Top BSE Growth Stocks To Buy

Want to add more growth to your portfolio but not sure where to look? Companies such as IntraSoft Technologies and Oberoi Realty are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

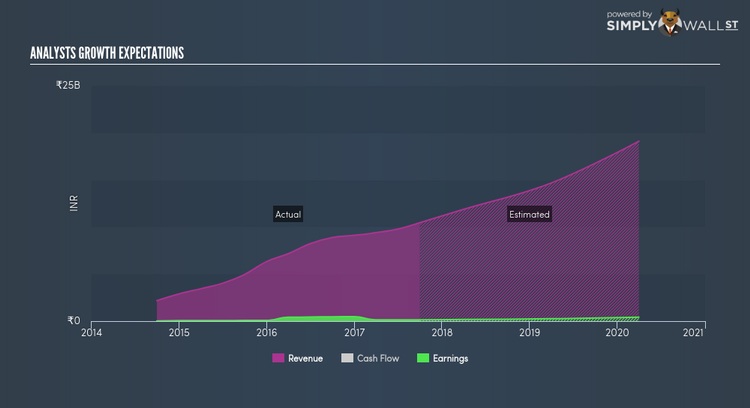

IntraSoft Technologies Limited (BSE:533181)

IntraSoft Technologies Limited, through its subsidiaries, engages in the development and delivery of e-commerce and e-cards services through Internet platform in India and internationally. Established in 1996, and currently lead by Arvind Kajaria, the company size now stands at 220 people and with the market cap of INR ₹11.29B, it falls under the large-cap stocks category.

533181’s forecasted bottom line growth is an optimistic 43.63%, driven by the underlying 61.55% sales growth over the next few years. It appears that 533181’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 18.81%. 533181’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? Have a browse through its key fundamentals here.

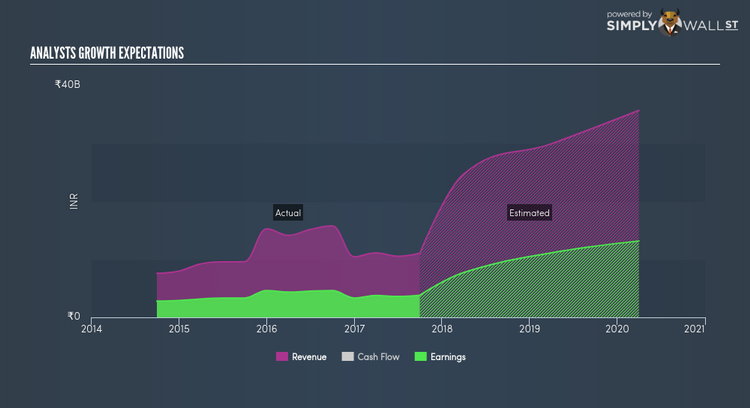

Oberoi Realty Limited (BSE:533273)

Oberoi Realty Limited, together with its subsidiaries, engages in real estate development and hospitality businesses in India. Started in 1998, and run by CEO Vikas Oberoi, the company currently employs 891 people and with the company’s market capitalisation at INR ₹182.06B, we can put it in the large-cap category.

533273’s projected future profit growth is a robust 34.05%, with an equally impressive underlying growth from its revenues expected over the upcoming years. It appears that 533273’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 17.05%. 533273 ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in 533273? Other fundamental factors you should also consider can be found here.

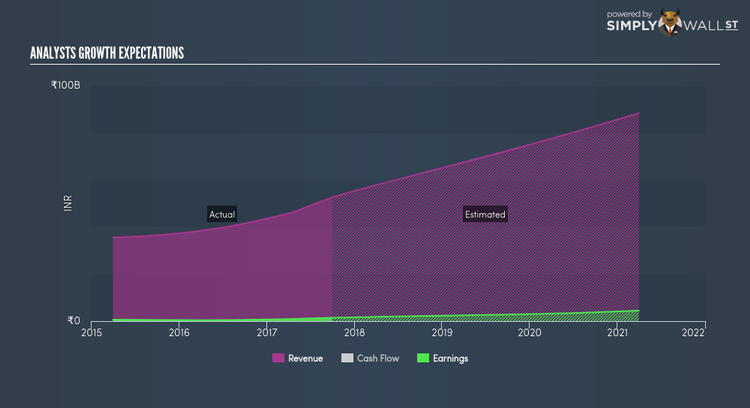

Security and Intelligence Services (India) Limited (BSE:540673)

Security and Intelligence Services (India) Limited, together with its subsidiaries, operates as a security services company in India and Australia. Founded in 1985, and now led by CEO Uday Singh, the company currently employs 148,867 people and has a market cap of INR ₹83.95B, putting it in the large-cap category.

Extreme optimism for 540673, as market analysts projected an outstanding earnings growth rate of 29.00% for the stock, supported by a double-digit sales growth of 37.81%. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 22.23%. 540673 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.