A Tale of Two E-Commerce Market Kings: Alibaba Group Holding Ltd (BABA) and Amazon.com, Inc. (AMZN)

Here's Why Alibaba Is a Top Pick

Alibaba Group Holding Ltd (NYSE:BABA) is so compelling that in previewing the Chinese e-commerce giant's first fiscal quarter earnings, Stifel analyst Scott Devitt adds the company to his Stifel Select List. Between healthy Chinese e-commerce sales trends, solid core commerce growth execution, enticing mobile monetization prospects, a fresh retail strategy, and a cloud services segment that reigns as king of the market, the analyst is increasingly bullish on BABA.

Therefore, the analyst sets high expectations before financial results to be delivered this Thursday before the bell, reiterating a Buy rating on BABA while lifting the price target from $165 to $180, which represents a 16% increase from where the shares last closed.

Ahead of the first fiscal quarterly results of 2018, the analyst is lifting his expectations for both the quarter as well as the fiscal year, anticipating sustained momentum for the giant. Now, the analyst is looking for a 56% year-over-year rise to $7.28 billion in revenue, more bullish than consensus of $7.14 billion. When glancing at the China eCommerce sales growth measured by the National Bureau of Statistics of China, growth has climbed 37% year-over-year in the first quarter of 2017 to 41% year-over-year in the second quarter of 2017, which leads Devitt to have robust topline expectations.

Additionally, the analyst sees strength in cloud revenue growth trajectory. Devitt projects a 95% year-over-year incline in the first fiscal quarter of 2018 on back of rapid-fire paying customer growth coupled with deeper penetration across existing accounts, which he notes is slightly offset by cost-cutting. For adjusted EBITDA, the analyst models $3.37 billion with a 46% margin, over consensus of $3.19 billion, which he explains stems from video, content, as well as omni-channel investments seeing an offset thanks to strong core commerce performance.

Especially encouraged following Alibaba's Analyst Day back in June, where the giant offered "very strong" revenue growth outlook for fiscal 2018, the analyst notes that core commerce is a stellar segment for the company, who has been able to drive even more growth here.

Devitt believes, "We expect continued topline momentum as Alibaba continues to benefit from personalization efforts within core commerce and a healthy macro environment. Alibaba remains one of our top selections in our coverage group. Alibaba continues to execute well in driving growth in the core commerce as well as invest in areas such as cloud services, video content, and multi-channel to support long term growth"

Looking beyond the earnings bell, "We see the opportunity to continue to advance mobile monetization through better customer engagement, better targeting, the leverage of consumer data, personalization, and greater capture of merchant ad spend. We believe the company’s new retail strategy will expand the addressable market as the company connects the online and offline shopping experience to realize healthy synergies. Alibaba’s cloud services business is the market leader, running at a $1B revenue run rate and remains a significant driver of growth given we are likely 1-2 years away from an inflection point," contends the analyst.

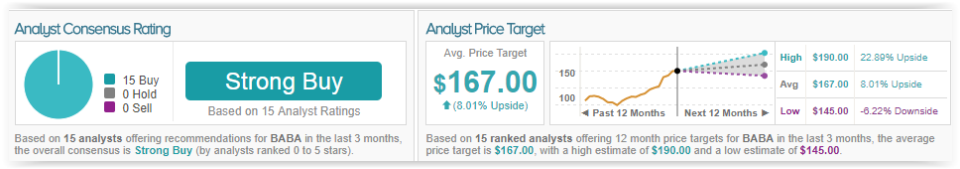

TipRanks analytics showcase BABA as a Strong Buy. Out of 15 analysts polled by TipRanks in the last 3 months, all 15 rate a Buy on Alibaba stock. The 12-month average price target stands at $167.00, marking an 8% upside from where the stock is currently trading.

Amazon's Enterprise Wins Are Key to Unlocking Value

Amazon.com, Inc. (NASDAQ:AMZN) held its annual Amazon Web Services (AWS) Summit yesterday in New York, where the online auction and e-commerce giant announced a slew of additions to its product battalion, from a machine-learning based security service to enhanced data management tools.

Top analyst Colin Sebastian at Baird is out with confident cheers, finding security and enterprise growth "in focus" for the company as its portfolio gets all the more valuable.

In reaction, the analyst reiterates an Outperform rating on AMZN stock with a price target of $1,100, which implies an 11% increase from current levels.

Between bolstered security tools and a savvy move with a new Hulu partnership, "[…] we note Amazon continues to broaden its robust portfolio of cloud services to generate significant value to enterprise customers and small businesses alike. As the company continues to emphasize the scalability of its SaaS applications, we note significant enterprise wins including the newly announced Hulu partnership are a key positive as they continue to move up the stack," the analyst comments, finding that expanded functionality-meets-accessibility will knock down entry impediments to consumers who wish to shift over to the cloud or develop their current cloud usage.

Sebastian concludes with bullish praise in his recap of the conference, elaborating that his bullish case looks as strong as ever: "Continued progress reinforcing our positive thesis. Yesterday's announcements support our positive view of Amazon's leading position in the cloud services market. Despite ongoing competitive pressure from Google Cloud, Microsoft Azure, and others, we believe Amazon's rapid pace of innovation, competitive pricing strategies, and ability to add enterprise-level customers will allow the company to maintain its dominant market position."

Colin Sebastian has a very good TipRanks score with a 77% success rate and a high ranking of #11 out of 4,628 analysts. Sebastian garners 23.6% in his yearly returns. When recommending AMZN, Sebastian realizes 36.5% in average profits on the stock.

TipRanks analytics demonstrate AMZN as a Strong Buy. Based on 31 analysts polled by TipRanks in the last 3 months, 29 are bullish on Amazon stock while 2 remain sidelined. With a return potential of nearly 19%, the stock's consensus target price stands at $1,169.08.