Study Finds the Ideal Salary You Need to Own a Home in Your State

Owning a home has long been a key component of the American dream. However, with the considerable cost of housing on the rise, it can be hard to estimate the income needed to own a home in the U.S.

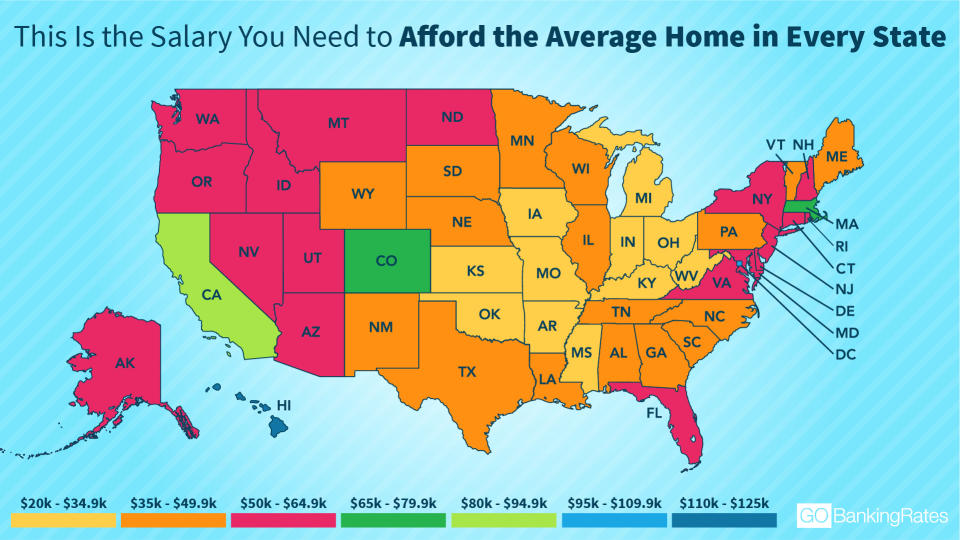

A new study from GOBankingRates found the minimum salary needed to afford a home is much steeper in some states than others.

Keep reading to see the cities where most Americans can’t afford a home.

The study determined each state’s average monthly mortgage payment based on the median list prices in the state and the average APR on a 30-year fixed rate mortgage. Then, assuming that 30 percent of your monthly income is devoted to this specific housing cost, GOBankingRates worked backwards to determine the ideal income that would allow you to afford that average mortgage payment.

At the upper end, Hawaii would require an annual income of $110,520 to afford the staggering $2,763 mortgage payment that would be typical for the state. On the other end of the spectrum, homeowners in Ohio can expect to secure an average mortgage for a little over $700 a month, meaning they would only need to earn $28,800 per year to afford their mortgage.

It’s also clear that, if you’re looking for a place where you can buy a decent home without needing to make a mint, the upper Midwest might be your ticket. Three bordering states in the Great Lake basin — Indiana, Michigan and Ohio — are among the five states with the lowest salary necessary to afford a mortgage there.

The costliest states, meanwhile, seem to be on the coasts. The 10 states with the highest income needed to afford a house include just three — Nevada, Colorado and Utah — that aren’t on the ocean (not including DC). Four of the five U.S. states that are on the Pacific Ocean are among the 10 priciest states to own a home in (Alaska being the odd Pacific state out). Meanwhile, Massachusetts, New York and DC on the Atlantic are all also among the 10 costliest.

Here’s a look at how much you need to earn a year to afford a home in all 50 states and the District of Columbia:

Alabama — $36,760

Alaska — $51,320

Arizona — $50,880

Arkansas — $31,320

California — $89,280

Colorado — $73,600

Connecticut — $55,360

Delaware — $51,040

District of Columbia — $97,280

Florida — $52,640

Georgia — $44,760

Hawaii — $110,520

Idaho — $51,560

Illinois — $37,840

Indiana — $31,320

Iowa — $32,400

Kansas — $31,760

Kentucky — $32,600

Louisiana — $38,080

Maine — $42,320

Maryland — $54,920

Massachusetts — $75,360

Michigan — $30,680

Minnesota — $46,720

Mississippi — $33,120

Missouri — $31,800

Montana — $55,640

Nebraska — $37,040

Nevada — $55,680

New Hampshire — $51,720

New Jersey — $51,720

New Mexico — $40,960

New York — $64,360

North Carolina — $46,600

North Dakota — $54,480

Ohio — $28,800

Oklahoma — $33,640

Oregon — $64,040

Pennsylvania — $35,760

Rhode Island — $51,960

South Carolina — $44,800

South Dakota — $40,880

Tennessee — $42,280

Texas — $49,840

Utah — $61,840

Vermont — $46,960

Virginia — $53,400

Washington — $64,200

West Virginia — $29,240

Wisconsin — $36,040

Wyoming — $44,600

Now, click through to see how many hours you have to work to afford a home in your state.

Methodology: To find the minimum salary need to own a home in every state (except North Dakota, whose median home list price information was sourced for Realtor.com) and the District of Columbia, GOBankingRates calculated the average mortgage payment in every state using the state’s median home list price and the average APR on a 30-year fixed loan, sourced from Zillow. Using the general rule of thumb that no more than 30 percent of your income should go toward housing, we then calculated the annual income needed to afford the average mortgage payment in every state.

This article originally appeared on GOBankingRates.com: Study Finds the Ideal Salary You Need to Own a Home in Your State