Tactics and Analysis, June 26, 2017 – Euro Ready for Rebound?

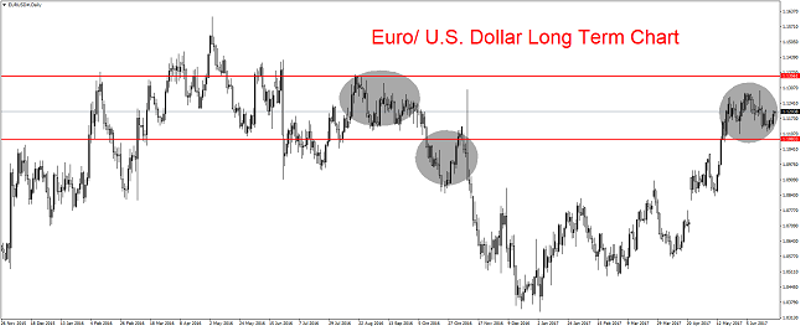

The Euro has done well in the midst on another interest rate hike from the U.S Federal Reserve. Last week’s trading showed the Euro can sustain its mid-term trend and may have the capability of adding more value against the U.S Dollar.

Euro Holds Value and is Set for Gains

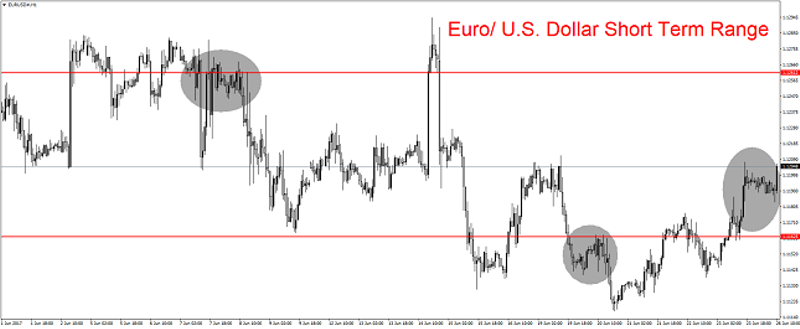

The past few trading sessions have seen the Euro hold onto its territory against the U.S Dollar in what has become a tight range.

However, the Euro has been able to hold onto the bulk of its value, which was gained before the U.S Federal Reserve increased their interest rate again in mid-June. Yes, the Euro did lose some initial ground after the hike and Fed pronouncement of another increase to come.

But importantly, the European currency did not lose massive value, and in fact it has been able to put in gains since the beginning of last week. The Euro is now poised at an interesting juncture as its maintains a steady value near the 1.12 level against the U.S Dollar.

Mid-Term Trend Remains Strong

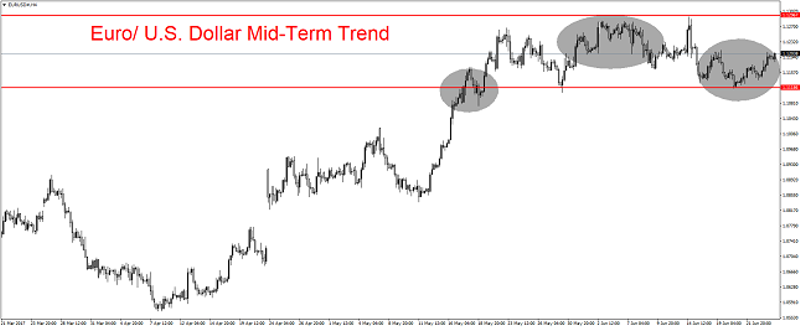

A look at a mid-term chart of the Euro shows its steady nature and the trend it has been able to achieve. Traders need to remain patient. They should not over leverage themselves and they need to practice risk management. However, the Euro appears it may be able to make another push upwards against the U.S Dollar.

In the wake of the U.S interest rate having been implemented and another hike threatened to come, the ‘bad’ news for the Euro is essentially known and this may limit downside risks. The Euro looks ready to test higher values which were attained in early June, particularly if its mid-term trend remains intact.

ECB and Monetary Policy

The European Central Bank will be holding a forum, which officially starts tomorrow in Portugal.

During the get together which will be attended by the world’s leading central bankers, numerous speeches will be made. Among the highlights will be the keynote speech from European Central Bank President Mario Draghi.

European economic data continues to show incremental improvements, and this should solidify the notion the ECB will have to take into consideration a change of its current monetary policy at some point. The European Central Bank may begin tightening its policy within the calendar year.

In the short term, we believe Euro may be positive. In the mid-term and long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire