A tax-limit law curbed a fast-growing Boise-area fire district’s capability. What now?

Three years ago, the Idaho Legislature passed and Gov. Brad Little signed into law a bill that capped the amount of new property-tax dollars that local governments can take from new, taxable development.

One Treasure Valley fire district says the law has contributed to the district falling so far behind in meeting the need for fire protection in new subdivisions that it must turn to voters to approve a special tax increase to circumvent the law.

The Middleton Star Rural Fire District is a partnership of the Middleton and Star fire departments that shares leadership to save money. But it hasn’t been able to save enough since joining forces in 2019 to keep up with growth.

Fire Chief Greg Timinsky says population increases, the property-tax budget cap, and fast-rising construction and equipment costs have left the department unable to keep up with staffing and operational demands.

“There is no doubt that Middleton and Star have grown, but bigger than that is the increased cost of our equipment and our buildings and the cost to outfit a firefighter today compared to what it used to cost,” Timinsky told the Idaho Statesman by phone.

Boise-area growth outstrips firefighting capability

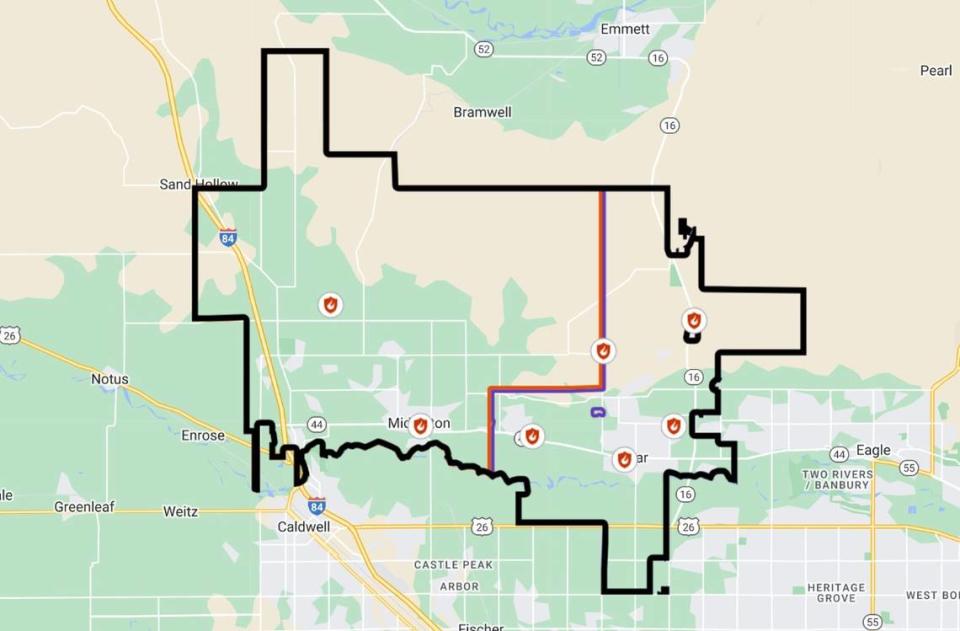

The Middleton Star Rural Fire District covers the cities of Middleton and Star and the rural areas north of them.

Star has two fire stations and Middleton has one. The joint district hopes to refurbish a station in Middleton and add a new one in Star, Timinsky said. The district has 12 firefighters on staff per day. The combined yearly budgets total about $6.4 million.

Since 2018, Middleton’s population has increased by 25% to over 28,000 people, and Star’s has risen 55% to 22,000, according to a news release from both cities. The number of buildings within district boundaries has increased by more than 2,000 to about 9,900 in Middleton and by more than 2,500 to about 7,160 structures in Star.

The growth has brought traffic backups on the highways and Interstate 84 and other major state and local roads that firefighters rely on to get to fires quickly.

“The district’s optimal response time for fire protection and emergency medical services is five minutes to minimize property loss and severe or fatal injury,” the department said in a news release to Middleton residents. “The district’s current response time within the downtown Star service area is up to five minutes. The response time outside the downtown Star station service area ranges from five to 20 minutes.”

The downtown Star station serves 110 square miles, the department said. The district hopes to refurbish a station on Harvey Road in Middleton to reduce response times to Star’s northwest.

The fire departments charge impact fees, which developers pay to offset the costs of new development, but Timinsky said they can use those fees only to build fire stations and purchase “big-ticket items” like firetrucks.

What good is a fire engine without staff?

With impact fees, Timinsky can’t pay for wages, fuel or health insurance.

Timinsky said the state law caps the percentage increase of a department’s property tax budget at 8% per year. The populations of Star and Middleton are growing at an average pace of 13%, he said.

“In my mind, this is simple math: We’re leaving the difference between 8% and 13% on the table, so those new people that are moving in aren’t paying back a portion of it,” Timinsky said.

A rural fire district is 97% reliant on property taxes, Timinsky said. Unlike cities, fire districts don’t get building-permit fees or liquor tax revenues.

Timinsky plans to ask the Middleton and Star city councils to approve a request to place a levy increase on the May 21 primary election ballot. The permanent levy override would cover the increased operational costs not funded by current property taxes.

Based on 2023 property values, the estimated cost to a homeowner would be about $60 to $65 per $100,000 of assessed value annually, or $5 to $5.50 per month, the district said in the Middleton news release. A permanent levy override requires a two-thirds majority to pass.

Timinsky knows a levy is a big ask.

“You and I are no different than the rest of the public: We don’t want to pay any more property tax than we have to,” he said. But if the levy doesn’t pass, he said, two fire stations will not be staffed, he said.

“Our response times to the areas around (those fire stations) are going to be longer response times and that’s what we’re trying to avoid,” Timinsky said.

Do you pay your fair share of Idaho taxes? What a new report says rich and poor pay

So you’ve heard your property taxes have gone down this year. Here’s what to expect