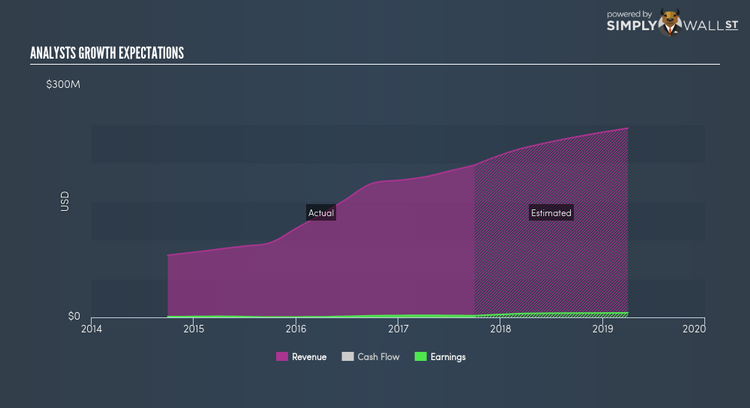

Mortice Limited (AIM:MORT)

Mortice Limited, together with its subsidiaries, provides security services in India and Sri Lanka. The company was established in 2008 and with the stock’s market cap sitting at GBP £13.89M, it comes under the small-cap category.

A potential addition to your portfolio? Take a look at its other fundamentals here.

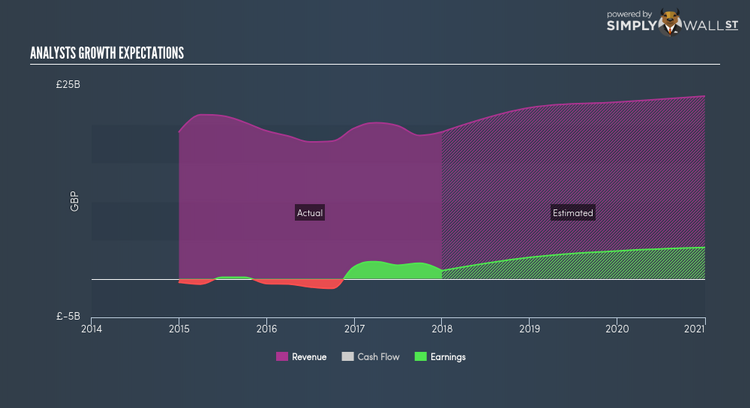

Barclays PLC (LSE:BARC)

Barclays PLC, through its subsidiaries, provides various financial products and services in the United Kingdom, other European countries, the Americas, Africa, the Middle East, and Asia. Founded in 1690, and currently headed by CEO James Staley, the company now has 119,300 employees and has a market cap of GBP £36.00B, putting it in the large-cap group.

BARC is expected to deliver a buoyant earnings growth over the next couple of years of 35.21%, driven by a positive double-digit revenue growth of 20.32% and cost-cutting initiatives. It appears that BARC’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 7.85%. BARC’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Interested to learn more about BARC? Take a look at its other fundamentals here.

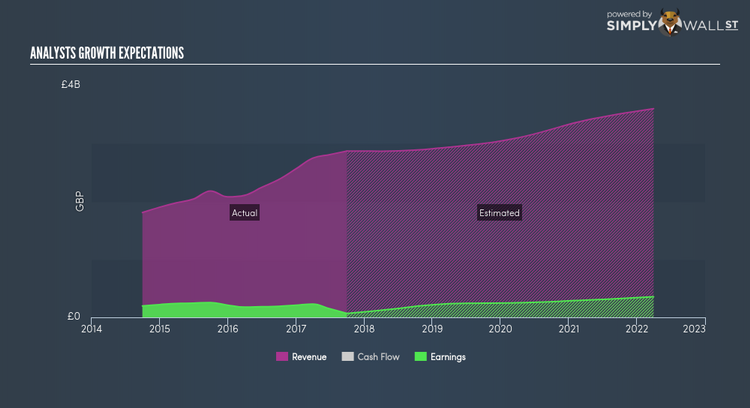

Mediclinic International plc (LSE:MDC)

Mediclinic International plc, together with its subsidiaries, operates private hospitals. Founded in 1983, and currently run by Danie Meintjes, the company currently employs 32,131 people and with the company’s market capitalisation at GBP £4.47B, we can put it in the mid-cap group.

MDC is expected to deliver a buoyant earnings growth over the next couple of years of 26.30%, driven by a positive revenue growth of 5.13% and cost-cutting initiatives. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of MDC, it does not appear too severe. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 5.73%. MDC ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.