Sunak Faces Election With Second Lowest Growth in G-7, IMF Warns

- Oops!Something went wrong.Please try again later.

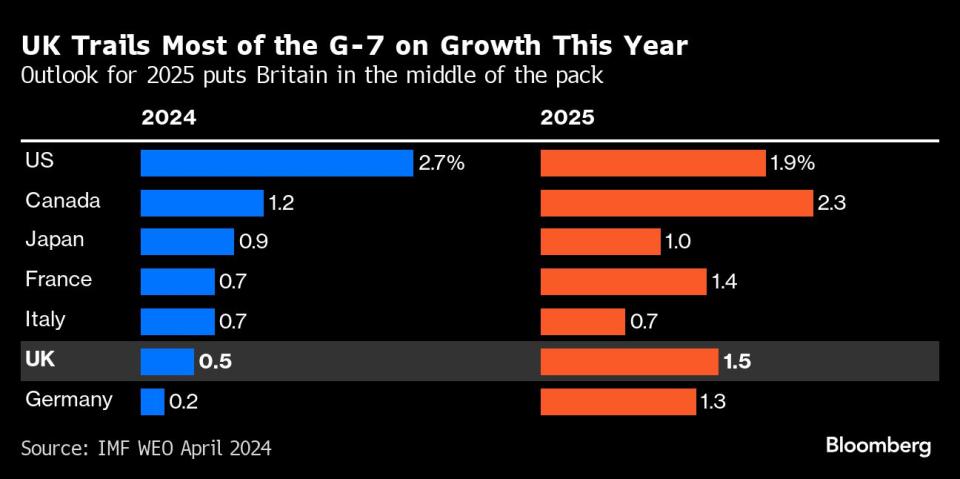

(Bloomberg) -- UK Prime Minister Rishi Sunak will go into an election having beaten the inflation crisis but having annual economic growth this year weaker than in any other Group of Seven nation other than Germany, according to the International Monetary Fund.

Most Read from Bloomberg

Dubai Grinds to Standstill as Cloud Seeding Worsens Flooding

China Tells Iran Cooperation Will Last After Attack on Israel

What If Fed Rate Hikes Are Actually Sparking US Economic Boom?

Powell Signals Rate-Cut Delay After Run of Inflation Surprises

Red Lobster Considers Bankruptcy to Deal With Leases and Labor Costs

The IMF downgraded its forecast for UK gross domestic product to show a gain of 0.5% this year instead of the 0.6% previously estimated. The figures in its updated World Economic Outlook are the second worst in the G-7.

However, inflation will average 2.5% in the IMF’s view. That’s above the 2% target but in line with other European countries — and lower than the US.

The fund’s forecasts show most major economies, including the UK, enjoying a soft landing as inflation drops back to 2% in 2025 and growth picks up. That points to a better inheritance for the next government.

Sunak is in need of good economic news as ruling Conservative Party trails the Labour opposition by almost 20 points in polls. The prime minister has said he wants to hold a general election when people “feel that things are improving” but it must be held by January 2025 at the latest.

In 2025, the UK economy will grow 1.5% — faster than all G-7 nations except the US and Canada, according to the IMF. Unemployment falls to 4.1% after peaking at 4.2% this year.

The Bank of England may bring some relief. The IMF’s forecasts assume about two quarter-point cuts in the benchmark lending rate, which at 5.25% now is the at the highest level in 16 years. There’s some indication the IMF believes the BOE could move quicker. The fund estimated that the gap between actual and potential output is minus 0.3%, a signal that policy may be too restrictive.

The IMF earlier this year criticized the UK government’s tax cutting plans, urging it to make investments in public services and infrastructure instead. It warned in its latest forecasts that elections across the world this year, including the UK, may tempt government’s into further inflation-inducing giveaways.

The fund cautioned that the risk was not just to resurgent prices but to the sustainability of government debt. The UK needs to find savings, either through tax rises or spending cuts, of about 3% of GDP simply to stabilize the debt in 2029. Public debt is almost 100% of GDP.

To bring debt back to pre-pandemic levels by 2029, a fiscal consolidation equivalent to 8% of GDP would be needed. The government is currently planning 3% of GDP by freezing tax thresholds and cutting public services. That squeeze is so severe that economists have branded it a “fiscal fiction.”

A Treasury spokesperson said: “Today’s report shows we are winning the battle against high inflation, with the IMF forecasting that it will fall much faster than previously expected. The forecast for growth in the medium term is optimistic, but like all our peers, the UK’s growth in the short term has been impacted by higher interest rates, with Germany, France and Italy all experiencing larger downgrades than the UK.”

--With assistance from Zoe Schneeweiss.

Most Read from Bloomberg Businessweek

A Resilient Global Economy Masks Growing Debt and Inequality

Cities Use AI to Help Ambulances and Firetrucks Arrive Faster

The Shadow Swiftie Economy Booms With Bootleg Bracelets and $1,150 Bodysuits

©2024 Bloomberg L.P.