TABOR refunds don’t always come automatically: Here’s how to claim yours

Editor’s Note: This story was updated to clarify and add filing guidelines for the state tax form.

DENVER (KDVR) — If you have been a resident in Colorado for a full year, you are eligible for an $800 refund on this year’s state taxes, but you have to claim it.

When Colorado takes in tax revenue beyond the limit, Coloradans who file taxes can expect a refund check in the mail known as under the law known as the Taxpayer’s Bill of Rights, or TABOR. For the 2023 tax season, eligible taxpayers can expect $800 tax-free.

When will you get your next TABOR check?

This refund comes after you file your Colorado income taxes, but it doesn’t always come automatically.

How to claim a TABOR refund

According to the Colorado Department of Revenue, the statute states that you must claim the TABOR refund. If you are eligible to claim your TABOR refund, you must file a 2023 DR 0104 by April 15, 2024, if you:

Were at least 18 years old when the tax year began,

Do not have a Colorado income tax liability,

Are not claiming a refund of wage withholding, and

Are not otherwise required to file a Colorado return because you have no federal filing requirement.

File the 2023 DR 0104 by Oct. 15, 2024, if you:

Have a Colorado income tax liability,

Claim a refund of wage withholding, or

Are required to file a Colorado return because you are required to file a federal return.

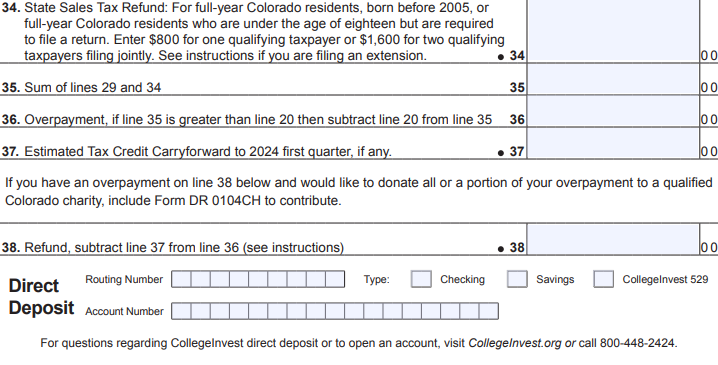

As far as claiming it, make sure this portion of your 2023 Colorado individual income tax return is filled out.

The filing format may look different, especially if you are using a site like TurboTax. Sometimes the refund is automatically filled out, but it doesn’t work that way for everyone.

2024 TABOR checks will be tax-free

When you’re wrapping up your taxes, make sure this portion is complete. If you’ve already submitted your taxes and didn’t claim your TABOR refund, there’s still time.

What happens if you don’t claim TABOR?

If you didn’t file for your TABOR refund, taxpayers can file an amended return to claim the TABOR credit up until the October extension deadline in most circumstances, according to Daniel Carr with the Department of Revenue.

If you missed the April deadline and don’t plan on filing an amended return claim, the cash won’t show up in your bank account, but it doesn’t disappear either.

If you don’t claim your TABOR refund, the money rolls over.

“Under-refunded TABOR surplus is accounted for in the next fiscal year and refunded at that time. So, it rolls over to be refunded in the next fiscal year,” said Carr.

If you haven’t filed your taxes yet, make sure the TABOR refund boxes are filled out before you send your taxes in. If you’ve sent in your taxes, you can check the status of your refund online.

For the latest news, weather, sports, and streaming video, head to FOX31 Denver.