Tesla and the Fed — What you need to know in markets on Wednesday

On Wednesday, two of the week’s most anticipated news items will be released: the Minutes from the Federal Reserve’s latest meeting and earnings from Tesla (TSLA).

The Minutes, which accompany the Fed’s announcement earlier this month that it would keep its benchmark interest rate pegged at 0.50%-0.75%, will reveal the FOMC’s deliberations and potentially provide insight on whether the March meeting could be the time for an additional rate hike from the central bank.

Markets will also be looking for clues about any commentary on developments from the Trump administration, though in a note out on Friday, Ethan Harris at Bank of America Merrill Lynch said, “We expect only a brief discussion of risks from fiscal policy given that there is little clarity on the potential policies.”

Tesla earnings, meanwhile, will be closely tracked by markets as its CEO Elon Musk is one of the most polarizing executives in markets. Analysts are looking for the company to lose $1.04 per share on revenue of $2.12 billion. Options markets are pricing in an expected move of about 6% in shares following the results, according to data from Bloomberg. Tesla is expected to report after the market close.

Earnings

Earnings season is almost over.

Earnings are on track to rise about 8% over the prior year. And as for the market’s performance, this has been the best earnings period for stocks since the fourth quarter of 2014 as the S&P 500 is up about 3% during the six-week period that typically covers earnings, according to Bespoke Investment Group.

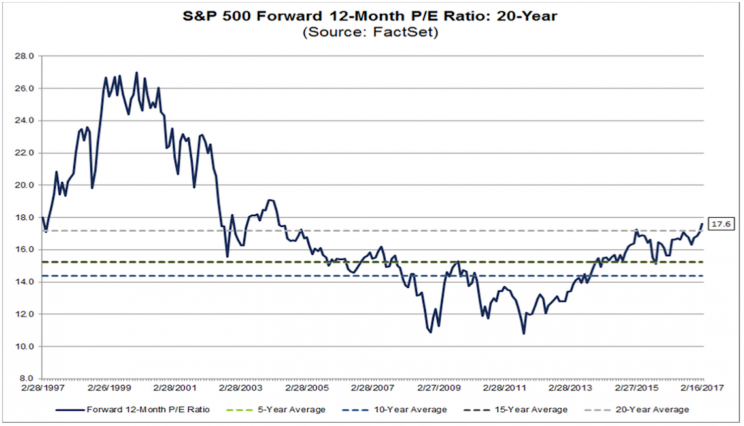

But as Yahoo Finance’s Sam Ro noted on Tuesday, analyst outlooks for stocks are growing increasingly cautious, earnings estimates are coming down, but the stock market seems unperturbed. Additionally, forward 12-month P/E ratios are now at their highest since 2004, perhaps giving some skeptics pause.

Bespoke notes that such a positive performance from markets during earnings could lend credence to the idea that recent gains have “borrowed” from future returns. The data, however, simply to not back this up.

During this current bull market, the average return for stocks during earnings season has been 1.85%. The median return in 1.99%. The rest of the quarter outside of typical reporting weeks, stocks are up on average 2.07% with median returns at 2.1%. And during earnings periods where the S&P 500 was up more than 3%, average returns during non-reporting weeks were 1.86% and median returns were 2.1%.

In other words, stocks perform almost identically following earnings periods where stocks go up by a lot and during periods when stocks go up just a little.

We’ve written recently that markets and politics are clearly moving in different directions. Markets see Trump and the possibilities presented by his administration as reasons to be bullish stocks. Politics see the apparent chaos of the White House as reasons to be nervous about the state of the US government.

And while a lot of lip service is often paid to the idea of “political risk” in investing, well-functioning governments are not a pre-requisite for buying stocks, and the inverse is not an adequate premise for selling.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: