Tesla earnings — What you need to know in markets on Wednesday

During another busy week for earnings and the economy, Wednesday’s highlight will be results from electric carmaker Tesla (TSLA), slated to report earnings after the market close.

Wall Street expects the company to report an adjusted loss per share of $1.88 on revenue of $2.51 billion.

Analysts will also look for any additional comments the company has on its new Model 3 car, designed to be a mass-market car and a vehicle that CEO and founder Elon Musk has said would see production increase exponentially, from about 100 cars this month for 20,000 per month by year-end.

Also on the earnings calendar on Wednesday will be results from Time Warner (TWX), Humana (HUM), Mondelez (MDLZ), and Molson Coors (TAP).

Investors on Wednesday will also still be working through results from Apple (AAPL), after the world’s largest company on Tuesday reported earnings and revenue that topped estimates, sending shares up by as much as 5% in after hours trading to a new record high.

On the economic calendar, ADP’s latest report on private sector payroll growth should be the highlight, with economists expecting 190,000 jobs were created in July. The government’s official jobs report is due out on Friday morning.

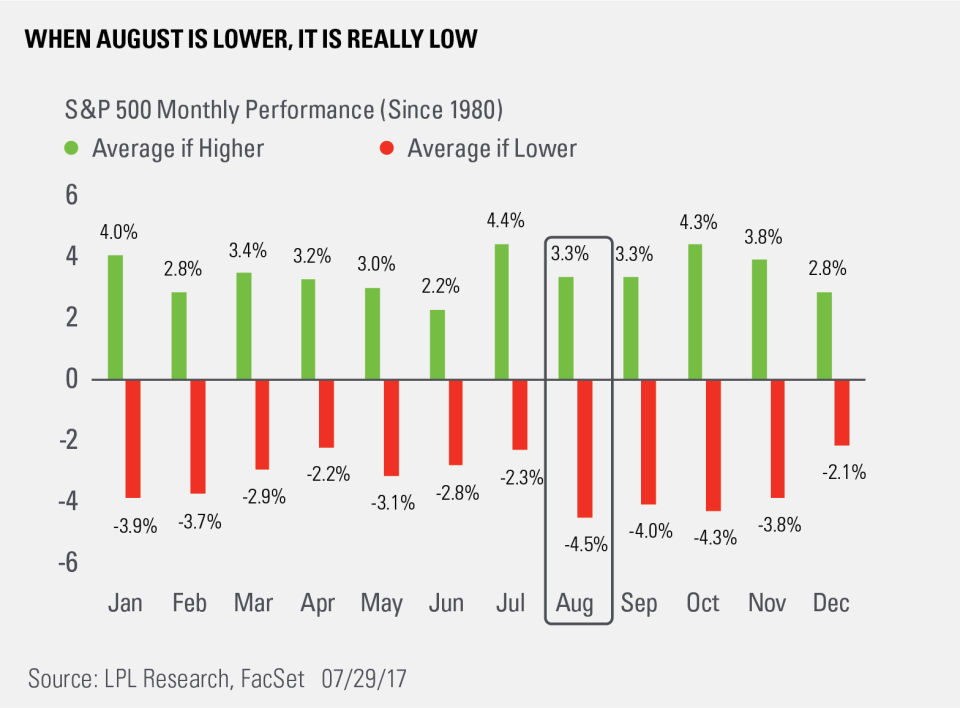

Beware of August

Since 1980, only two months have averaged negative returns for the S&P 500 — August and September.

Average returns in August have been -0.1% since 1980 (September is slightly worse, at -0.7%), but when August is in the red, it has been the worst performing month of the year. On average, the benchmark stock index loses 4.5% during August’s when stocks close in the red, the most of any month, according to Ryan Detrick at LPL Financial.

Detrick notes that back in 2013, when the S&P 500 gained 30%, stocks lost 3% in August. Two years later, stocks lost over 4% during the month and the S&P 500 dropped 230 points in just a matter of days.

“Maybe it is the back to school blues, but since 1980, there is no month with a worse average return when it is lower than August,” Detrick writes.

“Look at the recent history of August: 2015 was the China currency issues and a 1,000 Dow drop, 2011 had the U.S. debt downgrade, 2010 saw a big drop as worries over the global economy spread, 1997 and 1998 both saw big drops in August over the ‘Asian Contagion’ and the implosion of Long-Term Capital Management (LTCM). Oh, and Iraq invaded Kuwait in 1990.

“Pick a reason why these big, out of the blue events happen in August. Bottom line is they do and we should be ready ought it happen again.”

Taking this together with the fact that it’s been over nine months since we’ve had even a 3% pullback and more than year since stocks have declined 5% from a recent peak, a shot of volatility shouldn’t be unexpected in a month many might think is supposed to be one of the summer’s sleepiest.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: