A Tax Cut That Republicans Could Pass, Flaws And All

WASHINGTON ― House Republicans released their long-awaited tax cut bill on Thursday, with some interest groups coming out immediately against the legislation and most Republicans enthusiastically supporting the bill anyway.

Home builders, realtors and small business groups were among those opposing the legislation, citing changes to mortgage interest deductions and concerns about restrictions on who gets a 25 percent pass-through tax rate. But GOP lawmakers on Thursday didn’t seem to be taking arguments against the bill very seriously.

“I’m for it. Been for it. Didn’t see any reason to be against it,” Rep. Thomas Massie (R-Ky.) told HuffPost.

Massie, one of the most conservative Republicans in the House, said the general mood on Thursday when GOP leaders rolled out the bill in a special closed-door meeting was positive, and he didn’t think the bill would have any problems in the House.

Conservatives seem overwhelmingly supportive of the tax bill, which would increase debt by $1.5 trillion over the next 10 years in the name of lowering individual and corporate tax rates. House leaders have learned from recent fights, like health care, that once they get the conservatives on board, they can pressure the other members to vote yes. And in this case, they may not have to pressure too much. Republicans, longing for some kind of policy accomplishment, are eager to get behind the measure, signaling that they’ll make whatever changes are needed to get the bill over the finish line.

As Rep. Barry Loudermilk (R-Ga.) told HuffPost on Thursday: “Whatever it takes to get it done at this point.”

Still, there are dozens of ways the tax bill could fall apart. Lawmakers are just getting their hands on the text of the bill, and they’re sure to find provisions they want changed. Freedom Partners and Americans for Prosperity, two conservative groups partially funded by the Koch brothers, are taking issue with certain foreign territorial taxes. They’re presenting it as the much-maligned border adjustment tax “by another name.”

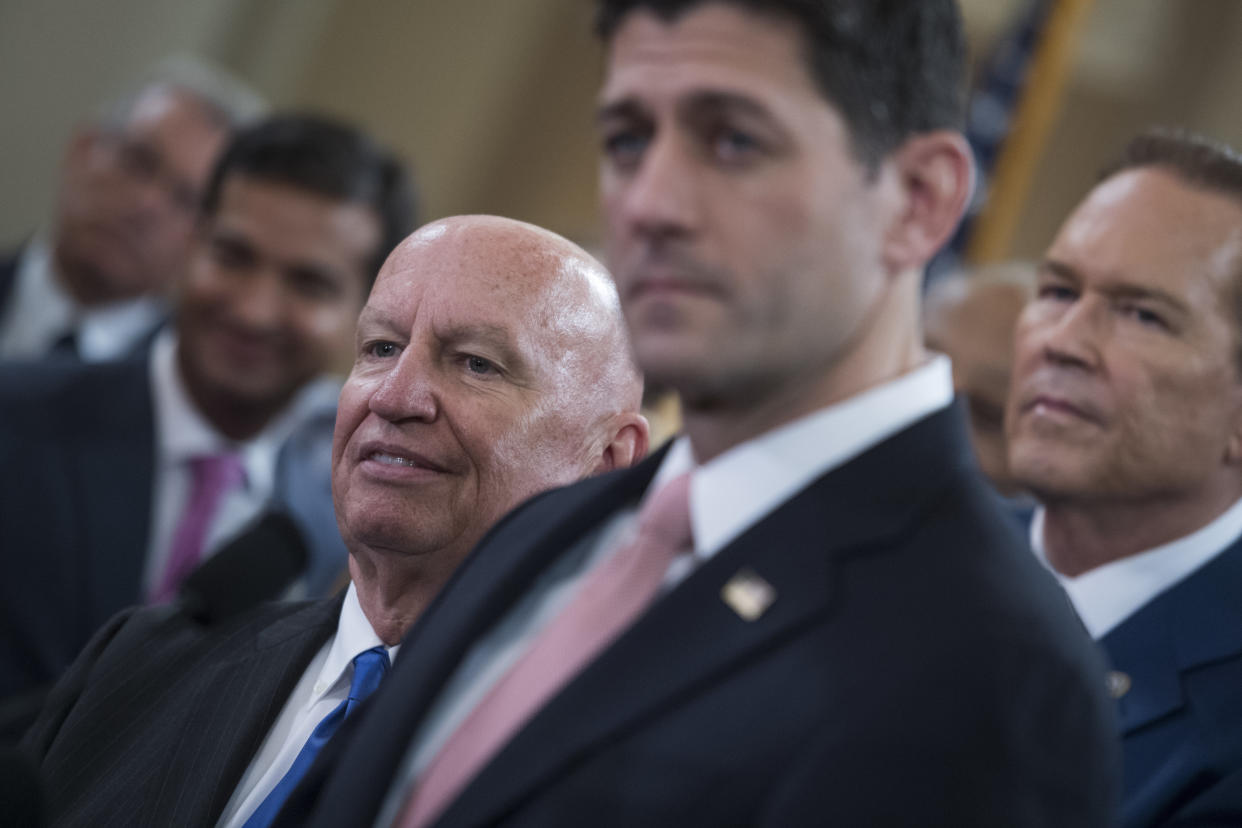

Republicans could also run into trouble with some provisions surrounding mortgage interest. The GOP tax bill would cut the deductibility of payments on mortgage interest from $1 million to $500,000 ― news that caused a home builders index fund to fall by more than 2 percent on Thursday. Realtors and home builders are concerned the GOP tax bill could cause a housing downturn, something that House Ways and Means Chairman Kevin Brady (R-Texas) dismissed Thursday morning.

“Nothing sells more homes and raises property values better than a strong economy,” Brady said.

Other, quirkier issues could also give some Republicans pause ― a 1.4 percent tax on investment income from large universities, eliminating the 80 percent charitable deduction of college sporting tickets, getting rid of tax-exempt bonds for professional stadiums ― but the biggest issue is still the state and local tax, or SALT, deduction.

Republican leaders say they’re still working to find a solution for states like New Jersey, New York and California that heavily benefit from the SALT deduction. Some members from those states, however, don’t seem to be holding their breath.

A handful of Republicans who voted against the budget setting up the tax cut bill last week were quick to announce their opposition to the tax bill Thursday. Reps. Dan Donovan (N.Y.), Peter King (N.Y.), Leonard Lance (N.J.), Frank LoBiondo (N.J.), Tom MacArthur (N.J.) and Lee Zeldin (N.Y.), all Republicans, have indicated they’re leaning against the proposal in its current form.

The draft released Thursday would let filers deduct up to $10,000 of their property taxes. That wouldn’t do much for the districts benefiting the most from the SALT deduction, but it could split the New York and New Jersey delegations and be enough to win over California Republicans. (Not a single California Republican has voted no on two budget resolutions setting up the tax bill for reconciliation, despite GOP leaders indicating they wanted to get rid of the SALT write-off entirely.)

For a handful of districts that benefit from the SALT deduction, the $10,000 capped write-off could be enough to make taxpayers whole, particularly when taken with the overall lowering of rates and the doubling of the standard deduction. But these states, which already pay more into the federal government than they receive back, would largely be financing a significant portion of the tax cuts for the rest of the country. “The people of New York deserve the same tax break as the people of the rest of the country,” Donovan told HuffPost.

The question for each member is how much their district is affected. MacArthur seems like he would vote yes if the deduction went up to $12,500, while LoBiondo said it would take more money for him to get to yes.

MacArthur is “speaking not for me,” LoBiondo said.

MacArthur knows that if Republicans ask for too much, they run the risk of perhaps just soaking the SALT districts and trying to get 217 votes in the House by appealing to other constituencies.

“They know how to count,” MacArthur said of leadership, “and if they don’t need our votes, they might take that approach.”

Assuming no Democrat votes for the tax bill, GOP leaders can afford to lose 22 Republicans and still pass the bill in the House. In the Senate, Republicans could only lose two votes and still pass the bill, with Vice President Mike Pence breaking a tie.

The Senate looks like it will be the tougher chamber for tax reform, with fewer votes to spare and harsher rules about increasing the deficit in a reconciliation bill. While the House bill comes in right around $1.5 trillion in increased debt over the next decade, Republicans are already clamoring for changes that would make more people eligible for the pass-through rate of 25 percent, and there’s been some chatter about reinstituting a tax break for research on rare diseases as well as the mortgage interest deduction on second homes (which the bill would end).

Sen. Marco Rubio (R-Fla.) has also made it clear he won’t settle for the smaller child tax credit that the House offered. The House bill would increase the child tax credit to $1,600 per minor, up from $1,000. Rubio and some other Senators want it to be at least $2,000.

Opening up the bill for changes could be difficult for Republicans. They have some ways to raise money by increasing rates here or there. But the most significant revenue-raiser is still the elimination of the SALT deduction, so getting more generous with how much they allow taxpayers to write off could be a challenge.

In the House, if past budget votes are any indication, there are only about a dozen Republicans who are serious about voting against the tax bill over SALT objections. Rep. Peter Roskam (R-Ill.), whose average constituent benefits about $14,000 a year from the deduction, told HuffPost that his district is interested in tax relief, “not particularly concerned by the equation by which they get it, and under this plan, they get it.”

If Republicans from districts like Roskam’s don’t have a problem with the SALT fix, it’s a good bet that this tax bill will pass the House. It’s difficult to predict how much the bill would affect taxes in every individual district for every individual situation, but there are clear winners and losers. Someone with an expensive home, with high medical expenses (that deduction is also eliminated in the GOP bill), from a high-tax area ― that person could see their tax bill go up. People who don’t own homes and don’t have many deductions already, on the other hand, could see a substantial cut.

Republicans are counting on moving this bill at such a quick pace that inertia takes over and gets them across the finish line. The Ways and Means Committee plans to begin marking up the measure next week, and leaders seem to have their sights set on passing the bill out of the House the week after that.

Unless there’s a sudden mutiny, it’s a good bet that gambit will work.

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.