Tactics and Analysis, August 17, 2017 – Pound Remains in Play for Traders

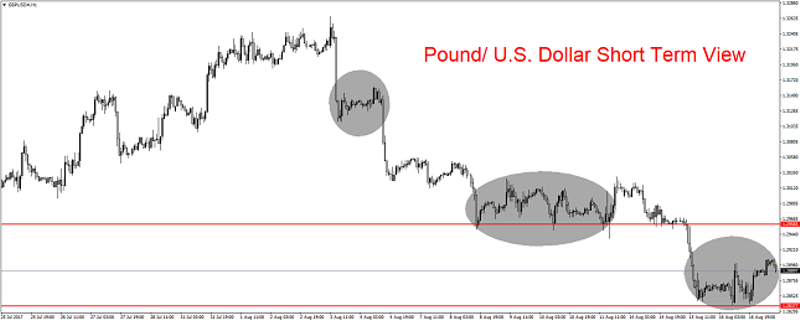

The Pound regained lost ground on Wednesday and may continue to tempt buyers. The 1.29 level for the Pound and U.S Dollar are in focus in the short-term. Economic data from the U.K yesterday was positive via the Average Earnings Index.

Pound Regains Lost Ground

The Pound bounced off lows on Wednesday and continues to present traders with upside potential against the U.S Dollar.

After a test of support near 1.28, the British currency has shown the ability to hold its ground and gain.

The combination of good inflation numbers from the U.K. via the Average Earnings Index, and the U.S Federal Reserve’s cautious Meeting Minutes report yesterday have helped the Pound in the short-term.

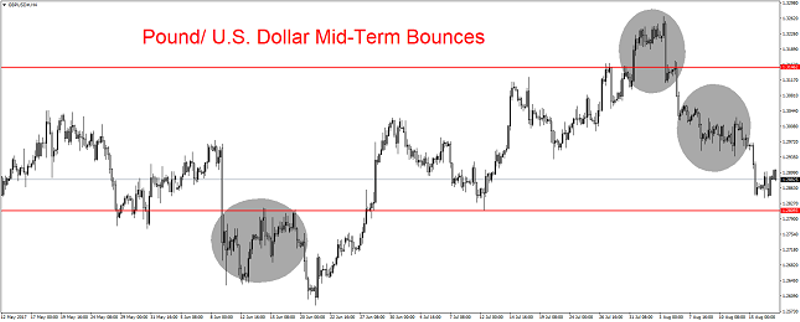

The Pound’s Bouncing Ball Value

While the mid-term looks like a bouncing ball for the Pound and its value. The currency has shown the capability of maintaining its stronger stance against the U.S Dollar.

The 1.29 level may remain a focal point today for traders, but speculators with a taste for the upside may be eyeing the 1.30 mark which was tested in early August.

Additional Value Opportunities via Pound

Economic data from the U.K remains a mixed bag, but yesterday’s employment numbers served notice that not everything is doom and gloom.

While the U.S Dollar enjoyed a good run of power the past week, traders may be tempted to seek continued reversals upwards for the Pound. The next two days of trading for the British currency could provide investors with an opportunity for additional value.

In the short term, we believe the Pound may be positive. Mid-term and Long-term we are unbiased.

Yaron Mazor is a senior analyst at SuperTraderTV.

SuperTraderTV Academy is a leader in investing and stock trading education. Sign up for a class today to learn proven strategies on how to trade smarter.

This article was originally posted on FX Empire

More From FXEMPIRE:

Tactics and Analysis, August 17, 2017 – Pound Remains in Play for Traders

EUR/USD, AUD/USD, GBP/USD and USD/JPY Daily Outlook – August 17, 2017

U.S. Dollar Declines in the Wake of Federal Reserve Report. Gold Edges Higher

Daily Market Forecast, August 17, 2017 – EUR/USD, Gold, Crude Oil, USD/JPY, GBP/USD