The market might be forecasting a faster recovery than we expect

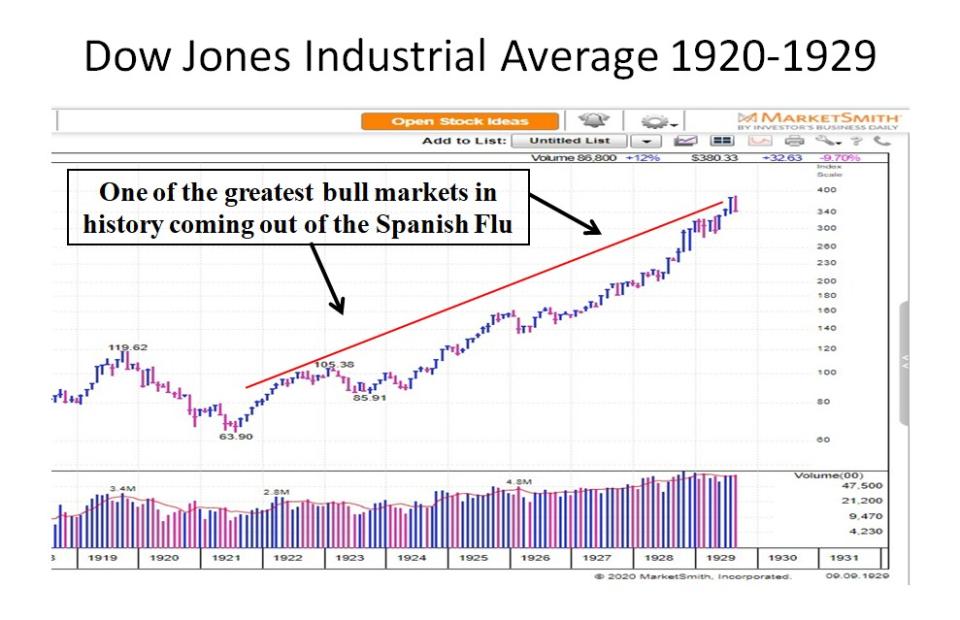

The Spanish Flu was one of the deadliest pandemics in history. It infected 500 million people, which at the time was more than a quarter of the world’s population. Approximately 50 million people died from this deadly virus, but guess what happened when this pandemic eventually ended? We had one of the greatest bull markets in history from 1920-1929.

Two weeks ago, I wrote an article saying that just because the coronavirus numbers were going to get worse; it didn’t mean the stock market had to go lower. My main point was that the stock market is a discounting mechanism. It trades on what will happen 6 to 9 months from now. I was more optimistic than most people because many stocks were rebounding well, the Fed is on our side, and sentiment was getting very negative. I was simply encouraging people to keep an open mind that maybe the worst news was already priced in.

‘End of the world’ thoughts

The responses to this article were fascinating to me because I am obsessed with human psychology. I didn’t mind all the negative emails I received, I am more fascinated with the “why?” What is triggering people to go down such a dark path? The responses included many “end of the world” thoughts such as: we’re all going to die, the Dow is going to 5,000, this will be worse than the Great Depression, the stock market will decline 80%, unemployment will exceed 50%, and we’re all going to be waiting in line for bread soon.

The world has been through many viruses, world wars, financial panics, major natural disasters, huge spikes in inflation, terror attacks, and much, much more — but this is the virus that is going to end the world??? I think three things are contributing to all this negativity: social media, the news, and being stuck at home. Social media is toxic, the news is designed to scare you to keep you watching for ratings, and we’re all dealing with various amounts of stress being quarantined at home. In addition, all this anger is leading to many political debates and arguments about social issues such as income inequality. I recommend separating your social and political views from your analysis of the stock market. If you let these emotions affect your investment decisions, you are making a big mistake.

How ‘recency bias’ might be influencing expectations

Back to the stock market, please keep in mind that not every correction has to be similar to 2008-09. Recency bias has many people believing that every bear market has to be a disastrous 50% decline or greater. Meanwhile, the average bear market lasts 6 to 9 months and declines 27%. The current economic crisis is triggered by a health crisis and not because of a problem with the banking system. People forget the economy was very strong before this virus occurred.

Medical technology could speed the recovery

If you are confused right now about the disconnect between the economy and the stock market, ask yourself one simple question. Do you think this virus will last forever? If your answer is yes, then you are living in such a deep state of fear that is likely triggered by one of the three reasons mentioned above. For most people, the answer is no but that opens up another question. Will the current economic slowdown last 3 to 6 months? Or will it last 1 to 2 years? I think the market is telling us something. It might be discounting a great deal of the bad news and forecasting a recovery sooner than most people expect. I’m not saying the world will be 100% back to normal soon, but there is one thing that is keeping me very optimistic: Technology.

Advances in medical technology are amazing. These firms are no longer run by only MDs and PhDs in science related fields. Many companies employ high level mathematicians and have super computers that can process large amounts of data in weeks vs. years. They are using machine learning, artificial intelligence, and data analytics to find cures and techniques for rapid testing. There’s a reason why so many biotech companies are trading near all-time highs. I am confident that we will get a vaccine or at least some antiviral medicine sooner than most people expect.

When we come out of this health crisis, we will be in one of the most favorable stock market environments in history. The economy will eventually get back to its pre-virus levels, the global central banks will continue to provide liquidity and low interest rates until the economy recovers, and the damaging psychological effects of this decline will keep sentiment very negative for a long time. This is great for the bulls because the market tends to fool the majority. Will we see an incredible bull market similar to the 1920s? Maybe. Either way, don’t get too negative on this market. It might be telling us something.

Read more:

Why the market doesn’t have to plummet further amid coronavirus

2 things the market needs to recover post-coronavirus

I can be reached at: jfahmy@zorcapital.com

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained on this site constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned on this site. The stocks presented are not to be considered a recommendation to buy any stock. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.