The 19 companies with CEOs paid over 1,000x more than the median employee

The message that has helped propel Bernie Sanders to the front-runner position of the Democratic primaries (at least for now) has been one that calls out inequality and a growing divide between the rich and the poor.

A new report from Jefferies equity research shows exactly how big the divide has become — and highlights the roles of companies by looking at the metric of CEO pay compared with median employee pay.

“CEO compensation is going to be a focus area for U.S. politicians,” Jefferies noted, and highlighted 50 companies with the highest disclosed CEO-to-median-worker pay ratio for 2018 and 2019. Of those, 10 of them showed a crater-size difference, with the CEOs going home with 1,000 times the median worker or more in total compensation. The average, according to Jefferies is 250 times, but federal data from 2018 showed it was even more — 287 times.

Here they are:

Gap (GPS) - 3,566 times ($20 million total compensation)

Align Technology (ALGN) - 3,168 times ($41.8 million total compensation)

Aptiv (APTV) - 2,609 times ($14.1 million total compensation)

ManpowerGroup (MAN) - 2,508 times ($15.9 million total compensation)

McDonald’s (MCD) - 2,124 times ($15.9 million total compensation)

VF (VFC) - 1,767 times ($17.8 million total compensation)

Linde (LIN) - 1,629 times ($66.1 million total compensation)

TJX (TJX) - 1,596 times ($18.8 million total compensation)

Discovery A (DISCA) - 1,511 times ($129.5 million total compensation)

Walt Disney (DIS) - 1,424 times ($65.6 million total compensation)

Hanesbrands (HBI) - 1,392 times ($8.8 million total compensation)

Western Digital (WDC) - 1,279 times ($12.9 million total compensation)

Ross Stores (ROST) - 1,222 times ($12.2 million total compensation)

Yum! Brands (YUM) - 1,191 times ($14.0 million total compensation)

Norwegian Cruise (NCLH) - 1,124 times ($22.6 million total compensation)

T-Mobile US (TMUS) - 1,116 times ($66.5 million total compensation)

Walmart (WMT) - 1,076 times ($23.6 million total compensation)

Starbucks (SBUX) - 1,049 times ($13.4 million total compensation)

Coca-Cola (KO) - 1,016 times ($16.7 million total compensation)

Jefferies notes that companies with high CEO-to-median-employee pay ratio are “being viewed as promoting inequality.” Furthermore, companies that engage in a lot of stock buybacks, high leverage, and a low effective tax rate are also prime targets for politicians’ ire.

Many of the companies on this list are in the service or retail industries with a large portion of employees who earn wages far closer to the minimum wage, driving the median number down.

According to the Economic Policy Institute, CEO compensation has grown 940% since 1978 while a typical worker’s compensation has only risen 12%.

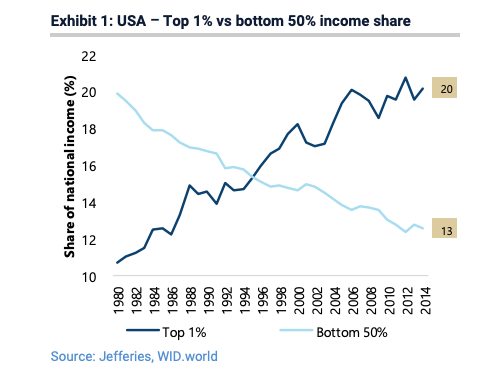

Broadly, Jefferies reports that the top 1% of earners in the U.S. accounts for 20% of the nation’s income, whereas the bottom 50% accounts for just 13%. Furthermore, the share of total income going to the top 1% is the highest it’s been since the 1930s.

The report calls out these companies for high CEO compensation, but notes that the recent information on the causes of inequality shifted some of the commonly believed blame from globalization to technology, noting the irony that “without technology, everyone would be worse off.”

According to Jefferies, “the debate should come back to institutions and politics, and how we develop a system that redistributes the benefits of both rising globalization and technology in a much fairer way.”

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Roger McNamee: Apple is designed to protect your privacy, ‘but there is a cost’

The government is finally cracking down on companies that enable robocalls

How an insured pro athlete ended up with $250,000 in medical debt

The first thing to do after you're involved in a hack, according to experts

'Snake oil salesmen': Two neurologists respond to the CBD craze

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.