This week in Trumponomics: The Trump slowdown is here

It wasn’t a bad week in the Trump economy. There were no new tariff announcements, and the White House slightly delayed the imposition of the some new tariffs on Chinese imports. Mexico, meanwhile, tried to appease Trump’s demand to interdict central American migrants crossing through Mexico en route to the United States, to preempt the punitive tariffs Trump has threatened there.

But there’s worrisome news for Trump all the same, because unstoppable growth in the labor market suddenly seems stoppable. Employers created 75,000 new jobs in May, which is mediocre and not alarming in itself. But longer-term data show a notable slowdown in hiring, which suggests a near-record-breaking 10-year expansion may be winding down.

Trump seems to think the U.S. economy is bulletproof and can withstand the higher costs and reduced trade flows his protectionist trade policies are causing. But there are growing signs it can’t. Trump’s tariffs might even be contributing to the weakness showing up in the jobs data and other parts of the economy. For those reasons, this week’s Trump-o-meter reads WEAK, the third lowest rating.

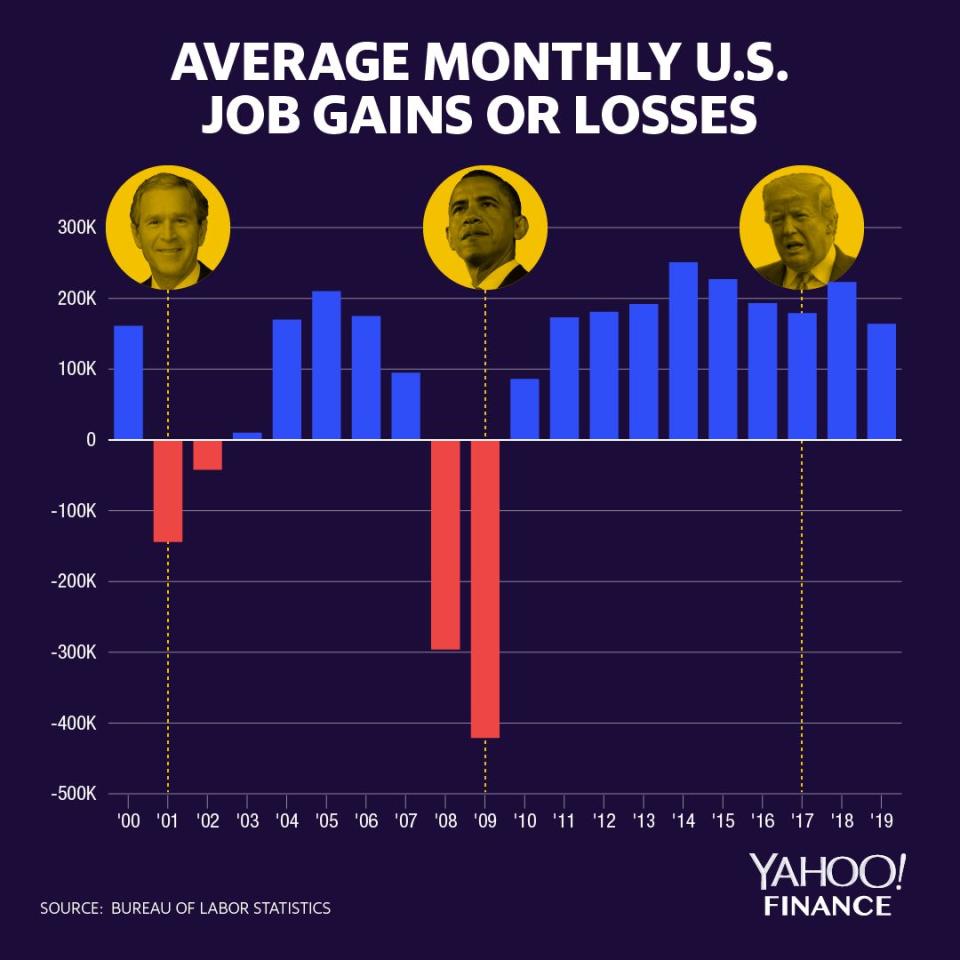

We’re not on the verge of a recession. But a slowdown can become a recession if policymakers screw up. Monthly job growth in 2019 has averaged just 164,000. Last year it averaged 223,000. The peak of the last 10 years came in 2014, at 251,000. Here’s the trend since 2000:

Job numbers jump around, but there are other signs the economy is slowing just as Trump ramps up his reelection bid. Manufacturing activity has weakened in 2019. So have retail sales and business investment. The Atlanta Federal Reserve’s popular forecasting tool predicts GDP growth in the second quarter of just 1.4%, down from 3.1% in the first quarter. “The U.S. economy will lose pace this year after peaking in 2018,” ratings firm Moody’s predicts.

Financial markets found something to cheer in the disappointing job numbers, with stocks rising about 1%. That’s because a weakening job market raises the odds of a Federal Reserve interest rate cut this year. Lower rates make it cheaper to borrow, which generally helps the economy. Market expectations suggest the Fed will cut rates by half a percentage point, or maybe three-quarters of a point, by the end of the year.

Economist Torsten Slok of Deutsche Bank points out that market expectations of Fed rate cuts are often wrong. And an economy with an ultra-low 3.6% unemployment rate shouldn’t need help. This is where the Trump tariffs become very problematic. Are they a modest strain on growth likely to remain contained? Or a time bomb that will explode in a few months? How much economic damage would Trump risk, anyway?

Trump probably thinks he can backtrack on his tariffs if markets or the economy show real signs of trouble. But that assumes harm can be undone, and it doesn’t always work that way. Jobs that should have been created last month but weren’t won’t suddenly materialize next month.

Confidential tip line: rickjnewman@yahoo.com. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

China is jamming Trump on trade

It’s folly to break up Amazon, Apple and Google

Trump has no choice but to land a trade deal with China

Your paltry savings from the Trump tax cuts

How Trump is blowing it with voters

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Read the latest financial and business news from Yahoo Finance