If you’re too young to remember the insanity of the dot-com bubble, check out these pictures

Mario Tama/Getty Images

Investors, entrepreneurs, and CEOs can’t stop arguing over whether or not the tech industry is in a bubble — and when that bubble is going to burst, if it hasn’t already.

But we’ve been through this before.

In the 1990s, a new breed of dot-com companies popped up, raised millions in funding, threw ridiculous parties…and then vanished.

Here’s how it went down.

Disclosure: Jeff Bezos is an investor in Business Insider through hispersonal investment company Bezos Expeditions.

The dot-com boom kicked off in the late nineties, as more people got the Internet in their homes, and the Microsoft Windows 95 Plus Pack included the first version of the Internet Explorer browser — most people’s first experience with the web.

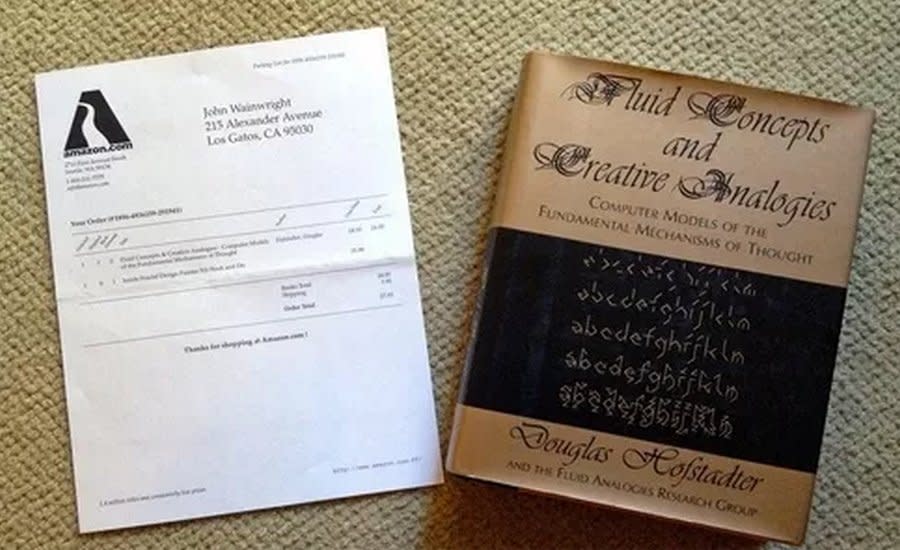

Entrepreneurial types saw a huge opportunity to serve this growing market. Jeff Bezos saw it coming early and founded Amazon in 1994. It shipped its first book, Douglas Hofstadter’s “Fluid Concepts and Creative Analogies: Computer Models of the Fundamental Mechanisms of Thought,” out of Bezos’ garage in early 1995.

They got the name “dot-com companies” because at the time, it was a novelty to have a business with a web address — and these companies only existed online and in warehouses.

The boom would continue into 1995: Craig Newmark would launch the Craigslist personal ad site…

…”Jerry and David’s Guide to the World Wide Web” would get renamed “Yahoo”…

…Microsoft would launch MSN, or the Microsoft Network, an internet portal and news site…

…and Pierre Omidyar would found auction site eBay, after successfully selling a broken laser pointer for $14.83 from his personal website.

Venture capitalists and investment banks, sensing a chance to make a lot of money from this boom and taking advantage of low interest rates, started investing millions in companies like grocery delivery startup Webvan, which raised $396 million from the likes of Benchmark Capital, Goldman Sachs, and Yahoo.

Alan Greenspan, then the chairman of the Federal Reserve, didn’t think this was sustainable. In 1996, Greenspan famously warned against “irrational exuberance” that would result in a market crash.

The market didn’t listen. Encouraged by some early success, more and more startups started pop up. Like Pets.com, an online pet supply store founded in 1998, which became famous for its sock puppet mascot.

It resulted in a lot of well-funded companies that made big, expensive promises to customers — like Cyberian Outpost, an electronics store which offered free overnight shipping to customers with no minimum, or Kozmo, which offered one-hour delivery from local stores.

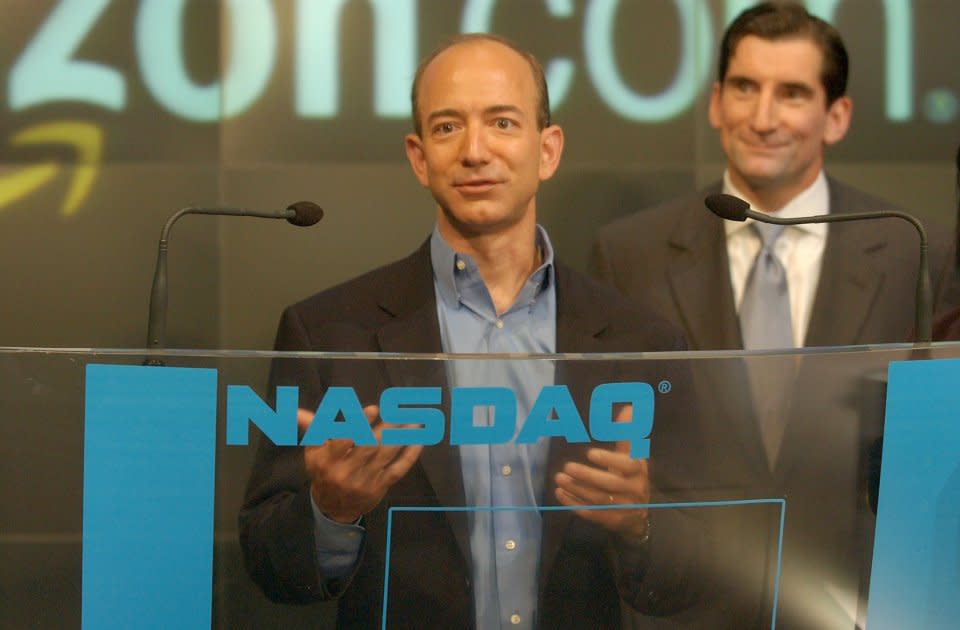

Investors were funding these companies in the hopes of a big payday — either via IPO, like Amazon’s in 1997…

…or via acquisition. Microsoft bought Hotmail for $400 million in 1997, in one of the earliest big dot-com deals.

It made for a lot of instant millionaires, like Mark Cuban, who made out like a bandit when Yahoo bought his startup Broadcast.com for $5.7 billion in 1999.

Future Silicon Valley luminaries like Peter Thiel and Elon Musk made a fortune when eBay bought PayPal for $1.5 billion in 2002.

In 1998, dot-com startup theGlobe.com’s IPO broke the record for biggest gains in the first day of trading. In 1999, CNN caught its CEO in a trendy Manhattan nightclub wearing tight plastic pants. He told CNN: “Got the girl. Got the money. Now I’m ready to live a disgusting, frivolous life.”

That kind of attitude led to a lot more scrutiny of these dot-com business models — while Amazon CEO Jeff Bezos invested in the company’s infrastructure to support sustainable growth, his contemporaries were blowing cash on lavish parties and unrealistic business plans.

Things peaked in 2000′s Super Bowl XXXIV, which featured commercials from 14 different dot-com companies. Those aren’t cheap. This was Pets.com’s.

Youtube Embed:

http://www.youtube.com/embed/AQ2w9gV1yeM

Width: 420px

Height: 315px

That same year, in 2000, AOL and Time Warner merged in a massive $164 billion deal, with the media giant hoping to use AOL’s Internet knowhow to conquer the new millennium.

By now, the bubble was already deflating. Investment cash dried up, and stock prices plunged as the market realized that many of these companies had very little revenue and no realistic path to get to profitability. Pets.com went bust in 2000, and Webvan went belly-up in 2001.

It sent shockwaves through the industry: Established enterprise companies like Cisco and Sun Microsystems also saw their values slashed. They had expanded their capacities to suit the needs of the dot-com startups. But once those went away…Cisco’s stock got cut by 86%. Sun, once worth $200 billion, at one point lost 98% of its peak value and was eventually acquired by Oracle for $7.4 billion in 2009.

Those dot-coms that survived also took a hit. Amazon went from a pre-bubble high of $107/share down to $7, post-bubble. Nowadays, it trades around $533 with a market cap around $275 billion , but it was high-anxiety for a while there.

The AOL-Time Warner merger has been called the worst deal in history. Following years of executive drama, layoffs, and disappointing financial results, the company went back to the “Time Warner” name in 2003.

Some companies waited out the storm. Google, founded in 1998, waited until 2004 to hold its IPO — it wanted to take its time and wait for the market to settle down.

Over a decade later, companies like Amazon and Uber are revamping many of the same concepts, this time (hopefully) with more stable business models. In 2015, Amazon has grocery delivery services similar to Webvan, and actually bought that company’s remnants in 2009. And Uber introduced UberRush, a Kozmo-style delivery service. And the rest, as they say, is history.

The post If you’re too young to remember the insanity of the dot-com bubble, check out these pictures appeared first on Business Insider.

Yahoo Finance

Yahoo Finance