Thursday’s Vital Data: JD.com Inc(ADR) (JD), Time Warner Inc. (TWX) and Gilead Sciences, Inc. (GILD)

U.S. stock futures are trending higher this morning, as Wall Street continues to digest the Federal Reserve’s interest rate hike and accompanying policy statement.

According to the Fed, it does not expect the Republican tax plan, should it pass, to accelerate its plans to raise rates in 21018. The central bank still expects to hike rates three times next year.

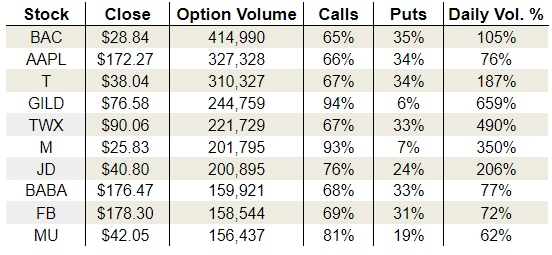

Diving right into Wednesday’s options activity, JD.com Inc(ADR) (NASDAQ:JD) attracted a spike in call volume after Stifel resumed coverage on the Chinese e-retailer. Meanwhile, Time Warner Inc. (NYSE:TWX) was also call heavy despite an ongoing lawsuit with the government over AT&T Inc.’s (NYSE:T) acquisition. Finally, Gilead Sciences, Inc. (NASDAQ:GILD) drew heavy call volume as traders sought to cash in on the company’s quarterly dividend.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

JD.com, Inc. (JD)

JD stock surged nearly 6% on Wednesday after Stifel resumed coverage on the stock with a “buy” rating. According to the ratings firm, there’s room for both JD.com and Alibaba Group Holding Ltd (NYSE:BABA ) to grow in China. JD is the more structured player with controlled logistics and an initial first-party model that has grown into a first-party/third-party hybrid,” Stifel said in a research note.

That was all JD options traders needed to hear. Volume surged to more than 200,000 contracts, more than doubling JD’s daily average volume. Furthermore, calls gobbled up 76% of the day’s take.

Looking out to January 2018, we find that call traders are in firm command of JD stock. The put/call open interest ratio for this back-month series stands at 0.66, with calls nearly doubling puts in January. Until yesterday, the most popular call strike was the January $40, with 33,000 contracts. Now the $45 call strike has taken the lead with 35,000 contracts, as traders adjust their targets higher following Stifel’s “buy” recommendation.

Time Warner Inc. (TWX)

Despite being tied up in a legal battle with the Trump administration, AT&T still believes that its acquisition of TWX will go through. That assertion comes despite ex-Trump campaign adviser Carter Page arguing that “reckless journalism” should prevent the deal.

A stronger argument for the acquisition could be looming on the horizon, however, if Walt Disney Co (NYSE:DIS) is allowed to buy several properties from Twenty-First Century Fox Inc. (NASDAQ:FOXA)

TWX options traders appear to be siding with AT&T lately, as call volume is picking up on the stock. On Wednesday, volume topped 221,000 contracts, with calls making up 67% of the day’s activity. There is still a wealth of negativity to overcome in the January 2018 series, however, as the put/call OI ratio arrives at 2.17, with puts more than doubling calls. With the shift toward calls recently on TWX, we may finally be seeing speculative traders accepting that a deal of some form will actually take place.

Gilead Sciences, Inc. (GILD)

GILD stock was inundated with a veritable flood of call activity on Wednesday. Regular readers know that this type of call action is often indicative of a dividend on the horizon. More than 244,000 contracts traded on GILD yesterday, more than 6.5 times the stock’s daily average. Calls made up 97% of the day’s take.

Gilead shares trade ex-dividend today, meaning today is the last day to own GILD stock if you want to collect the dividend.

Gilead will pay out 52 cents per share on Dec. 28 to holders of record at the close on Dec. 14.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Thursday’s Vital Data: JD.com Inc(ADR) (JD), Time Warner Inc. (TWX) and Gilead Sciences, Inc. (GILD) appeared first on InvestorPlace.