Three Reasons to Watch Marvell Stock

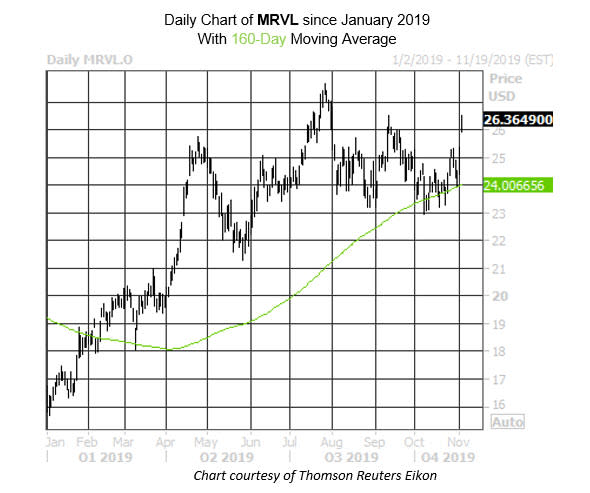

A chip stock to keep an eye on is Marvell Technology Group Ltd. (NASDAQ:MRVL), for a lot of reasons. For starters, MRVL is up 5% to trade at $26.36 today, after Wells Fargo upgraded it to "outperform" from "market perform" and hiked its price target to $32. Plus, the stock recently pulled back to the 160-day moving average, which historically been a good time to go target the semiconductor concern.

More specifically, Schaeffer's Senior Quantitative Analyst Rocky White took data from the past three years and looked at similar pullbacks for MRVL. There have been four other signals like this with the 160-day moving average, and they've resulted in an average one-month surge of 4.3% for the stock.

Another move higher of similar magnitude would put Marvell stock just below its 13-year high of $27.64 from July 26. Year-to-date, MRVL is up 62%, and Wells Fargo noted in its upgrade today that it sees robust 5G-related sales as a tailwind heading into 2020.

That big upgrade has sparked a flurry in MRVL's options pits today. At last check, almost 7,000 calls have exchanged hands, five times what is typically seen at this point. Most of this action is taking place at the weekly 11/08 26.50-strike call, where new positions are being opened. This suggests that traders could be expecting the shares of MRVL to sustain the gains from today's breakout.

The options pits have been surprisingly pessimistic though, with the security's Schaeffer's put/call open interest ratio (SOIR) of 0.79 arriving in the 100th annual percentile. This suggests a bigger-than-usual appetite for puts over calls among short-term traders.

There's also pessimism to be unwound among short sellers. Short interest increased by 25.5% in the most recent reporting period to 39.37 million shares, the most since May. This accounts for a healthy 6% of MRVL's total available float, and a weeks' worth of buying power, at its average pace of trading.