So, About That Tax Break For Private Jets

Tucked away inside the Senate Republican’s tax bill, already jam-packed with goodies for U.S. businesses, is a provision that seems specially tailored to spark massive populist outrage: a tax break aimed at private plane travel.

It appears on page 50 of the bill, which is headed for a vote sometime after Thanksgiving. The plane thing got a wave of attention Thursday after a tweet about the provision went viral.

“If there were any doubt about who this [tax plan] serves, the special tax break for private planes should settle it,” Paul Krugman, the New York Times columnist and liberal economist, wrote on Twitter.

Well, yes and no. The measure is certainly a tax break for private plane travel, and the fact that this is part of the Republican tax bill is yet another clear sign of the way the party has used this bill to favor businesses over humans.

“It’s an egregious double standard,” said Seth Hanlon, a fellow at the liberal Center for American Progress. Senate Republicans are going out of their way to help out the private aviation industry, as part of a bill that will hurt millions of Americans.

But the provision itself isn’t quite as deliciously terrible as the tweets would have you believe.

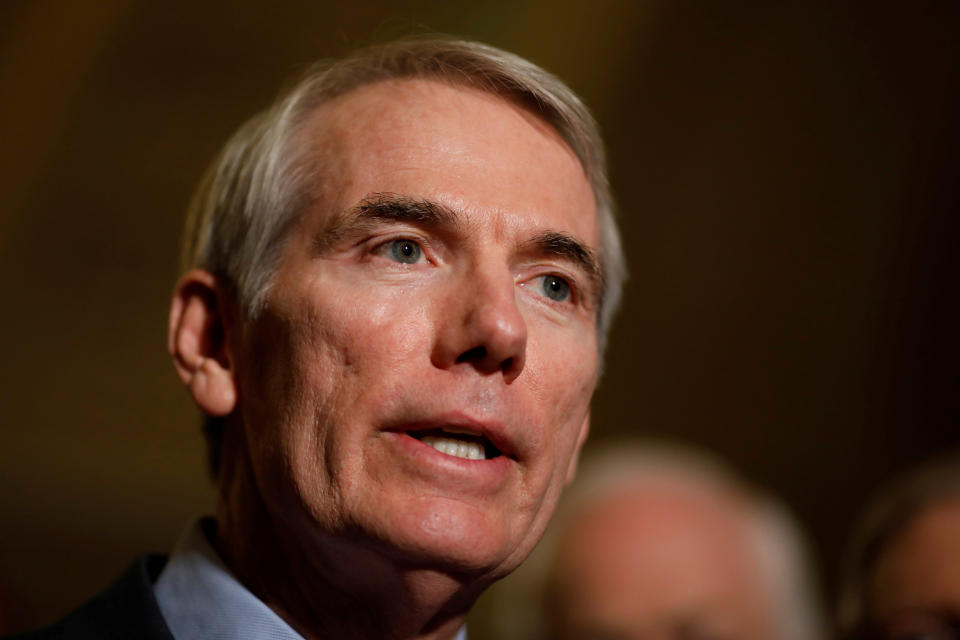

Private plane operators aren’t actually getting any new tax break here. Indeed, the Joint Committee on Taxation, a nonpartisan congressional panel that examines tax legislation, says the plane break won’t actually cost anything. The industry and their backers in the Senate, including the super liberal Sen. Sherrod Brown (D-Ohio), explain that the provision merely brings clarity to a long-standing tax dispute, kicked off five years ago by a memo from the Internal Revenue Service.

The provision makes clear that the companies that manage private air travel ― plane owners use them to hire pilots or handle logistics ― do not have to pay a 7.5 percent excise tax on air travel. The 7.5 percent tax is also known as a “ticket tax” and Americans pay it when they travel commercial.

This doesn’t mean private air travel isn’t subject to taxes, there’s just a different kind of tax ― a fuel surcharge that amounts to around 20 cents per gallon of gas. Planes burn through 300 gallons an hour.

Think of it like how car owners pay gas taxes but if you take a taxi, you pay a different fee, said Nel Stubbs, an aviation tax expert at Conklin & de Decker Aviation Information, an aviation research and consulting company.

“I’ve been doing this a long time and it’s not giving owners a tax break, it’s clarifying the application of a tax,” she added.

Industry representatives emphasized that the break wasn’t for the millionaires who own the planes, but for the small businesses that they pay to help deal with their travel.

At the same time, the private plane tax break is a clear sign of just how in sync Republican lawmakers were with business interests when it came time to write this legislation. The provision is modeled on legislation authored back in February, with the backing of both senators from Ohio, home to NetJets, the private plane company owned by Warren Buffett’s Berkshire Hathaway.

While the tax bill brings certainty to the world of private air travel, the legislation is poised to disrupt millions of regular American households.

“They’re settling a long-term dispute between companies and the IRS at literally the same time they changed the bill to make every single tax cut for individuals and families expire after 2025, which creates enormous uncertainty for every household in the United States,” Hanlon said.

Hanlon agrees that this measure on its face isn’t terrible, but it is a sign of how the industry is able to get what it wants from policymakers.

There has been years of pressure from the private plane industry ― particularly Buffett’s NetJets and Executive Jet Management.

“I know our entire industry is grateful to Mr. Buffett’s Berkshire Hathaway for leading the effort with the IRS to clarify this position,” said Greg Raif, CEO of Private Jet Services, an aviation consultancy and charter plane provider with clients that he says include professional sports teams, presidential candidates and government agencies.

Brown’s office made clear that he does not view this as yet another tax giveaway for the rich in a bill already packed full of them.

“This provision in no way cuts taxes for private jet owners,” said spokesperson Jennifer Donohue. “It simply clarifies what the law already says — that service companies made up of mechanics and service workers don’t pay ticket taxes, because they don’t sell tickets.”

Brown himself got into a shouting match Friday with Republican Sen. Orrin Hatch (Utah) over the tax bill and how it favors the rich.

“When the Republicans are in power, the first thing they want to do is give tax cuts to the rich. That’s just what’s ― it’s in their DNA,” Brown said.

Up until 2012, plane management companies never had to pay the 7.5 percent excise tax, but that year someone inside the IRS changed the policy. That triggered a lot of tax audits and a lot of lobbying and lawsuits from the industry, which fought hard to avoid this tax.

Since the legislation pushed by the Ohio senators never made it to law, the private plane industry saw the tax bill as a good time to push the change through.

“We haven’t had a comprehensive tax bill in years and years,” said Stubbs, the aviation tax expert. “This is an opportunity.”

Arthur Delaney contributed reporting.

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.