Top Growth Stocks To Buy Today

Companies such as Virscend Education and Guangdong Land Holdings have a significantly positive future outlook on the basis of their profitability and returns. Investors seeking to enhance their portfolio should consider these financially stable, high-growth stocks. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

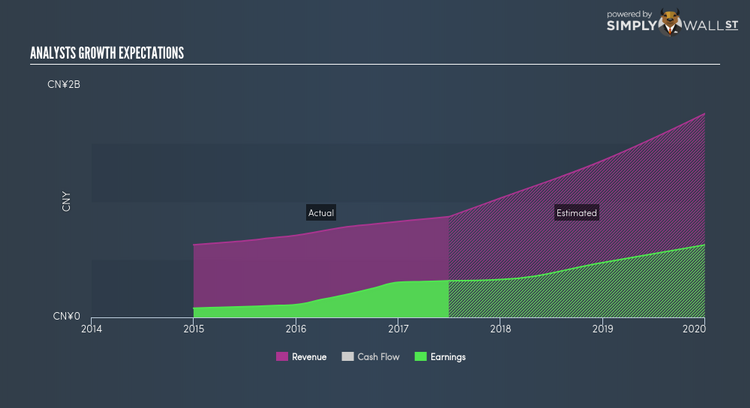

Virscend Education Company Limited (SEHK:1565)

Virscend Education Company Limited, an investment holding company, provides K-12 private education services in the People’s Republic of China. Established in 2000, and currently headed by CEO Ming Xu, the company provides employment to 3,001 people and with the stock’s market cap sitting at HKD HK$15.13B, it comes under the large-cap category.

1565’s projected future profit growth is a robust 32.06%, with an underlying 78.96% growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 18.31%. 1565’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering 1565 as a potential investment? Check out its fundamental factors here.

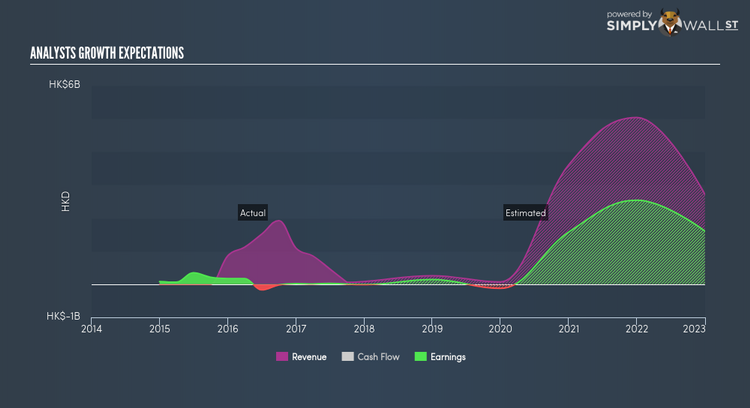

Guangdong Land Holdings Limited (SEHK:124)

Guangdong Land Holdings Limited, an investment holding company, invests in and develops properties primarily in Mainland China. The company now has 225 employees and with the stock’s market cap sitting at HKD HK$3.15B, it comes under the mid-cap group.

124 is expected to deliver an extremely high earnings growth over the next couple of years of 52.15%, bolstered by an equally impressive revenue growth of 97.84%. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. 124’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering 124 as a potential investment? I recommend researching its fundamentals here.

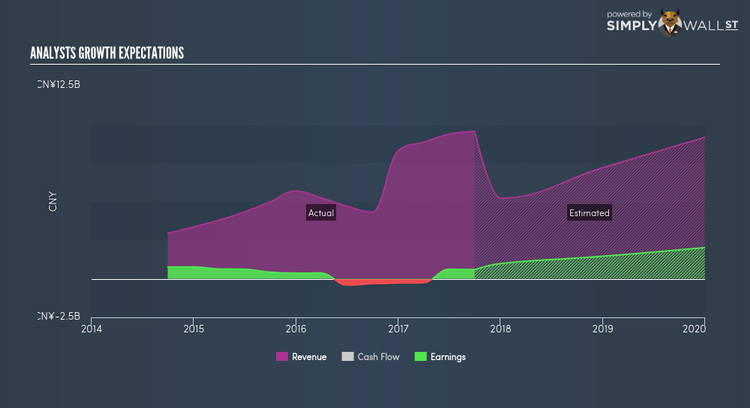

Kingsoft Corporation Limited (SEHK:3888)

Kingsoft Corporation Limited, an investment holding company, operates as a software and Internet services company in Mainland China, Hong Kong, Singapore, and internationally. Started in 1988, and now led by CEO Tao Zou, the company provides employment to 6,998 people and with the company’s market cap sitting at HKD HK$37.90B, it falls under the large-cap category.

3888 is expected to deliver a buoyant earnings growth over the next couple of years of 42.24%, driven by a positive cash flow from operations growth of 1.53% and cost-cutting initiatives. An affirming signal is when net income increase also comes with operating cash flow growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of 3888, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 16.01%. 3888 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about 3888? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.