Tax Strategist vs. CPA: Differences You Need to Know

AI was used in the creation of this article. The article was reviewed, fact-checked and edited by a content review team. We might earn a commission if you make a purchase through one of the links. McClatchy newsrooms were not involved in the creation of this content.

In an era where the quest for specialized talent intensifies, the spotlight on the distinct roles of tax strategists vs. CPAs has never been more relevant. A recent survey by Thomson Reuters highlights a soaring demand, with 64% of firms planning to expand their tax professional teams within the next year, indicating an average increase of 6.6 tax experts. This trend escalates in larger firms, where 94% aim to onboard an average of 23.3 additional tax specialists.

But what does this mean for you?

Amidst this hiring spree, discerning the nuanced differences and synergies between tax strategists and CPAs becomes paramount. Leveraging insights from perspectives from seasoned professionals in the tax strategy arena, this article is your gateway to understanding how these roles differ and intersect, guiding you to align your career path with the industry’s evolving demands.

Key Takeaways

Specialization in Tax Planning vs. Comprehensive Financial Expertise: Tax strategists focus on tax law, planning, and compliance, while CPAs provide a broader spectrum of financial services, including auditing and business consulting.

Certification and Educational Requirements: As a tax professional, a CPA must pass a stringent exam and fulfill specific educational and experience prerequisites, whereas tax strategists may possess various certifications, such as Enrolled Agent status or qualifications in financial planning.

Career Prospects and Earning Potential: Both careers offer a range of opportunities. However, CPAs typically enjoy a broader scope of employment across different sectors, often reflected in higher average salaries than tax strategists without CPA certification.

The Challenge of the CPA Exam: Transitioning from a tax preparer to a CPA involves surmounting hurdles, especially in conquering the REG section of the CPA exam, where extensive study and a robust review course are indispensable, regardless of one’s background in tax strategy.

Understanding a Tax Strategist

A tax strategist specializes in tax law, tax planning, tax return filing, and compliance. They are committed to advising individuals and businesses on optimizing their tax situations. Unlike tax preparers, who mainly concentrate on filing tax returns, tax strategists provide strategic advice to reduce their tax burden, increase tax savings, and save money while complying with tax laws and regulations. They deeply understand the tax code’s intricacies and offer customized advice to aid in financial planning and decision-making.

Characteristics of a Tax Strategist

Expertise in Tax Law and Planning: Proficient in leveraging tax laws to improve clients’ financial scenarios, focusing on tax efficiency and savings.

Certification: While some are CPAs or tax attorneys, others hold specific tax strategy certifications or financial planning qualifications, showcasing their expertise and dedication to the field.

Client Representation: Competent tax strategists, particularly those who are also enrolled agents or CPAs, can represent clients in IRS dealings, including audits, appeals, and tax dispute resolutions, offering a vital service in complex tax situations.

Understanding a CPA

A CPA is a beacon of accounting, financial planning, and tax services expertise. This role transcends simple tax preparation to encompass financial audits, business consulting, and holistic financial management. With a profound grasp of accounting principles and tax regulations, Certified Public Accountants are invaluable advisors for navigating financial complexities and ensuring adherence to legal standards.

Attributes of a Certified Public Accountant

Accounting and Financial Mastery: Skilled across various accounting and financial management practices, CPAs offer more than tax advice, including audits, financial reporting, and strategic business planning.

Certification: Achieving CPA status requires passing a comprehensive examination and meeting state boards’ educational and experience standards, highlighting their proficiency and commitment to the field.

Client Representation: CPAs are authorized to represent clients before the IRS in audits, tax disputes, and other tax-related issues, providing substantial support and expertise in financial and tax matters.

Career Paths for Tax Strategists and CPAs

Tax strategists and Certified Public Accountants provide distinct yet often complementary services, addressing a broad spectrum of financial and tax-related needs. While tax strategists primarily focus on tax planning and compliance, CPAs offer a wider array of financial services, including auditing, business consulting, and tax services, enabling them to cater to a diverse clientele across various industries.

Tax Strategist Careers

Tax Strategy and Compliance: Specializing in advising individuals and businesses on tax-efficient strategies and compliance, emphasizing long-term tax planning and savings.

Financial Planning Services: Providing comprehensive financial planning advice, including the tax implications of investment decisions, estate planning, and retirement planning, to enhance clients’ financial well-being.

IRS Representation: Qualified tax strategists, especially Enrolled Agents, are empowered to represent clients before the IRS in audits, appeals, and tax dispute resolutions, offering invaluable assistance during complex tax issues.

Certified Public Accountant Careers

Audit and Assurance Services: Employed by public accounting firms to deliver audit, assurance, and compliance services, ensuring the accuracy and reliability of financial reporting for clients.

Business Advisory Services: Offering consulting services on business operations, financial accounting, risk management, and improving financial processes for businesses of all sizes.

Tax Services: Providing tax preparation, planning, and consulting services, utilizing their extensive knowledge of tax deductions and regulations to benefit their clients.

Specialized Financial Services: Engaging in niche areas such as forensic accounting, environmental accounting, international taxation, and information technology consulting, catering to the specific needs of a varied client base.

Executive Roles in Corporate Finance: Occupying high-level positions within corporations, such as Chief Financial Officer (CFO) or finance director, overseeing the financial strategy, reporting, and operations of the organization.

Government and Nonprofit Sector: Working in governmental or nonprofit organizations, focusing on financial oversight, public accounting, budgeting, and financial reporting to support public and community goals.

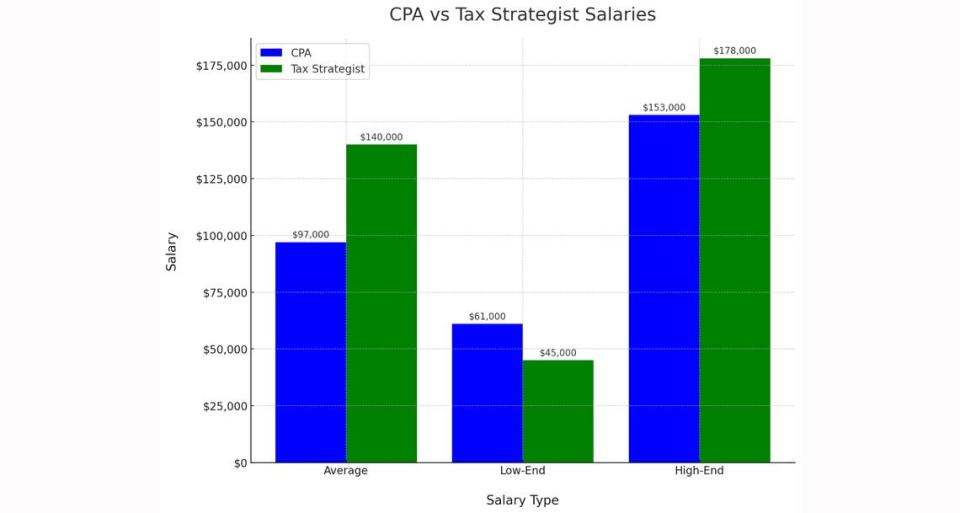

Salary Comparison for CPAs and Tax Strategists

The comparison between CPA and tax strategist salaries highlights significant earning potential in both fields, with tax strategists showing a particularly high upper salary range. While CPAs have a strong foundational salary, tax strategists can earn more, especially in high-level strategic roles that require extensive experience and specialization.

CPA Salaries

Certified Public Accountants enjoy a broad spectrum of salary opportunities, from auditing roles in small firms or government sectors, typically near the lower end, to senior positions in financial consultancy or management accounting within large corporations or financial institutions, commanding salaries at the higher end.

Average Salary: $97,000

Low-End Salary: $61,000

High-End Salary: $153,000

Specialized CPAs, such as those focusing on forensic accounting or financial analysis for investment firms, often find their compensation aligning with the upper salary ranges due to the complexity and high demand for their expertise.

Tax Strategist Salaries

Tax Strategists, on the other hand, often work in advisory capacities, offering strategic planning services to minimize tax liabilities for high-net-worth individuals or large organizations.

Average Salary: $140,000

Low-End Salary: $45,000

High-End Salary: $178,000

Those at the lower end of the salary spectrum may be starting in boutique tax consultancy firms or as part of a larger team in corporate settings, while individuals in the highest salary brackets typically hold senior roles, such as lead tax strategy consultants for multinational corporations or specialized tax advisory firms, where their in-depth knowledge of tax legislation and strategic planning significantly impacts their clients’ financial efficiency.

A Day in the Life of a Tax Specialist: Insights from Accounting Experts

Embarking on a career in tax accounting is a journey filled with intricate details, diverse experiences, and a blend of rewarding and challenging moments. According to seasoned professionals on Reddit, the life of a tax specialist is anything but monotonous. Here’s a glimpse into their world, combining direct quotes and summaries from those in the trenches.

Starting the Day

The day of a tax accountant begins with a routine that sets the stage for productivity. “I log in, check my emails, check what meetings I have, and then check my to-do’s,” shares one user, highlighting the importance of organization. This small Excel document becomes a lifeline, tracking pending tasks and setting the agenda for the day. The process of picking a project and diving in is a testament to the self-driven nature of the role.

The Workflow

The workflow is meticulous for tax specialists, especially those handling individual returns like the 1040. It starts with reviewing budgeted hours for a client, a crucial step that helps manage time efficiently. Manual entries, from medical expenses to schedule E’s and C’s, are part of the daily grind. Resolving diagnostics and keeping notes on missing items or questions mark the culmination of a return’s preparation.

The Enjoyable and the Stressful

Tax accountants find joy in the diversity of their clients and the satisfaction of completing complex projects. “You get to see a lot of clients and basically know their entire life from their tax documents,” one accountant notes, finding intrigue in their clients’ unique businesses and stock trades. However, the flip side is the stress of the busy season, with 60+ hour workweeks being the norm for the first four months of the year.

Essential Skills

Communication emerges as a critical skill for success in this field. “If you get stuck on something for more than 10-15 minutes, reach out to someone for help,” advises one professional, underscoring the importance of efficient problem-solving and persistence in following up on pending items.

The Internship Experience

Interns in tax accounting often start with foundational tasks like formatting PDFs, entering numbers into spreadsheets, and importing them into tax software. This exposure, though seemingly administrative, is crucial for understanding the broader workflow and the software tools at play.

The Varied Nature of Work

The experiences shared by tax specialists underscore the variability of the work, depending on the client and the type of return. The challenges vary widely from straightforward individual returns to more complex entity returns. “Miserable, but uh, yea truth depends on which client. Some are organized and make sense, others are hot messes, and you feel lost,” one user candidly shares, highlighting the unpredictable nature of tax accounting.

Advice for Aspiring Tax Accountants

For those considering a career in tax, advice from seasoned professionals is invaluable. Emphasizing the importance of being proficient in Excel, making clear notes, and managing communication effectively, they offer a roadmap for navigating the early stages of a tax accounting career. “The first year will feel like constant failure and not knowing what you’re doing... Be patient with yourself,” advises a tax manager, providing a dose of reality mixed with encouragement.

Conclusion

Discerning the differences between tax strategists and CPAs is vital for individuals at a crossroads in their financial or career decisions. While CPAs often provide tax strategy services, embodying a wide spectrum of financial expertise, including auditing, financial planning, and business consulting, not all tax strategists hold the CPA designation.

Tax strategists specialize in tax law, planning, and compliance, focusing on strategies to minimize tax liabilities and ensure regulation adherence. This specialization highlights the importance of recognizing each profession’s unique skills, qualifications, and services, enabling informed decisions about which path best aligns with one’s professional aspirations or financial needs.

FAQs

What are the main differences between a tax strategist and a CPA?

Tax strategists specialize in tax law, planning, and compliance, focusing on strategies to minimize tax liabilities. CPAs offer a broader range of financial services, including auditing, financial planning, business consulting, and tax services. While some CPAs also serve as tax strategists, not all tax strategists are CPAs, each bringing unique skills and qualifications to the table.

Can a tax strategist represent clients in tax disputes like CPAs and tax attorneys?

Yes, qualified tax strategists, especially Enrolled Agents, can represent clients before the IRS, including audits, appeals, and resolving tax disputes.

How does one decide between pursuing a career as a tax strategist or a CPA?

The decision depends on your interest in specializing in tax law and compliance versus seeking a broader scope of financial expertise. If you’re drawn to deep dives into tax planning and ensuring compliance, becoming a tax strategist might suit you. If you’re interested in a broader range of financial services, including auditing and business consulting, pursuing CPA certification could align with your career vision.

What qualifications are necessary to become a tax strategist, and how do they differ from those required for CPAs?

Tax strategists may hold specific tax strategy certifications or qualifications in financial planning, such as the Enrolled Agent status. To become a CPA, one must pass a rigorous CPA exam and meet educational and experience criteria set by state boards, which typically include a bachelor’s degree in accounting or a related field and a certain number of hours of accounting coursework.

How does the salary potential compare between tax strategists and CPAs?

Salary potential varies based on qualifications, experience, and the specific services offered. Tax strategists can expect to earn around $140,000 per year. CPAs have a broader scope for employment across various sectors, with an average annual salary of $97,000. This demonstrates the importance of specialized training and certification in enhancing one’s earning capacity within the financial advisory domain.

What are the continuing education requirements for tax strategists and CPAs to maintain their certifications?

Continuing education is critical for both tax strategists and CPAs to maintain their certifications and stay current with the evolving landscape of tax laws and financial regulations. For CPAs, the American Institute of Certified Public Accountants and state boards typically require a certain number of CPE hours every reporting period, which can vary by state but often ranges from 40 to 120 hours every 1 to 3 years.